Pros

- Availability of flexible brokerage plans to suit customer preference

- One can invest in various segments

- Wide network of branches across India and abroad

- Their “Trader Terminal” is considered as one of the best desktop trading platform

- Free Account Opening and Zero AMC for 1st Year

Cons

- No intraday tick by tick charts available in Investor Terminal (IT)

- Not a 3-in-1 demat account

In this article, I am discussing about India Infoline (IIFL) and about their trading platforms, brokerage structure and other charges.

About India Infoline (IIFL):

Established in year 1995, India Infoline or IIFL is a well known stock broker of India and now has presence in more than 4000 locations spread across 900+ cities in India.

It also has offices abroad namely Hongkong, Dubai, Newyork, London, Singapore and Mauritius.

Being a full service, it offers service under below segments,

- Equity

- Derivatives

- Currency

- Mutual Funds

- IPOs

- Bonds

- Commodities

Client base of IIFL is in excess of 2Lakh and they are mainly concentrated in northern part of India.

They also set up discount brokerage arm and it is called 5Paisa whose brokerage is as low as Rs20 per executed order.

IIFL Brokerage Charges:

Following table describes the brokerage and other important charges levied by IIFL.

Account Opening Charges:

- Trading Account opening charges: Rs 0

- Demat Account opening charges: Rs 0

- Trading Account Annual Maintenance charges: NIL

- Demat Account Annual Maintenance charges: Rs 0 for first year and Rs 450 per annum from second year onwards

IIFL Trading Margins:

IIFL provides margin of upto 5 times for cash delivery segment. For other segment, the margin is as follows

IIFL Trading Platforms:

Being a full service stock broker, they provide trading platforms for all kid of devices namely Web, desktop and Mobile. Let us look into the details of each platform and their features.

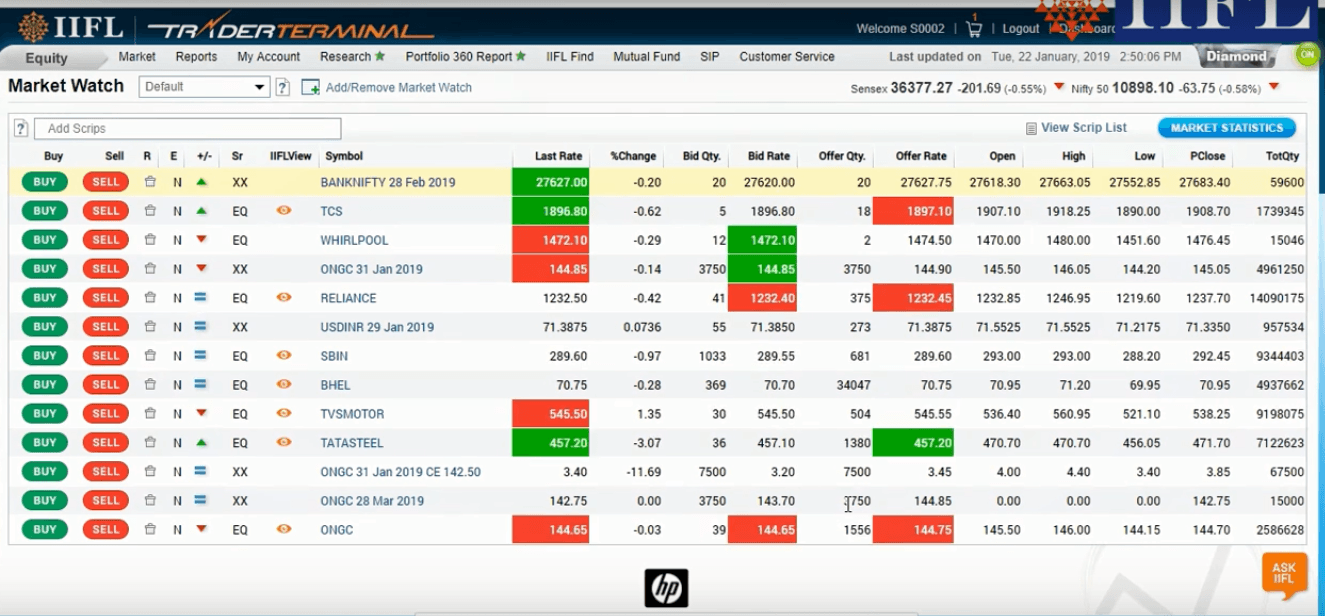

IIFL Trading Terminal:

It is for desktop traders and one need to install the software. The software can be downloaded from their website. Along with the software you also need to install .net software. However, they are providing the trading software for only windows operating system as on date.

Read : Best Trading Platforms of India

Some of the salient features of trader Terminal are,

- Multiple types of charts, large number of technical indicators and heat maps

- Relatime market watch

- Faster execution of the order and confirmation

- Multiple layers of security to validate the user

- Customization of the workspace is possible for widgets, dashboard and alerts etc

- Fund transfer across 40+ banks possible within the terminal

IIFL Markets:

It is the advanced Mobile trading app from IIFL. Good thing is that it is offered for Android, iOS and Windows phone as well.

Some of the features of the app are,

- Create stock list of upto 50 stocks

- One swipe trading – this feature allows you to trade with a single swipe and hence there is no delay in placing order

- Availability of message board where in others provide their view on markets

- Possible to set up alerts based on various criteria

- One can even apply IPOs using the mobile itself

IIFL Trader Terminal Web:

As name suggests, it is a browser based trading platform. Hence no need to install any software in your system. One can access the platform from anywhere like cyber cafe. However it is slower compared to software based trading platforms.

It has following feature in built,

- Data tools and charts of different typles

- Heatmaps

- Research reports and recommendations

IIFL Contact Details:

Registered Office:

IIFL Center,

Kamala City,

Senapati Bapat Marg,

Lower Parel (West)

Mumbai – 400013

Website : India Infoline Website

IIFL Pros and Cons:

Disadvantages of IIFL:

- No intraday tick by tick charts available in Investor Terminal (IT)

- Compared to other full service brokers like ICICI Direct, investing in IPO and mutual funds is not that smooth

- It is not a 3-in-1 demat account

- Number of complains against them at BSE and NSE is very high

Advantages of IIFL :

- Availability of flexible brokerage plans to suit customer preference

- One can invest in various segments

- Wide network of branches across India and abroad

- Their “Trader Terminal” is considered as one of the best desktop trading platform

IIFL Review – Conclusion:

IIFL will be a good options if you are beginner in stock market. Discount bboker does not offer any one to one relation.

IIFL provides guidance and advise to their clients and hence it will be good fit for new comers.

Thier trading terminal is also comes with high performance.

So you can choose to open account with IIFL to begin with and then move on to a discount broker once you gain decent experience instock market.

As the account opening fee is also waived off, you can make use of this offer.