Best Stock Brokers In India

I always wondered who is the best stock broker in India? as there are more than 300 Stock brokers registered on Indian stock exchanges. For this I started making list of top 10 stock brokers in India for 2025 who are reputed, genuine, trust worthy and have atleast 5 Lakh clients which are suitable for beginners and small investors. In this article, I am going to discuss about each one of them with details like brokerage charges, acccount opening charges and pros & cons compared to others. I am sure it will help you in choosing a good Indian stock broker for yourself.

My self switched from a full service based stock broker ( Sharekhan) to a discount broker (Zerodha) in 2012. At those time discount broking was still in nascent stage.

Having first hand experience of various types of brokers, I assume that I am entitled to provide you some advice on top stock brokers in India!.

Who is a Stock Broker?

As per Investopedia, a Stock broker is professional who buys and sells share on behalf of his clients.

In India, one can buy or sell shares of a company on stock exchanges like NSE and BSE. However, buying and selling of shares directly from exchanges is not allowed for common people.

They have to go through the middle man who is recognised by government and has obtained the license to transact on exchanges on client’s behalf.

This middle man is known as “Stock Broker”. Not everyone can become a stock broker. Government has set stringent requirements and should have large networth to apply for stock broking license. I will explain about that in some other article.

But to buy or sell shares shares you need to open good demat account with a recognized stock broker.

Ranking For Best Stock Broker In India 2025:

Selecting best stock broker in India out of multiple share brokers operating is difficult task. To make it easier for you, I have shortlisted top 10 stock brokers in India and ranked them based on my research.

Here is the list of 10 best stock brokers in India,

- Zerodha Stock Broker

- Upstox Stock Broker

- Angel One Stock Broker

- Motilal Oswal Stock Broker

- 5Paisa Stock Broker

- Sharekhan Stock Broker

- ICICI Direct Stock Broker

- Edelweiss Stock Broker

- Kotak Securities Stock Broker

- HDFC Securities Stock Brokers

Here is the brief information about these best stock brokers of India. I will provide detailed information about each one of them in next sections.

#1. Zerodha Stock Broker

Without doubt, Zerodha is the No.1 Stock broker in India with highest number of clients. Within a span of 8 years of their inception, they toppled ICICI DIrect from top position.

Founded as start up by Nithin Kamath in year 2010, their growth is exponential. When they started their operation, brokerage industry was ruled by ICICI DIrect and Sharekhan.

Those brokers charged brokerage in terms of %age of total traded value. That means if you buy share worth 1 Lakh rupee, with 0.55% ICICI Direct deducts Rs 550 as brokerage charges.

But Zerodha told, we are going to charge Rs 20/executed order, what ever may be the traded value. This flat price concept is known as discount brokerage and was very popular in USA. Zerodha introduced the concept in India.

But lower brokerage is not the only reason for Zerodha’s growth. Many new discount brokers popped up in India offering as low as Rs9/trade but are not as successful as Zerodha.

What is the reason?, how Zerodha could manage to become biggest stock broker in India without spending a penny on advertisements?

I will explain about it later, but first discuss more on their offerings.

Zerodha is registered member of NSE, BSE, MCX and MCX-SX providing service in below segments,

- Equities

- Derivatives

- Mutual Funds

- Government Securities

- Sovereign Gold Bonds

Know more about Zerodha, in this detailed review.

Zerodha Brokerage Charges

Initially Zerodha used to charge Rs20/trade for all segments. But recently made the delivery trade charges Zero.

That means, if you buy shares today but don’t sell it on same day, brokerage charges will be Zero. Hence for all the investments are brokerage free at Zerodha.

Zerodha Margin/Exposure/Leverage:

Zerodha Trading Terminals:

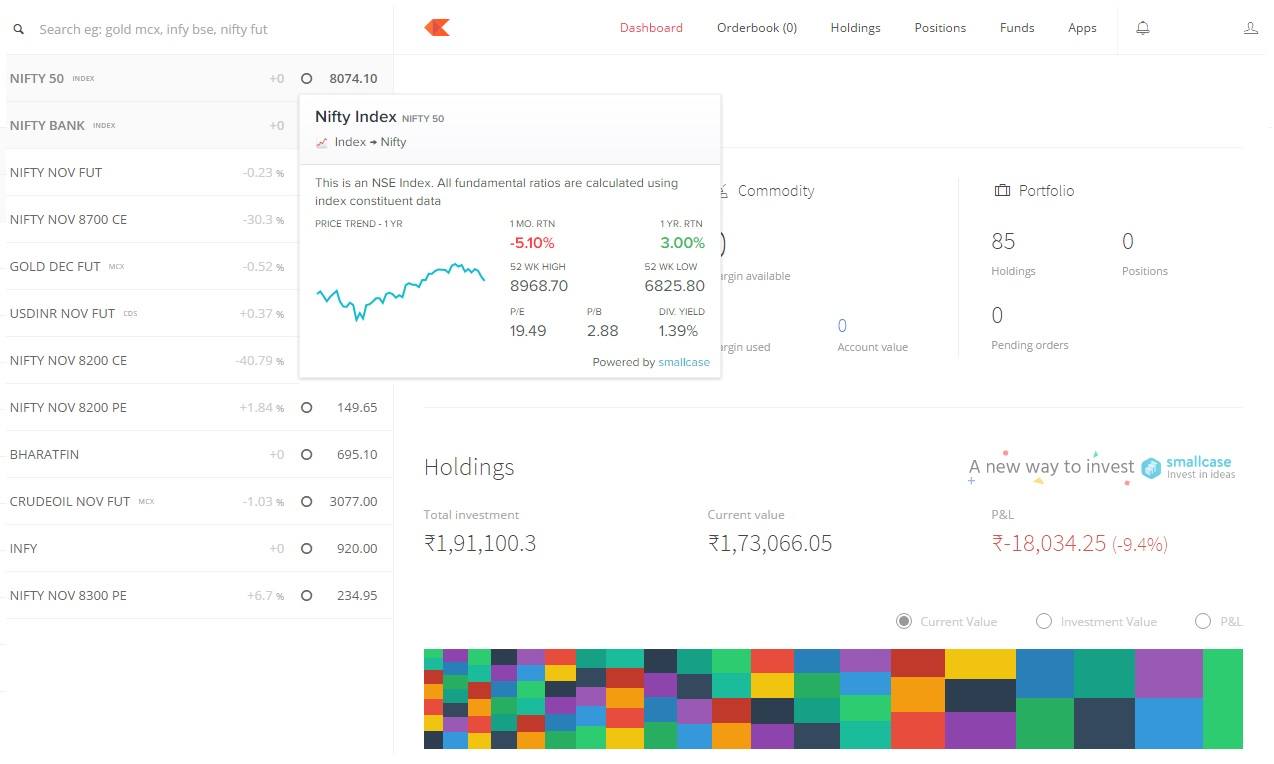

KITE is the trading terminal from Zerodha. The USP of Kite is it’s minimalistic and clutter free interface.

KITE is available as both desktop trading terminal and as Mobile App.

KITE is the real reason for popularity of Zerodha apart from Zero brokerage.

As I told before, low brokerage can take you for some distance but the quality of products is the real differentiator.

After using for many years I can say that, KITE is one of the best trading app in India which cuts down all distractions allowing me to concentrate on my trade which is what really matters.

Some of the salient features of KITE mobile App are,

- Biometric (fingerprint and Face ID – iOS) 2FA for seamless logins and better security

- TradingView charts along with ChartIQ on both web and mobile

- Universal overview screen for all instruments

- Instant status update after order placement

- Order update push notifications

- Customisable multi-marketwatch views

- Apply 100+ technical indicators on real-time charts

- Trade directly from charts with the Trade From Charts (TFC) feature

- Dark mode

Advantages & Disadvantages of Zerodha:

Pros

- Biggest Stock broker of India

- 50 Lakh+ customers – highest in India

- Zero Brokerage on Delivery trades

- Maximum Brokerage is capped at Rs 20 for other segments

- 100% online account opening – No paper work

- Easy to understand brokerage structure

Cons

- Call and Trade is chargeble at Rs20 per trade

- Not a 3-in-1 demat account (Feasible with IDFC First Bank)

Zerodha In Comparison with Other Brokers:

Check out how Zerodha equates in comparison with other leading stock brokers of India. Click on the respective broker to see the side by side comparison of that particular broker with Zerodha.

Zerodha in comparison with other Stock Brokers |

||

How much Brokerage can be saved with Zerodha?

Zerodha’s brokerage plans suits both investors and frequent traders. Let us understand with help of an example.

For Investor:

If you plan to invest Rs 10 Lakh, with 0.55% brokerage (ICICIDirect charges this much!), you have to shell out Rs5,500 in brokerage itself where as you pay nil in case of Zerodha (Investments are free at Zerodha).

Hence there will be 100% savings in brokerage charges compared to brokers like ICICI Direct.

For Trader:

Now let us see for intraday and Futures traders, how much can be saved.

Let us assume you buy Rs 10lakh and sell 10lakh worth of shares daily. That means in around 20 trading days of month it will be 400 lakhs.

ICICI Direct charges 0.0275% hence the brokerage charges per month is Rs400Lakh * 0.0275% which is Rs 11,000.

So yearly it would be,

Rs11,000 * 12 months = Rs 1,32,000

Now Zerodha charges Rs 20/trade for intraday. In Zerodha, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600

Hence, as shown above, traders can save more than 90% of brokerage and indirectly add to their profit.

How to open Zerodha Account?:

Opening account with Zerodha is completely online with Zero paper work. Account can be opened in 15 minutes and it is done using Aadhaar number.

I have written detailed step by step guide with screenshots on how to open account with Zerodha, please refer this post.

Following documents are required to open account at Zerodha (Zerodha is affiliated to CDSL). You can take photo of above with your smartphone and upload. No need of hardcopies

- PAN Card

- Aadhaar Card

- Passport Size Photo

- Cancelled Cheque/ Savings Bank account passbook. (Required only if you wish to trade in Futures & Options Segment. Not required for equity segment)

Zerodha Account Opening Charges:

Zerodha has made account opening free with effect from June 29, 2024. Use below link to go directly to Zerodha account opening page to open the Zerodha demat account without any fees.

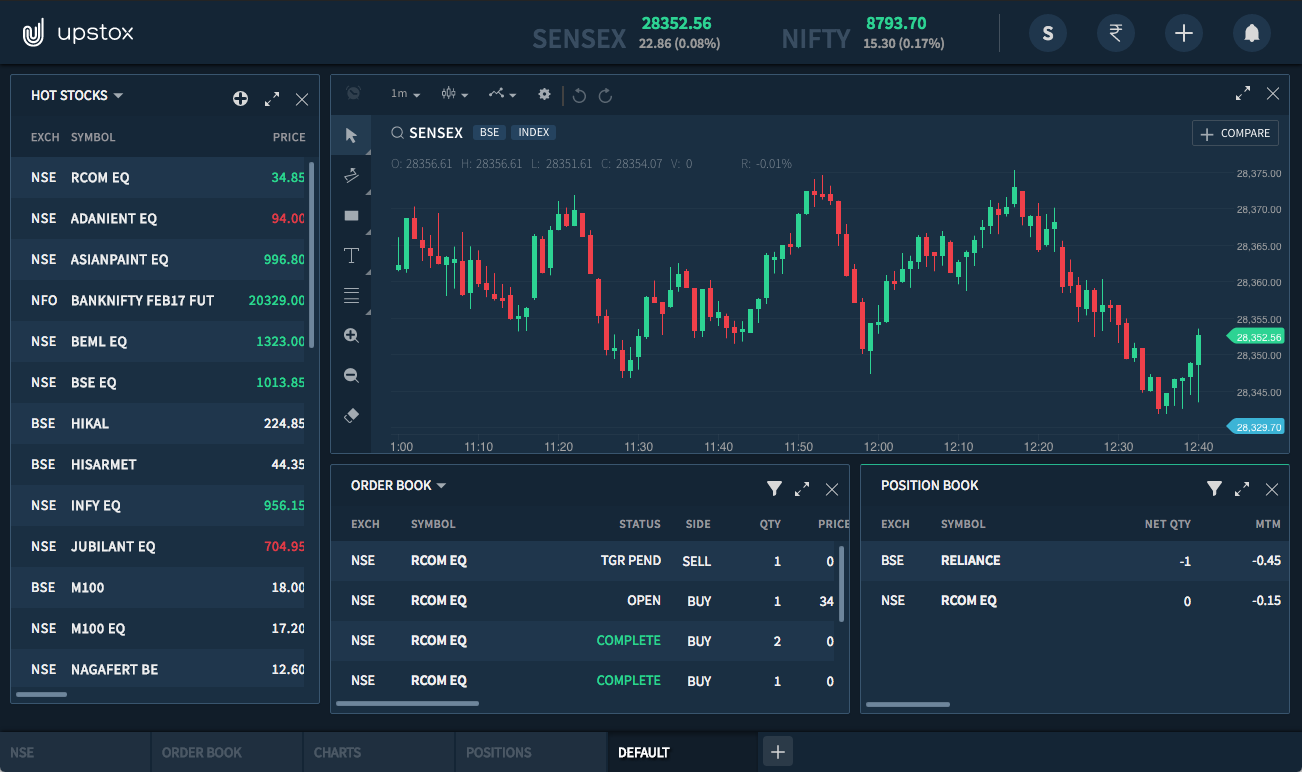

#2 Upstox Stock Broker

Upstox is second biggest discount broker of India after Zerodha. And they are on their way in becoming one among top 10 stock brokers in India.

Based out of Mumbai, Upstox was earlier known as RKSV securities. Upstox was started by four entrepreneurs after returning from USA.

Upstox is funded by prominent investors such as Mr. Ratan Tata, Kalaari Capital and GVK Davix.

To know more about Upstox, read this detailed review.

Upstox had monthly brokerage plans when they commenced their operation ( It was called freedom plan – Rs1947/month for unlimited trading). But they soon discontinued it and followed Zerodha’s model.

Though started around same time of Zerodha, Upstox lagged behind Zerodha. Main reason is, they delayed launch of their own trading terminal.

They offered traditional third party terminal like NEST and NSE Now, which every other broker was offering.

But off late they are catching up and hence became first broker to open 1lakh demat account in a month.

Related Read : Comparison of Upstox Vs Zerodha : Who is Best?

Upstox is member of NSE, BSE, MCX-SX and offer service under below segments

- Equities

- Derivatives

- Currencies

- Commodities

- Mutual Funds

Upstox Brokerage Charges:

Brokerage charges of Upstox is more or less similar to that of Zerodha. Upstox also offers free delivery trades.

Upstox Account Opening Charges:

Margin/Leverage Provided By Upstox:

This is the section Upstox fares better than Zerodha straight away. Zerodha is very conservative in offering higher margins.

Upstox offers higher leverage compared to Zerodha.

Also, they have a separate pack called “Priority Pack” for the users looking for extra margin and don’t mind paying extra.

In Priority Pack , you need to pay monthly charges of Rs 999 for Equity, F&O and Currency and Rs 499/month for Commodities.

Also, instead of Rs20/trade the brokerage charges for Priority pack is Rs30/trade.

Upstox Trading Terminal:

As Upstox was offering not so advanced trading terminal initially, customers preferred Zerodha as KITE is more trader friendly interface.

But Upstox built their own in house product called Upstox PRO. It is available for desktop (web based) and also as Mobile App.

Some of the salient features of Upstox PRO mobile are,

- Universal search tool to find simple and complex stocks.

- Charts of multiple intervals, types and drawing styles

- Apply 100+ technical indicators on real-time charts

- Trade directly from charts with the Trade From Charts (TFC) feature

- Set unlimited number of price alerts for instant updates

- Create unlimited number of customized watchlists

- Receive real-time market feeds to stay on top of your scrips

Upstox Vs Competitor Comparison :

Upstox in comparison with other Stock Brokers |

||

Advantages and Disadvantages of Upstox:

Pros

- One of the first brokerage house to start discount broking in India

- Backed by likes of Mr.Ratan Tata

- Zero Brokerage on Delivery trades

- Zero Demat Account Opening Charges (Limited Period Offer)

- 100% Online account opening – No paper work

Cons

- Call and Trade is chargeble at Rs20 per trade

- Good Till Cancelled (GTC) orders are not supported in Delivery segment

#3 Angel One Stock Broker

Angel One is full service broker turned discount broker!. Earlier they were known as Angel Broking.

The company is among top 10 full service broker of India. They also used to charge based on %age basis.

But owing to heavy competition from discount brokers, they have now adopted discount brokerage model.

Angel Broking is a reputed stock broker established in year 1987 and as on date have presence in more than 900+ cities with 8500+ sub broker network.

Their customer base is around 20Lakhs.

To know more about Angel Broking, read this detailed review.

Angel One Brokerage Charges:

As I mentioned earlier, they used to charge on %age of traded volume. But recently they introduced iTrade Prime plan, in which they have adopted the flat brokerage model.

Note here also, the price is flat Rs20/trade. There is no (0.03% or Rs20/trade, which ever is lower clause).

Hence, it will become expensive for traders trading lower volumes with Angel Broking compared to Zerodha.

Angel One Account Opening Charges:

Margin/Exposure by Angel One :

Angel One Trading Terminal:

- Angel EYE ( Browser based terminal)

- Speed Pro By Angel Broking ( Desktop based terminal)

- Angel Broking App ( Mobile App)

Some of the salient features of Angel Broking App are,

- Access the past ten transactions for Ledger, DP and Funds reports directly from the app

- Track your derivatives portfolio

- Track your portfolio and rebalance with just two clicks

- Get personalised notifications on basket maturity

- Around 40 technical chart indicators and overlays to help you analyse every aspect of stock

- Viewing fundamental ratios and last five corporate actions for stocks

Angel One Vs Competitors comparison:

Angel Broking in comparison with other Stock Brokers |

||

Angel Broking in comparison with other Stock Brokers | ||

Advantages & Disadvantages of Angel One:

Pros

- One of the most trusted brand of India

- Advanced trading terminal

- New investment vehicle based on Artificial Intelligence (ARQ)

- Large network of sub brokers and franchises

- Good team of research analysts providing research reports and tips

Cons

- Does not offer 3-in-1 demat account

- Call and Trade is charged at Rs 20

#4 Motilal Oswal Stock Broker

If you are beginner to stock market and does not mind paying some extra brokerage, then Motilal Oswal might be best suit for you.

They assign you a relationship manager who will provide guidance for investments.

Being a top 10 stock broker in India, Motilal Oswal invest 10% of their revenue for equity research. They have dedicated team for largecap and mid cap companies. Hence the research paper from MOSL is widely acknowledged.

Started in 1987 by Mr.Ramdeo agarwal, Motilal Oswal (MOSL) has rich experience in research and advisory.

They have collection of 30000+ reports covering more than 230 companies and 21industries.

MOSL has presence in more than 500+ cities and towns and 2200+ offices of it’s own branch and from franchise.

Apart from regular broking service, they offer service in insurance, gold ETFs, fixed income and Portfolio Management Services (PMS).

To know more about Motilal Oswal , read this detailed review.

Motilal Oswal Brokerage Charges:

Below table has the default brokerage plan of MOSL. They also have different pre-paid brokerage plans where in brokerage slabs are reduced deepening on prepaid brokerage deposited.

Motilal Oswal Account Opening Charges:

Account opening charge is high for Motilal Oswal. Though one time, it is more than other full service brokers.

Margin/Leverage Offered By MOSL:

MOSL Trading terminal:

Motilal Oswal offers wide range of products for their customers. They also offer Smart Watch which you can wear like a watch and gets instant notification on it.

MOSL Trading terminal include:

- MOSL Desktop Application

- MO Trader ( For Mobile)

- MO Smart Watch

Some of the salient features of Motilal Oswal MO Trader are,

- Get a single view of your orders, positions and limits with our MY WALLET feature in trading apps

- Secure live updates on NSE & BSE from our mobile trading app

- Create and view 4 multi asset watch lists with just one tap. Add up to 50 scrips in a single watchlist on our trading apps.

- Bulk order functionality to execute multiple orders in just single click from this online trading app.

- View multiple type of charts with intervals ranging from 1 minute to 5 years and access to 9 technical indicators through this online trading app

MOSL in Comparison Vs Other Stock Brokers :

Motilal Oswal in comparison with other Stock Brokers |

||

Pros and Cons of Motilal Oswal :

Pros

- Good trading terminal and useful for all kind of traders

- One of the established brokerage house of India

- Large number of franchise network

- Fund transfer facility with more than 60 banks

Cons

- Many complaints around hidden charges which are not explained by sales person during account opening

- No 3-in-1 demat account

- High Account Opening Charges

#5 5paisa Stock Broker

5paisa.com is a leading discount stockbroker and also the first Public listed fintech company to list in NSE and BSE. It is the fastest broker to acquire more than 1 million customers in a short span of 4.5 years.

5paisa.com started operations in March 2016 and has become the 6th largest stock broker in India.

As on today, they have more than 1.2 million clients and turnover of more than 50,000 crore.

5Paisa has default brokerage charges of Rs20/trade and customer can avail the reduced slab with Rs10/trade by subscribing to monthly packs.

To know about 5Paisa. read this detailed review.

5Paisa Brokerage Charges:

5Paisa charges are at par with Zerodha and Upstox. But delivery trades are not free.

To avail special benefits of lower brokerage charges, one need to subscribe to their monthly plans.

Also, if you carefully look into the brokerage structure, the charges are flat Rs20/trade. But in case of Zerodha, it is Rs20/trade or 0.03% which ever is lower.

Hence if you buy Rs100 worth of share, Zerodha would charge Rs6. In case of it will be Rs20 flat.

Hence, when we compare 5Paisa with Zerodha, the brokerage structure is not suitable for traders who trade lower volumes or low priced scrips.

5Paisa Account Opening & AMC Charges:

Below are the AMC charges with 5Paisa. Currently they are running offer of Zero Account opening fee.

5Paisa Margin/Exposure:

5Paisa Trading terminal:

The brokerage firm offers terminal for all three version namely, desktop. web and mobile.

- 5Paisa Trade Station Web (For Web Interface)

- Trade Station EXE ( For Desktop – Installable)

- 5Paisa Mobile App

Some of the Salient feature of 5Paisa Mobile app are,

- Charting: Cutting edge charts with a wide range of studies and drawing functionalities for advanced technical analysis

- One-click order placement: Execute trades at lightning-fast speed with a single click

- Research: Access industry’s best stock research & tips to help you decide when to Buy and Sell stocks with the help of products like – Smart Investor, Swing trader, Sensibull, Smallcases, Screeners

- Watchlist: Create multi-asset watchlist, synced across devices

- Alerts: Set price alerts for instant updates via mobile notifications based on real-time market feeds

Comparison of 5Paisa With Other Brokers:

5Paisa in comparison with other Stock Brokers |

||

Advantages & Disadvantages of of 5Paisa :

Pros

- Very competitive brokerage plans with Rs20 per executed order

- Investing in IPOs, Mutual funds and insurance is possible

- Reputed parent company i.e India Infoline limited (IIFL)

- Research reports and tips are provided which is rare in case of discount brokers

Cons

- Non availability of fixed per month brokerage plans

- Customer service is lagging

- The recommendations are mainly from robotic based and purely depends on their algorithms

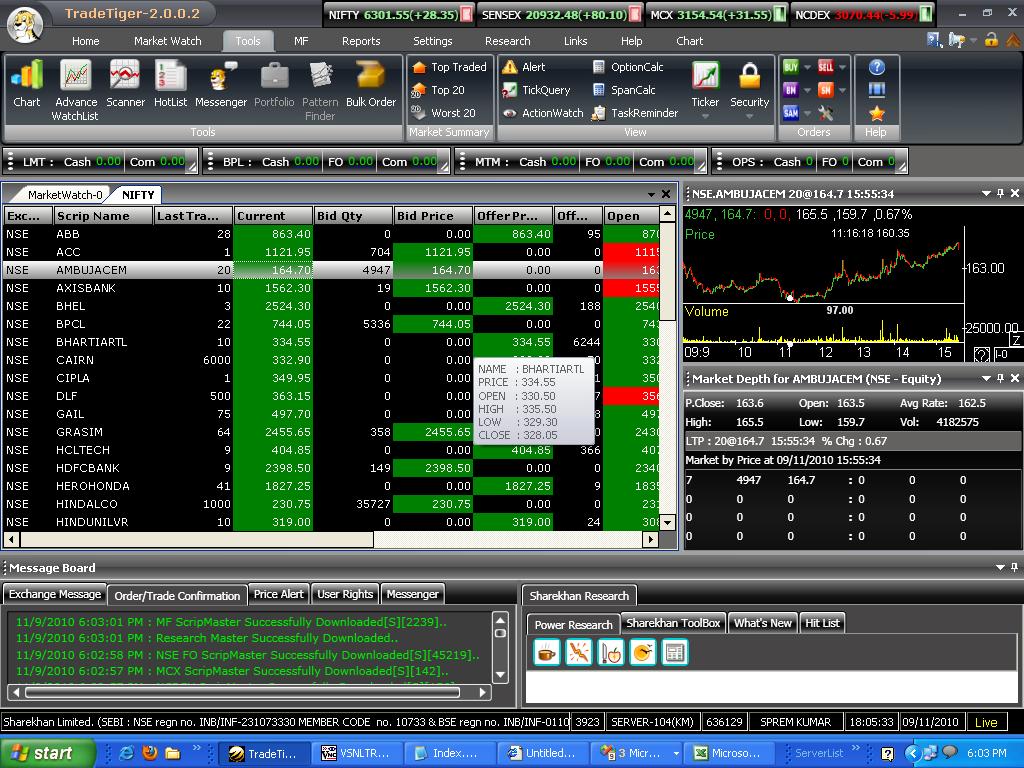

#6 Sharekhan Stock Broker

Sharekhan is house hold name in India. It is among the top 10 stock brokers in India based on the active number of customers.

Sharekhan was established in year 2000 and was part of SSKI group. In 2015, BNP Paribas acquired Sharekhan for Rs 2200 crores. They are Depository Participants (DP) affiliated to NSDL.

They have huge network of branches and franchise over 550 locations in India. Sharekhan has more than 1800 offices and also has presence in Oman and UAE.

They are the third biggest stock brokers after Zerodha and ICICI Direct.

Sharekhan is good stock broker in India for beginners as they conduct workshops and training. But for experience traders and investors, their brokerage slabs make they too expensive.

To know more about Sharekhan, read this detailed review.

Sharekhan Stock Broker Brokerage Charges:

Brokerage charges of Sharekhan make them not much suitable for frequent traders. particularly for options trader, their brokerage structure is insane.

Sharekhan Account Opening Charges:

Best Stock Broker in India : Sharekhan Margin/Leverage:

Sharekhan Trading terminal:

TradeTiger is famous trading terminal which is desktop based software.

It was one of the most popular terminal for traders before the entry of Zerodha KITE.

TradeTiger screen is loaded with lot of information against KITE’s minimalistic interface.

Salient features of Sharekhan TradeTiger are,

- Real time market updates and multiple market watch

- Offers trading in multiple segments and multiple exchanges

- Online transfer of funds from various banks

- Studies with graph and multiple indicators overlays

- Different tools like span calculator and Options premium calculator

Sharekhan also offers Web based and mobile based trading terminal.

Comparison of Sharkhan Vs other Brokers:

Sharekhan in comparison with other Stock Brokers |

||

Sharkhan Advantages & Disadvantages:

Pros

- Call and trade is completely free

- No charges for fund transfers from banks to trading account and other way round

- Online class room sessions for beginners and advance traders for free

- Wide reach across India and can be accesses across all major towns

- Availability of Prepaid brokerage schemes to reduce the brokerage outgo

- Sharekhan offers one of the finest trading terminal(Trade tiger)

Cons

- Minimum brokerage clause which charges 10/paise per share and because of this it is not profitable to trade in stocks which trade below rs 20

- Sharekhan does not offer 3 in 1 demat account

- Facility to place after trading time is not available

- Commodity trading service is not offered to classic account holders

- Brokerage charges are very much higher compared to Rs20 from Zerodha

- It is more than even other full service brokers such as Motilal Oswal

#7 ICICI Direct Stock Broker

ICICI Direct is the subsidiary of ICICI bank which is one of the prominent private sector bank in India.

ICICI Direct is responsible for popularizing online trading in India. Earlier all the transaction used to happen through physical shares.

The broking company was top most stock broker of India until toppled by Zerodha.

The biggest advantage of ICICI Direct is, being a bank based stock broker they offer 3-in-1 demat account . It helps in seamless transfer of funds between Savings account and trading account.

To know more about ICICI Direct, read this review.

ICICI Direct Brokerage Charges:

ICICI Direct is one of the most expensive stock broker of India.

Also, they have minimum brokerage clause because of which, Rs35 per trade is charged.

For example, their brokerage slab is 0.55%. So if you buy Rs1000 worth shares, you expect brokerage charge to be Rs5.5 but you are charged Rs35.

ICICI Direct Account Opening Charges:

Margin/Leverage offered by ICICI Direct:

Comparison of ICICI Direct Vs Other stock Brokers:

ICICI Direct in comparison with other Stock Brokers |

||

ICICI Direct Trading Terminal:

ICICI Direct’s trading terminalis know as “TradeRacer”. Brokerage firm charges Rs75/month as subscription fees for the terminal. But if you generate a brokerage more than Rs750, the subscription charges are waived off.

Some of the salient features of ICICI Direct are,

- View all trending scrips in a single screen

- Customisable color and layouts in the charts

- Various screeners to identify all the stocks matching their criteria

- Heatmap to identify the market behavior

Trade Racer is also available in Web version and hence no need to install any software.

ICICI Direct mobile app is for the mobile users. But users have give 3.1 rating for the app. Hence need lot of improvements.

Advantages and Disadvantages of ICICIDirect:

Pros

- 3-in-1 demat account , easier flow of funds

- One of the most reputed name in brokerage industry

- One stop solution for all the investments and also insurance

Cons

- One of the broker charging highest brokerage

- No support for commodity trading

- Mobile app is not upto the mark

- Minimum brokerage clause make it expensive for small and beginners

- No brokerage calculator is provided

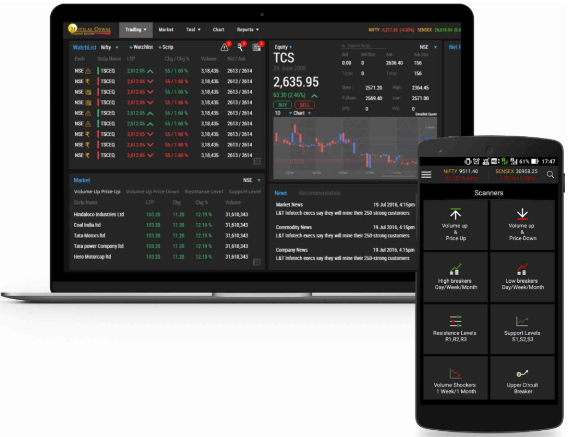

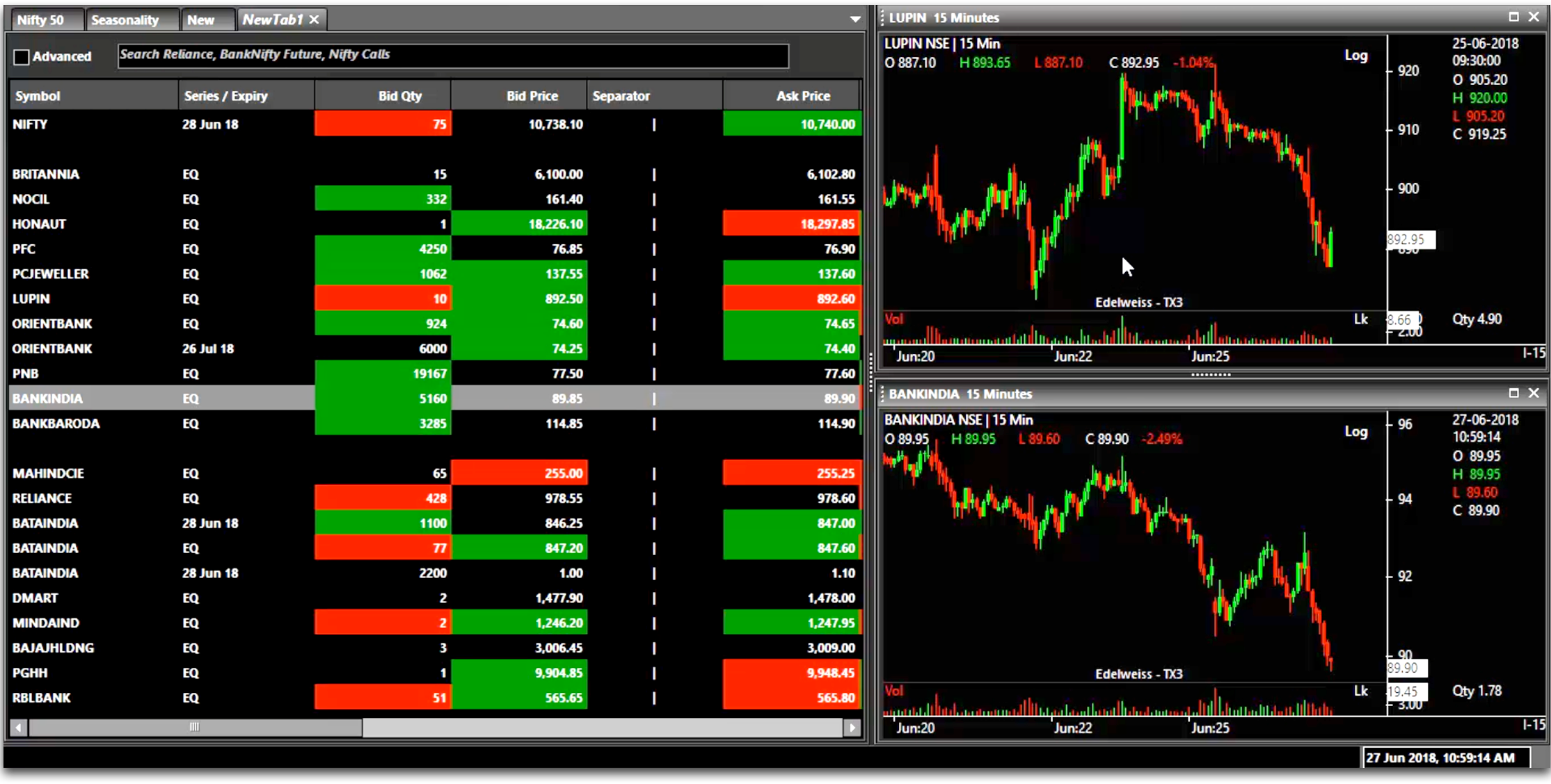

#8 Edelweiss Stock Broker

Edelweiss Broking is incorporated in year 2008 and part of reputed Edelweiss group.

This Brokerage firm is a diversified financial service company providing broad range of products and services including life insurance, mutual funds and housing finance apart from Stock Broking.

Edelweiss has strong presence across India with more than 475 offices in more than 205 locations.

Though started late, they are quick to make it to the list of top 10 stock brokers in India.

To know more about Edelweiss Broking, read this detailed review.

Edelweiss Brokerage Charges:

Best Stock Broker In India – Edelweiss Account Opening Charges:

This demat account provider has waived off account opening fee and Annual Maintenance Charges (AMC) is also free for first year.

However, Rs500 AMC from second year is expensive compared to other brokers.

Edelweiss Margin/Exposure:

Comparison of Edelweiss Vs Other StocK Brokers:

Edelweiss in comparison with other Stock Brokers |

||

Edelweiss Trading Terminal:

- Terminal X3 (TX3) Terminal

TX3 is EXE based installable trading Terminal designed for faster usage. One need to install it on their desktop/laptop before start using it.

Some of the salient features of TX3 are,

- Customizable Workspace

- Tools like Options Calculators, Event calender’s are available

- Dedicated space for research and recommendations

- Live Portfolio details and reports

- 60+ Advanced technical indicators

Pros & Cons of Edelweiss Broking:

Pros

- One of the most reputed research and advisory firm of India

- Availability of brokerage plans to suit both investors and traders

- Great offline presence with more than 4300 sub brokers across various cities of India

- Free Call and trade facility

- Good and reliable trading terminals for all the devices

Cons

- Comparatively higher brokerage charges wrt other brokers

- High AMC charges

- No 3-in-1 demat account

- Customer service improvement is expected

#9 Kotak Securities Stock Broker

Kotak Securities is backed by Kotak Mahindra Bank and established in 1994.

They have more than 11 Lakh customers and presence in more than 1200+ locations.

Being the bank based broker, Kotak Securities provides 3-in-1 demat account.

Through Kotak Securities, one can invest and trade in equities, derivative, gold ETFs, Tax Free bonds, IPOs and currency derivatives.

To know more about Kotak Securities, read this detailed review.

Kotak Securities Brokerage Charges:

Brokerage charges of Kotak Securities for Options segment is too costly.

Kotak Securities Account Opening Charges:

Margin/Exposure Offered By Kotak Securities:

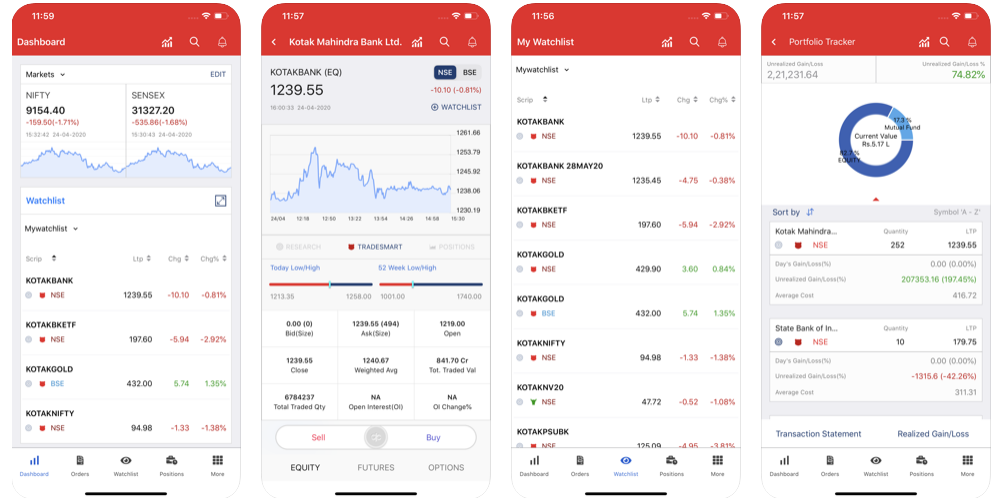

Kotak Securities Trading Terminal:

Kotak Securities offers advanced terminal by below names,

- KEAT Pro X (Desktop Terminal)

- Kotak Stock Trader App ( Mobile App)

Some of the salient features of Kotak Stock Trader App are,

- Get a bird’s-eye view of the BSE and NSE live – Set up customised watchlists and follow scrips on the BSE Sensex, the NSE Nifty, and the MCX commodity exchanges.

- Mobile stock trading on the go – The radial navigation feature ensures a smooth and intuitive experience. Get in touch via chat for quick support and troubleshooting

- Track the share market live with charting tools – Multiple chart views help you stay on top of the Sensex and Nifty without breaking a sweat.

Kotak Securities Vs Competitors:

Kotak Securities in comparison with other Stock Brokers |

||

Advantages & Disadvantages of Kotak Securities :

Pros

- offer 3-in-1 demat account which enables seamless transfer of funds

- All investment avenues under one roof

- Above par trading termina and also provision for traders with slow internet connection

- Online chat facility with support team

Cons

- No support for commodity segment

- Brokerage charges are high even when compared to other full service brokers

#10 HDFC Securities Stock Broker

HDFC Securities is in top 5 stock broking companies of India. Backed by India’s biggest private sector bank HDFC Bank, company offers 3-in-1 demat account.

Established in year 2000, HDFC Securities is based out of Mumbai. The brokerage company also felicitates to invest in US stocks.

This makes HDFC Securities among top 10 stock brokers in India.

To know more about HDFC Securities, read this detailed review.

HDFC Securities Brokerage Charges:

HDFC Securities Account Opening Charges:

Margin Offered By HDFC Securities :

HDFC Securities Vs Competitors:

HDFC Securities in comparison with other Stock Brokers |

||

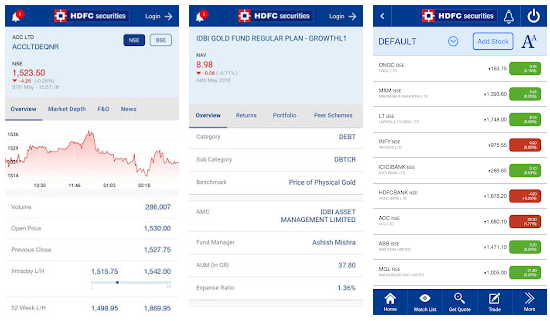

HDFC Securities Trading Terminal:

Trading terminal is not free in HDFC Securities. They charge subscription charge of Rs 1999 per year for using their desktop based terminal .

I feel it is very crazy to charge for a trading app when there is so much competition is there.

Some of the salient features of HDFC Securities MobileTrading are,

- Trade in Equity & Derivatives

- Instant details of the stocks in single click.

- News and views that impact your stock investments

- Get notifications on key market events

- Conveniently track & trade with multiple watchlists

- Instant access to trending investing ideas

- Just tap and find your next investment opportunity

- Locate our branch closest to you

Best Stock Broker in India – Pros and Cons of HDFC Securities :

Pros

- Brand name with backing from reputed bank HDFC

- Company conducts educative seminars for its customer frequently

- NRI account is possible

Cons

- Trading Teminals (HDFC Pro) is not free and monthly subscription charges are applied

- No support for trading in Commodity segment

- Even the SMS based research tips are charged separately

10 Best Stock Broker In India : Final Thoughts

Stock brokers lure customers with many different offers. Their brokerage charges also seems to be very low. But they have many hidden charges.

Few example, ICICI Direct has minimum brokerage clause. That means for any trade, they charge minimum brokerage of Rs35.

Sharekhan has minimum 1paisa/share clause, that means it becomes impossible to trade low priced shares (Penny stocks).

Based on my research, I found Zerodha as the best stock broker in India as there is no gimmicks like zero account opening charges. Their brokerage slab is (Rs 20/trade or 0.03% which ever is lower).

So if I trade Rs 100 worth of share, I will pay only Rs3 as against Rs20 with Angel Broking.

To sum it up, you can choose to open account with any of the stock brokers listed above.

Top 10 stock brokers in India listed above are registered with SEBI and are into broking business for sufficiently long duration.

I prefer to trade with leader and choose Zerodha, they are debt free company and hence my funds are safe with Zerodha.

Best Stock Broking Firms FAQs

Question – Which is the Best Full Service Stock Broker ?

Answer : India Infoline. They have strong team of research analyst covering multiple companies.

Question – Which is the Best Discount Stock Broker in India ?

Answer : Zerodha. with the ratings of 9.21/10 , is the best discount stock broker of India. Traders can save upsto 90% of their brokerage charged when compared to full service brokers. They also have top class products and services.

Question – Which is broker has the lowest brokerage charges?

Answer : Zerodha with Zero brokerage charges for investment has the lowest brokerage charges. Some other brokers has as low as Rs9/trade but they have lot of hidden charges.

Question – Who is the most experienced stock broker?

Answer : Angel Broking who established in 1987 is the most experienced stock broker in India.

You May Also Like To Read :

- 10 Best Discount Brokers of India who can reduce your trading costs significantly

- 6 Stock Brokers of India well suited for Options trading

- 5 Best Stock Brokers for Day trading (Intraday trading) in India

- Top 7 Commodity brokers of India to trade in Commodity Segment

- Stock Brokers best suited for applying to IPO Investments

- 10 Leading Brokers who provide High Margin and also Low Brokerage

- Stock Brokers Who are Known For their Best Customer Service in India

- List of Stock Brokers having Highest Active Clients in India

- Tool to do Side By Side Comparison of Any Two Stock Brokers of India

- Find the Best Stock Broker In Your City

- How to Choose the Best Stock Broker In India as per your Requirement