Angel One Review:

Pros

- One of the most trusted brand of India

- Advanced trading platforms

- New investment vehicle based on Artificial Intelligence (ARQ)

- Large network of sub brokers and franchises

- Good team of research analysts providing research reports and tips

Cons

- Does not offer 3-in-1 demat account

- Call and Trade is charged at Rs 20

In this Angel One review, I am going to present a detailed information about the service and products offered by them, including brokerage charges and trading platforms.

They have been in brokerage industry since 1987 and have good customer ratings. Their trading platforms are regarded as one among the top trading software and advisory services is also top notch.

Angel One Overview:

Angel One belongs to Full service broker category and hence they offer services in many areas such as

- Equities

- Mutual Funds

- Commodities

- IPOs

- Portfolio Management Services (PMS)

- Life Insurance

Its Managing Director Mr. Dinesh Thakker started as a small broker but he has built the Angel One very well.

Angel One is headquarted at Mumbai and has strong network of 8500+ sub brokers across 900+ cities across India.

Its current customer base is more than 10 lakhs.

Angel One Brokerage Charges:

Angel One used to charges was revised from April 2019. Earlier they used to charge on percentage basis of total traded values ( Like other full service brokers)

But owing to tough competition from discount brokers, they adopted the flat fee brokerage model.

Related Read : 10 major discount stock broker of India

Also Read : Zerodha – The largest stock broker of India

The new brokerage plan is called Angel iTrade Prime Plan. Below is the detail of the Angel One brokerage charges,

But it is important to note here it is, the brokerage is fixed at Rs20 irrespective traded value.

But in case of Zerodha , the brokerage is Rs20/trade or 0.3% which ever is lower.

So if the traded value is Rs 200, with Zerodha you will pay 60paisa where as with Angel One , it is Rs 20.

Hence the brokerage structure though looks like discount broker, it is not suitable for small traders who trade with less amount.

To know more difference, read this comparison of Angel One Vs Zerodha

Angel One Demat Account Opening Charges:

Good thing is, account opening charges are Zero in Angel One .

Angel One Account Opening – Documents required :

The fastest way to open demat account with Angel One is Online. The account can be opened completely in 15 minutes if your mobile no is linked with Aadhaar and you can start trading.

You just need to upload the scanned copies (you can take photo from your mobile) of following documents,

- PAN Card

- Aadhhar card

- Passport Size Photo

- Photo of your signature done on a white paper

- Cancelled cheque/passbook (Required only if you wish to trade in Futures & Options Segments)

You can use below button to go directly to Angel One account opening page. If you get stuck at any point due to any confusion, dont worry, just leave your contact information there and their sales will reach out to you and help.

Angel One other charges:

Apart from brokerage and AMC charges, there are some other charges levied.

These charges are charged by almost all brokers, and many are like taxes which goes to government of India

Angel One Trading Platforms:

Being a leading brokerage house, they have invested heavily in developing the advanced trading platforms.

They offer trading platforms for Web, Desktop and Mobile devices.

Angel One App Review:

The app is for the customer who wish to trade on the go. It can be downloaded and installed from play store and App store.

For detailed information about the Angel One Mobile App, check out this article. In which I have covered top features of the app, major advantages and disadvantages.

One can trade across all segments though this app and see the live ledger .

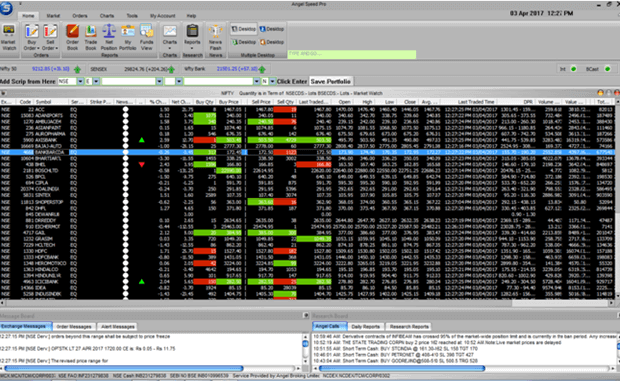

Angel One Speed Pro (Desktop Software) Review:

This software has to be installed to your laptop or desktop. It is useful for high speed traders.

It comes with lot of features , 30 day intraday and 20 years EOD data. 70+ technical indicators are also available.

Angel Eye (Browser based) Review:

No need to install any softwares. Can be accessed from anywhere. But the feature are less compared to Speed PRO.

Exposure/Margin/Leverage provided by Angel One :

Exposure provided by Angel One is as Follows,

Advantages and Disadvantages of Angel One :

I am providing the Pros and Cons of Angel One below,

Disadvantages:

- Minimum brokerage charges is Rs 30 irrespective of size of the investment

- No brokerage calculator as available with discount brokers.

Advantages:

- One of the most trusted brand of India

- Advanced trading platforms

- New investment vehicle based on Artificial Intelligence (ARQ)

- Large network of sub brokers and franchises

- Good team of research analysts providing research reports and tips

Comparison of Angel One with other Brokers:

when we compare Angel One with other leading demat account providers of India in side by side manner, we will get clear idea of their products and services.

Below table has the links to table comparing them will all major stock brokers of India.

Angel Broking in comparison with other Stock Brokers |

||

Angel Broking in comparison with other Stock Brokers | ||

Angel One Review – Conclusion :

What I feel is, their marketing team is very competitive and probably first to see the necessity of a Robo advisor.

Sharekhan followed very late compared to ARQ. So with latest tools and platforms, along with the attractive brokerage plans, you may consider Angel One .

But I advise you to negotiate hard for lower brokerage while opening the demat account. Yes, it is possible to get some discount and you should never miss it!

Also one also need to check the Angel One review of the trading platforms and see if they are suitable to them.

You May Be Also Interested In: