In this article, I am going to review Trading Bells which is an Indore based discount stock broker. It is backed by Swastika Investment Limited who are into stock broking since 1992.

The company has the membership of almost all major stock exchanges such as NSE, BSE, MCX-SX and NCDEX.

It was founded by two IIT passouts Mr.Amit Gupta and Mr.Parth Nyati and has presence in more than 55 cities spread across 16 states of India.

Parent company claims to have more than 55,000 clients. They offer service under following segments

- Equity

- Derivatives

- Commodity

- Currency

- NRI Investment

They have their own DP at NSDL and CDSL and currently offering free demat account.

Trading Bells Brokerage Charges:

They have adopted the brokerage model from more established discount brokers such as Zerodha and Upstox.

They charge flat Rs20/executed order or 0.01% of the traded value whichever is lower. For the Delivery based trades, the fee is waived off.

Following table gives the details of the Trading Bells commission rates,

| Segment | Brokerage Charges |

| Equity Delivery | Rs 0 |

| Equity Intraday | Rs 20/ Executed Order or 0.01% whichever is lower |

| Equity Futures | Rs 20/ Executed Order or 0.01% whichever is lower |

| Equity Options | Rs 20/ Executed Order |

| Currency Futures | Rs 20/ Executed Order or 0.01% whichever is lower |

| Currency Options | Rs 20/ Executed Order |

| Commodity | Rs 20/ Executed Order or 0.01% whichever is lower |

Trading Bells Account Opening & AMC Charges:

As I mentioned earlier, they are not charging any account opening fee as of now. Other charges are as below

- Demat Account Opening Charges : Zero

- Trading Account Opening Charges : Zero

- Demat Account Maintenance Charges (AMC) : Rs 250 / year

- Trading Account Maintenance Charges (AMC) : Zero

Trading Bells Trading Platforms:

They offer trading platforms for all type of devices. All the platforms are third party software and not developed in house.

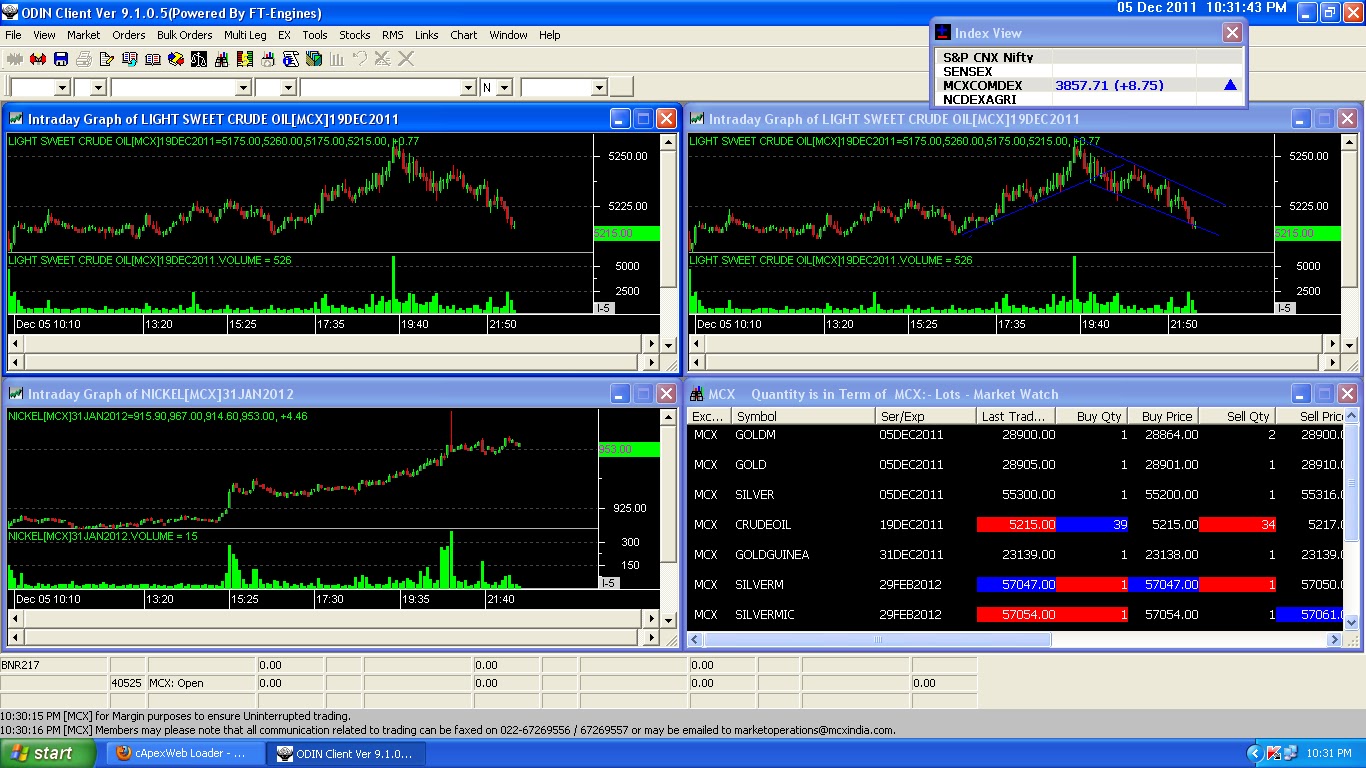

ODIN Diet:

It is desktop trading platforms that you need to download and install on your laptop/desktop. This trading software is developed by Financial Technologies, a firm which develops application for financial firms. ODIN was one of the popular platform particularly during last decade.

However, nowadays traders are not using this platform much because of its resource requirements. It consumes lot of system memory hence you need to have good system configuration if interested in using this terminal.

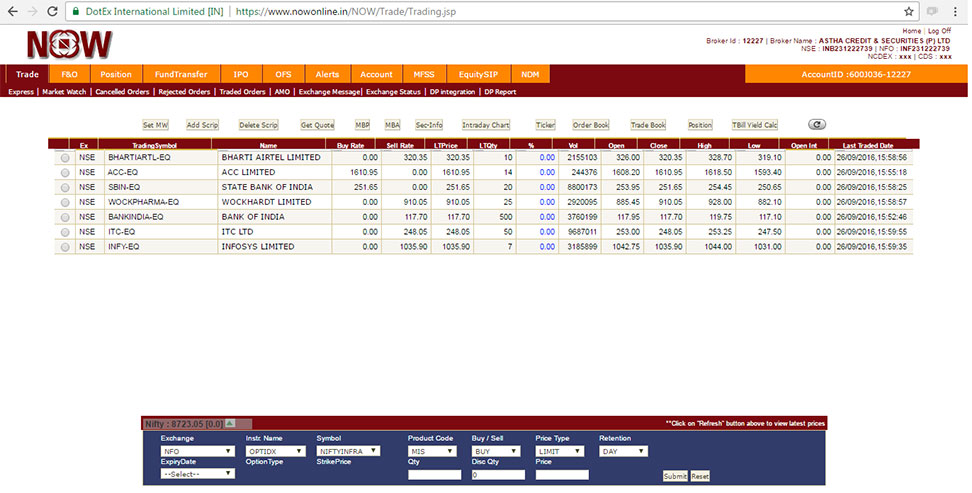

NSE NOW:

NSE NOW is the web based trading platform provided by National Stock Exchange (NSE) for their trading members (Brokers such as Trading Bells). The brokers in turn provide it for their clients.

Since it is a browser based application, you don’t have to install any software. One can access their trading account from anywhere and anytime even from the internet cafe,

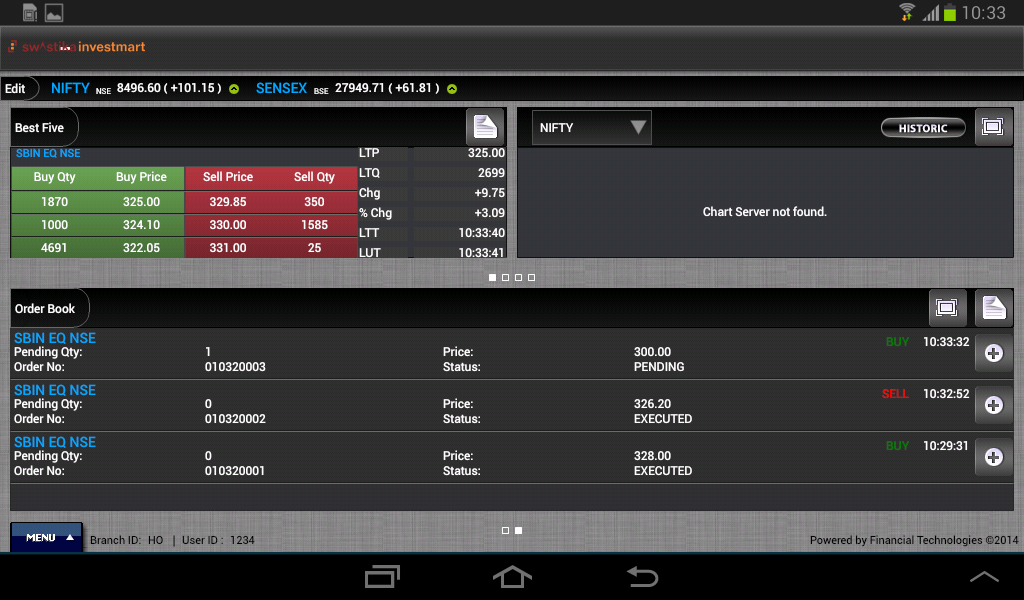

Mobile APP:

Trading Bells uses the mobile app which Swastika Investment provide it for their customers. Using the app, one can trade on the go, check portfolio and view research reports.

One can download the app from Android playstore at Swastika Mobile Trading App page.

Along with above, the company also provides NSE NOW mobile app. Client can choose any of the above apps to trade. NSE NOW is available on Android, iOS and BlackBerry devices.

Pros and Cons of Trading Bells:

Disadvantages:

Following are the factors which I am concerned about them,

- Trading platforms are developed by third parties, makes the company to depend on them to fix bugs.

- Started operations late in 2016, most of the discount brokers have established themselves by that time

- IPO and Mutual fund investment is not possible

- No monthly unlimited plans

Advantages:

Following are the factors which I think they are good,

- High level exposure , beneficial for the traders expecting better leverage

- Zero Brokerage for delivery based investments

- They offer margin funding and loan against shares

- Account opening in 15 minutes through Aadhaar

Trading Bells Review: Final Thoughts

In my opinion, they still need to build up their brand name. They are still unknown and for people to trust them, they need to provide better customer service.

It will happen over the time but they don’t have the benefit of first to market. Discount brokerage industry today is saturated and big 3 have most of the clients. Probably more innovation and initiative can help Trading Bells to grow further.

If you already have accounts with them, please share your experience with me through comments.

You May Be Also Interested In: