Sharekhan Review 2024

Pros

- Call and trade is completely free

- No charges for fund transfers from banks to trading account and other way round

- Online class room sessions for beginners and advance traders for free

- Wide reach across India and can be accesses across all major towns

- Availability of Prepaid brokerage schemes to reduce the brokerage outgo

- Sharekhan offers one of the finest trading platform (Trade tiger)

Cons

- Minimum brokerage clause which charges 10/paise per share and because of this it is not profitable to trade in stocks which trade below rs 20

- Sharekhan does not offer 3 in 1 demat account

- Facility to place after trading time is not available

- Commodity trading service is not offered to classic account holders

- Brokerage charges are very much higher compared to Rs20 from Zerodha

- It is more than even other full service brokers such as Angel broking and Motilal Oswal

In this Sharekhan review , I am going give detailed information about Sharekhan Brokerage charges, Sharekhan Demat account benefits & drawbacks and their trading platforms.

About Sharekhan

Sharekhan, as on date is one of the major stock broker of India with more than 14 Lakh customers.

Sharekhan was established in year 2000 and was part of SSKI group. In 2015, BNP Paribas acquired Sharekhan for Rs 2200 crores.

They have huge network of branches and franchise over 550 locations in India. Sharekhan has more than 1800 offices and also has presence in Oman and UAE.

If the total customer base is considered, they rank 3rd after Zerodha and ICICI Direct. In my opinion, it is a remarkable growth in these years.

It is easy for ICICIDirect to acquire clients as they convince customers to open demat account who visit them to open normal Savings bank account.

But Zerodha has managed to out rank Sharekhan by offering very competitive brokerage structure and quality products. I have written in detail about the reason behind Zerodha’s success in this review.

Sharekhan Products and Service:

Sharekhan offers products and services across multiple segments. Some of the financial services they are into are

- Equities

- Derivatives

- Currency

- Commodities

- Mutual Funds

- IPOs

- PMS

Portfolio Manage Service(PMS) is one of the famous product from Sharekhan. Well qualified professionals manage you portfolio at at fee.

But only draw back is , Sharekhan expect you to invest atleast 50Lakh in this scheme.

Sharekhan do not have products in Insurance, Banking and Forex Trading.

Sharekhan has another interesting product called “Pattern Finder“. The tool identifies any trading opportunity by recognizing the chart patterns and flashes on the screen.

Sharekhan also conduct online classes and workshops for its customers regularly.

They also provide research reports, advisory, fundamental reviews, top picks etc on weekly, monthly basis.

All these services are costs money and it is passed on to customers. Because of this, brokerage charges of Sharekhan is on higher side. Let us see how much ths brokerage firm charges as commission.

Sharekhan Review – Brokerage Charges

Sharekhan brokerage charges are little higher when compared with other full service brokers.

What I have observed is, if you can negotiate hard with the sales person, he will bring down the commission rates drastically lower.

They have a basic plan which is insanely high. No one charges this much this much in today’s competitive world. They just retained this plan which is 10 year old and reduce it depending upon your negotiation skills.

Sharekhan Basic Brokerage Slabs:

This table is for the customers who does not give any upfront brokerage charges. This is the default brokerage plan of Sharekhan

Sharekhan Prepaid Brokerage Plans:

They also have schemes in which customers can give a upfront brokerage charges and avail the reduced brokerage slabs.

For example, if you pay Rs 2000 upfront, the delivery brokerage charges gets reduced from 0.5% to 0.4%. Similar intraday charges gets reduced from 0.1% to 0.007%.

But the catch is, the scheme is valid for only one year. After that you need to renew the scheme by availing any upfront slabs.

Hence, if your reduced brokerage should compensate for Rs2000 you already paid. Only then opting for the scheme makes sense.

Sharekhan Demat Account Opening and AMC Charges:

The charges for demat account and trading in Sharekhan is as follows,

- Demat and trading Account Opening Charges : Zero

- Annual Maintenance Charges : Rs 400 (Free for first year)

Sharekhan Other Charges:

Apart from brokerage charges, you will incur other expenses which are mostly common among all other brokers as it is charged by government.

| Segment | Transaction Charges | Stamp Duty |

| Intraday | 0.025% (Sell Side Only) | 0.002% |

| Delivery | 0.125% (Both Sides) | 0.010% |

| Futures | 0.017% (Sell Side Only) | 0.002% |

| Options | 0.017% (Sell Side Only, if squared off), on Premium | 0.002% on Premium |

And GST of 18% + 2% Education Cess + 1 % Higher Education cess is also charged by Sharekhan as all brokers do.

Sharekhan Leverage or Margin Review

Leverage is double edged sword. If used properly can lead to tremendous success in Stock market. At the same time, the exposure used can wipe you out.

Sharekhan offers reasonable exposure for their customers. Below table has the summary of the leverage provided by Sharekhan.

Sharekhan Trading Platforms Review

Shrekhan provides trading platforms for all 3 types of devices namely Desktop, Web and mobile.

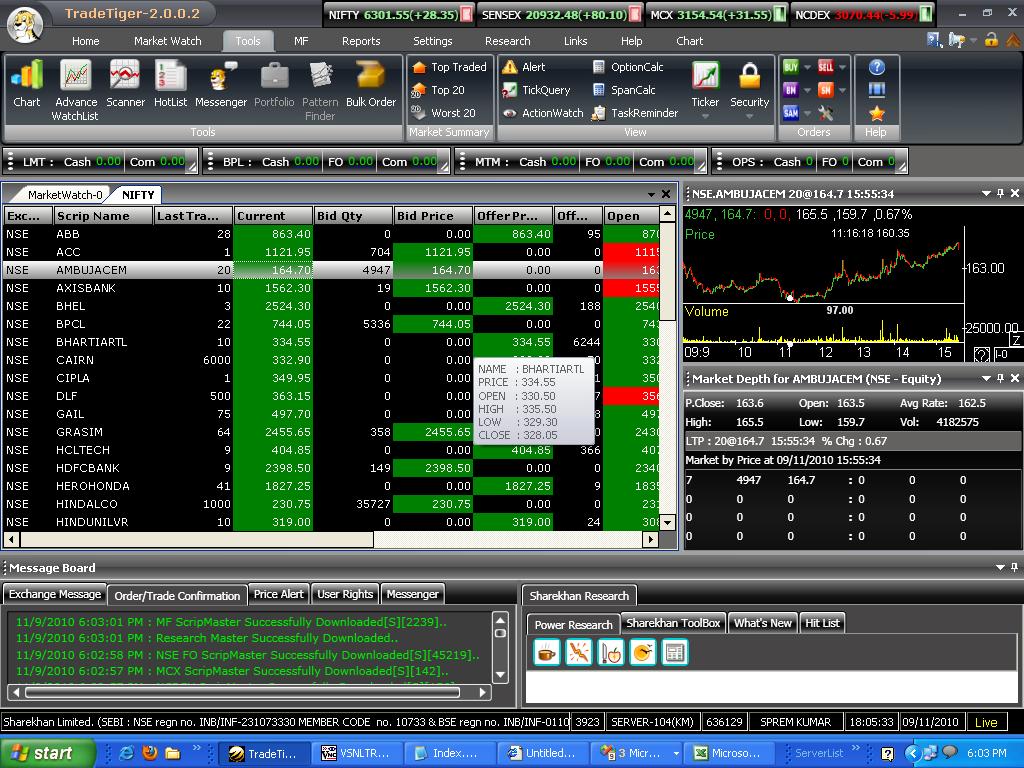

Sharekhan Trade Tiger Review:

Trade Tiger is Sharekhan’s desktop based application. You need to install it once before using it. It was used considered as on of the best trading platforms in India, especially for day traders.

But entry of Zerodha’s KITE changed the entire scene. While TradeTiger is loaded with lot of information on the screen, KITE has simple and clutter free interface.

Traders loved KITE interface which helps in concentrating on what is important.

Some of the key features of Trade Tiger are:

- Real time market updates and multiple market watch

- Offers trading in multiple segments and multiple exchanges

- Online transfer of funds from various banks

- Studies with graph and multiple indicators overlays

- Different tools like span calculator and Options premium calculator

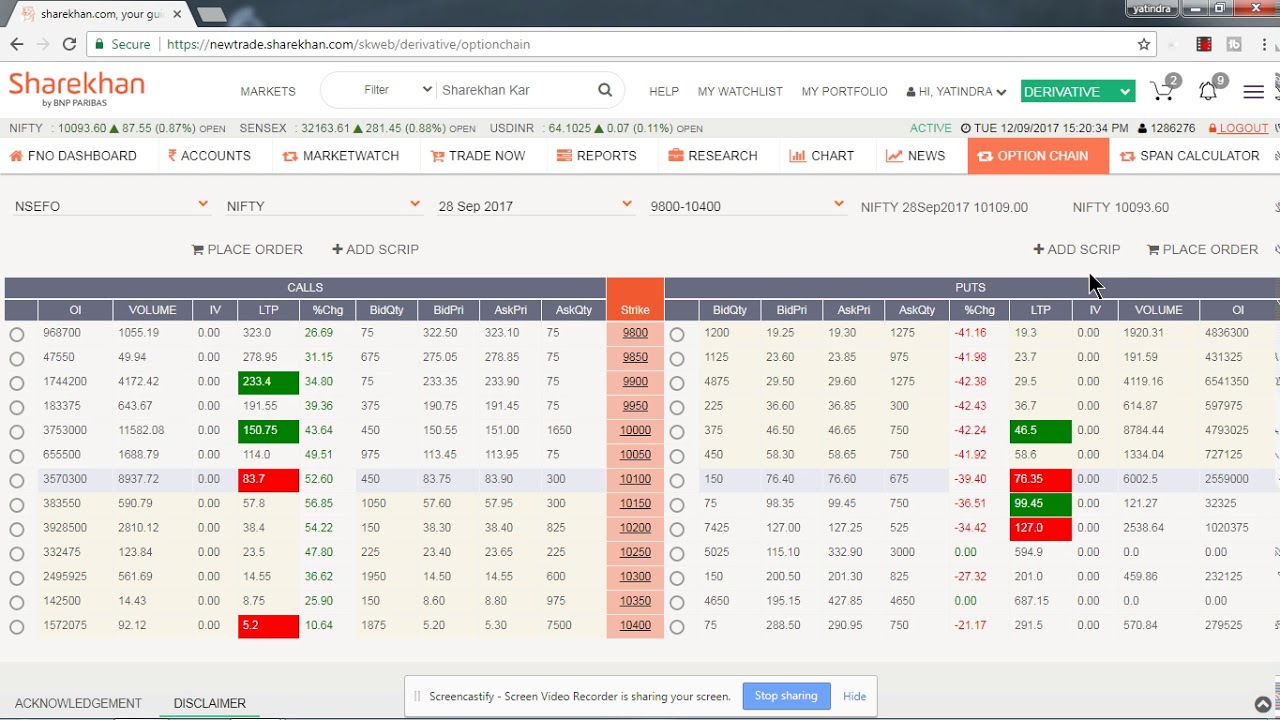

Sharekhan Web Trader Review:

One can access this platforms from any where. No need to install any software. Offcourse , it will slow compared to Trade tiger.

Some of the key features of Web trader are:

- After hours order placement possible

- Real time portfolio tracking

- Integration of Trading , bank and Demat account

- Instant order and trade confirmation by email and SMS

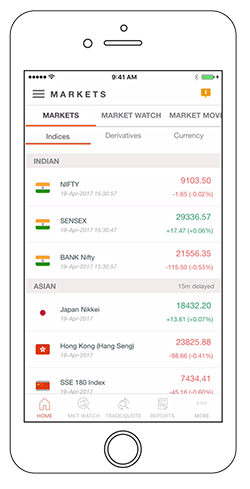

Sharekhan App Review:

This is for traders on the move. Recently they released a new version called Sharekhan App compared to their old Sharemobile.

It is available for both Android and iOS. You can download the app from Playstore.

Some of the key features of Sharekhan App are:

- Enhanced Live Charges at various time ticks

- Trade and invest in multiple exchanges and segments

- Track market trend by adding to market watch

- Transfer of funds possible through the mobile app

- Invest and track Mutual Funds

Sharekhan Dial and Trade:

You can also place the order through the phone by calling a dedicated number. It is useful when your are not connected to internet at remote place or internet is down.

- It is a toll free number

- All the conversation is recorded

- There is no limit on number of calls a customer can make

But what I observed is, their dial and trade lines are usually busy and one has to wait considerable amount of time. Hope they act on this.

Sharekhan Customer Support Mechanism:

Customers can reach to the company through various means. Like,

- Email Support

- Chat Support

- Toll Free Number : 1800 22 7500

- Branches & franchise outlets

Complaints against Sharekhan:

Number of complaints against a stock broker gives fair idea about the integrity and service quality of the broker.

One should not look at only the number of complaints but see in conjunction with number of resolved complaints.

Below are the exchange wise complaints lodged against Sharekhan in current year.

- Complaints lodged in BSE : 198

- Number of complaints resolved in BSE : 184

- Complaints lodged in NSE : 218

- Number of complaints resolved in NSE: 217

Sharekhan Vs other Stock Brokers:

Sharekhan in comparison with other Stock Brokers |

||

Sharekhan Pros and Cons:

Disadvantages of Sharekhan:

- Minimum brokerage clause which charges 10/paise per share and because of this it is not profitable to trade in stocks which trade below rs 20

- Sharekhan does not offer 3 in 1 demat account

- Facility to place after trading time is not available

- Commodity trading service is not offered to classic account holders

- Brokerage charges are very much higher compared to even other full service brokers such as Angel broking and Motilal Oswal

Advantages of Sharekhan:

- Call and trade is completely free

- No charges for fund transfers from banks to trading account and other way round

- Online class room sessions for beginners and advance traders for free

- Wide reach across India and can be accesses across all major towns

- Availability of Prepaid brokerage schemes to reduce the brokerage outgo

- Sharekhan offers one of the finest trading platform (Trade tiger) for free

Sharekhan Review – Conclusion:

Sharekhan is known for strict adhering to regulations and its own policies. So there is no question of trust deficient.

Hence if you are looking for a trusted stock broker, Sharekhan fares very well.

But same thing cannot be said about their brokerage charges. I don’t know why they still charge so heavily in this era of discount brokers.

I am sure that you cannot profit in intraday by trading with Sharekhan. Brokerage itself will eat away huge portion of your profit.

Tradetiger is good, but I have seen many traders using Tradetiger for charting purpose but trade with Zerodha to save on brokerage.

Please share your ratings and review of Sharekhan with fellow visitors.

You May be Also Intereseted In :