Zerodha Vs Upstox : Whom you should choose?

Few of you may be confused about whether to open account in Zerodha or Upstox as both look similar at outset. But, only when I put them side by side and compare, clear picture emerges.

So let us compare Zerodha Vs Upstox with each aspects and see who would be better match for you. By end of the post, you will be able to make up your mind.

Zerodha and Upstox are the two well known brokerage firms of India in 2024. They are into the brokerage business from 2010 and 2012 respectively.

I myself trade with Zerodha. I have written reason for it here.

But Upstox is also a reputed and reliable stock broker based out of Mumbai and equally as good. They are second largest discount brokers now after Zerodha. Also they are backed by many prominent investors like Mr. Ratan Tata.

Zerodha Vs Upstox : Best Discount Brokers of India

Both Upstox and Zerodha are known as discount brokers. That means they don’t provide any recommendations or tips. But they provide state of the art trading platforms, charge low and flat brokerage charges.

So discount brokers are good for those who don’t need any guidance in stock market trading/investments. There is will be no Relation Manager (RM) to bug you now and then to trade (in most of the cases they have their own interest in generating brokerage to meet their company target)

I was not looking for any guidance in trading and hence I switched from Sharekhan to Zerodha. Looking back, I am happy that I made that decision which resulted in huge savings in terms of brokerage.

Read : 10 Best Discount Stock Brokers of India

Zerodha Vs Upstox : Comparison Parameters

I have equated Zerodha Vs Upstox based on Company overview, Account related charges, Brokerage Charges, Transaction charges, Exposure provided, other features, Investment services, Customer service , Research/recommendations and promotion offer on account opening if any.

So, let us check comparison of these brokers based on each parameters side by side.

Zerodha & Upstox : Company Information

At first, we will take a look at basic information of each company. Comparison of products and services will see later.

Zerodha Vs Upstox : Products and Services Offered

Here there is no much difference between them. But Zerodha provides service for NCD and Bonds where as Upstox does not offer any service in these segments.

If you are an NRI, only Zerodha supports NRI account. (Best NRI Accounts in India)

Zerodha Vs Upstox Charges Comparison

This is important section, as charges are the ones which pay repeatedly and we primarily open account with discount brokers to have reduced charges.

Let us now compare various charges associated with Zerodha and Upstox like,

- Brokerage Charges

- Account Opening Charges

- Transaction Charges

- Other statutory charges

1) Brokerage charges comparison : Zerodha and Upstox

Zerodha fares better in comparison to Upstox when it comes to brokerage charges.

If you buy shares and don’t sell it on same day and take delivery, it is called delivery trade.

While brokerage is Zero in Zerodha for delivery segment, Upstox charges Rs20/order.

So now imagine this, if you carry out 5 transactions (5 buy and 5 sell), the brokerage in upstox is Rs200.

This is the reason I advise not to consider only account opening fee as deciding factor. Yes, Zerodha has Rs200 account opening fee and there is no charges in Upstox. But as I explained earlier, Rs200 is lost in only 5 transaction and for all the remaining transactions you will be paying Rs20 in Upstox for rest of your life.

Zerodha was the first to introduce Zero brokerage for delivery trades. Upstox followed it.

Earlier Upstox had monthly brokerage plan called freedom plan for Rs1947. But they scrapped it later.

Below is the comparison of brokerage charges of Zerodha Vs Upstox

2) Account opening charges : Zerodha comparision with Upstox

Here, Zerodha looks little bit expensive in comparison of Upstox as far as account opening and AMC charges.

Upstox some time offer Zero account opening offer. Please check with their sales person while opening the account.

That means, if you are opening both equity and commodity account with Zerodha, account opening charges are Rs500.

Commodity account is optional. You can opt for only equity account and save Rs 200 (If you don’t trade in commodities). Commodity account can be opened later also.

3) Transaction Charges : Zerodha’s and Upstox’s charges Comparison

Each broker has to pay the charges to stock exchanges like NSE and BSE for the transaction done.

Every brokers pass on this charges to customers. But they are free to charge little extra above the charges that they pay to exchanges.

Infact this how most of the discount brokers make money. Brokerage charges are just front end charges where customer concentrate.

Customers overlook transaction charges but brokers make money out of it.

Here is the comparison of Zerodha’s and Upstox’s transaction charges.

What does 0.00325% means?

If you purchase 1000 shares of a company at Rs500 then total traded value becomes (1000 X Rs 500) Rs 5,00,000

0.00325% that is (0.00325/100 X Rs 5,00,000) Rs 16.25 is levied.

But in Options segment, it is calculated only on the premium instead of traded value.

4) Zerodha Versus Upstox : Statutory Charges Comparison

These are the charges levied by the government and more or less the same across every broker. These charges are nothing to worry much about.

Statutory charges are paid to Government of India and brokers don’t have any control over them. These include STT, SEBI Charges, GST and Stamp duty charges.

Zerodha Vs Upstox Margin/Exposure/Leverage Comparison

Margin allow traders to use broker’s funds to buy/sell shares for more than the amount available in their trading account.

Every broker provides leverage but you should not choose a broker who provide too much of exposure. It puts both broker and all of their customer at risk.

Fortunately, both Zerodha and Upstox provide reasonable leverage which make them safe.

Zerodha is much conservative among both. Upstox has special plan called “Priority pack” which provides extra margin. But for Priority pack, brokerage charges are fixed at Rs30/trade instead of Rs20/trade

Below table shows the comparison of margin provided by Zerodha and Upstox.

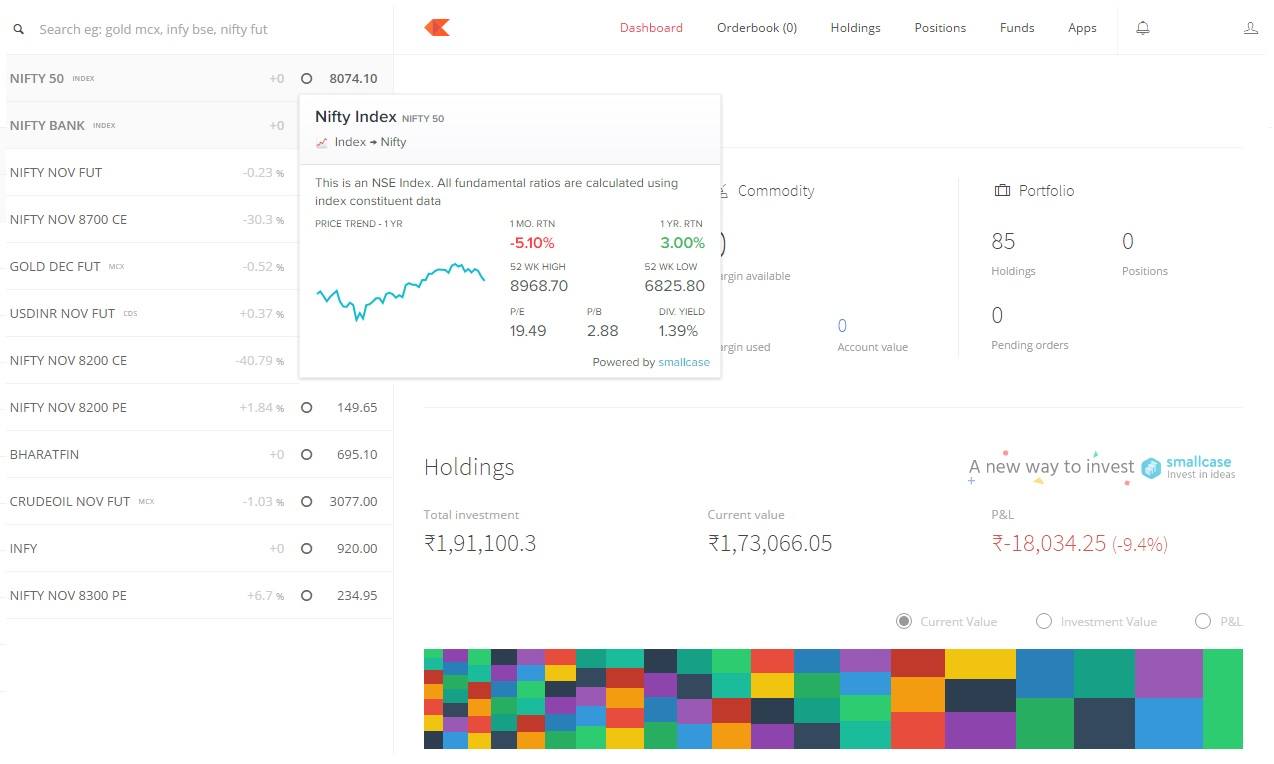

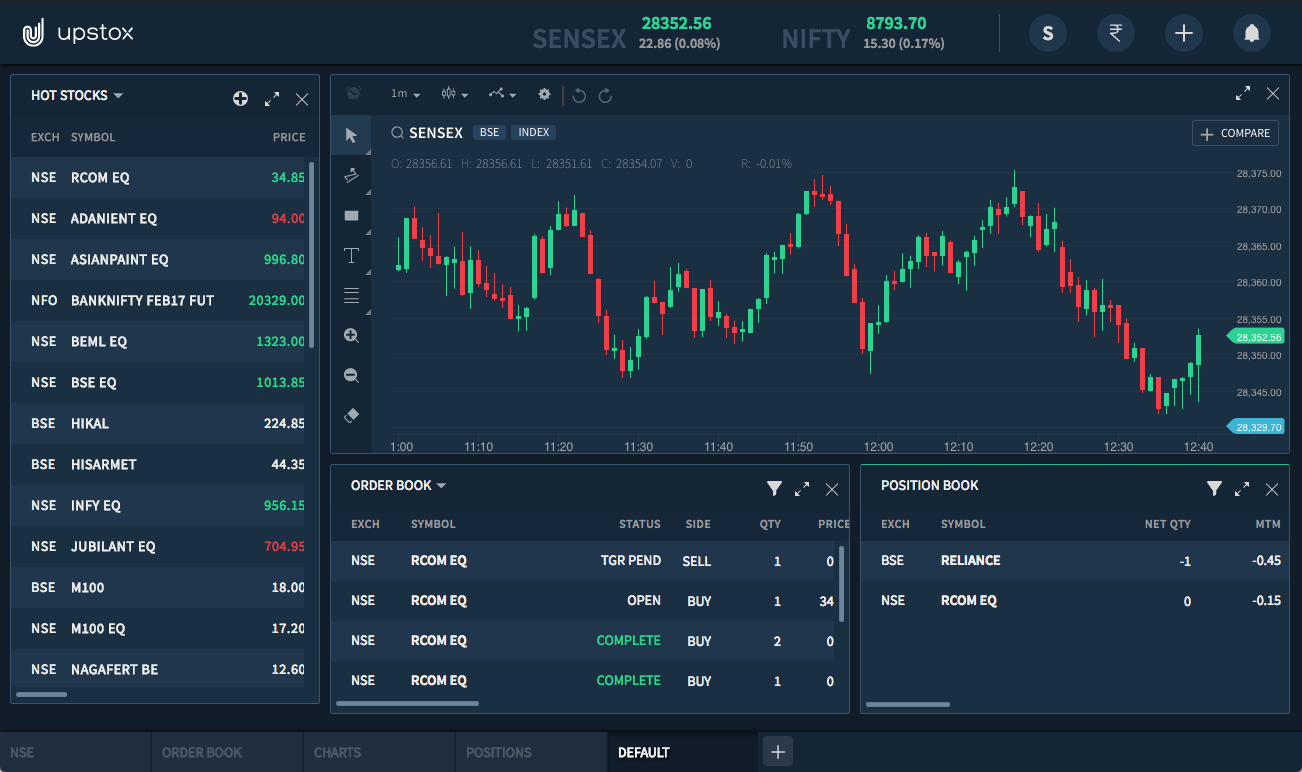

Trading Platform Comparison of Zerodha KITE with Upstox Pro

Trading platforms offered by both Zerodha and Upstox are best in the industry. Please read this article to know about best trading apps in India.

Infact, Zerodha could attract more customers because of their neat and simple to use , clutter free trading platform called “KITE”.

While every other brokers were offering third party software like NEST, Zerodha invested and developed their in house platform.

Read : Detailed Review of Zerodha KITE – India’s finest trading platform

Similarly, Upstox followed the suit and developed platform called “UpstoxPro”.

Good thing is that both KITE and UpstoxPro are offered for free.

Both of them are available for Desktops, Mobiles and Tablets. But MAC platform support is not available for both.

Mobile app is available for both Android and iOS.

Upstox & Zerodha Trading Platform comparison

Features of Zerodha & Upstox platforms

Upstox – Zerodha : Supported Order Types

There are numerous types of order one can place like CNC Order, MIS Order, Normal Order (NMRL), BTST and STBT orders.

Above order are supported by most of the brokers. But some of the special order types are supported by only few brokers.

These order include Cover Order (CO), Bracket Order (BO), After Market Order (AMO) and Good Till Triggered (GTT) order.

Zerodha supports all these types of orders whereas Upstox too supports these orders.

Below is the summary table of types of orders supported by these brokerage companies.

Branch Address of Zerodha & Upstox

In this aspect, Zerodha fares better than Upstox. Zerodha has more branches when compared to Upstox.

As all operations happens online visiting office is not required , but is is assuring to know that a office is present in our city/town.

Zerodha is present in more than 22 branches while Upstox has only 2 branches.

Zerodha Head Office is at Bengaluru and Upstox is based out of Mumbai.

Below table shows address of theirs in major metro cities.

Zerodha & Upstox Customer Complaints

Number of complaints gives fair idea about the quality of customer support of the brokers.

But we should not look only at the absolute numbers. We need to check how many complaints per 1000 customers.

Zerodha Pros and Cons:

Pros

- Option to invest in Direct mutual funds for free

- 100% online account opening based on Aadhaar number

- Offer best trading platform in India

- No brokerage on equity delivery

- Maximum brokerage is capped at Rs20

- NRI Demat account available

Cons

- Call and Trade is charged at Rs 20

- No recommendations and tips and research reports

- 3-in-1 demat account is available with only IDFC First bank

- Margin funding is not possible

Upstox Pros and Cons:

Pros

- Have different trading plan to avail higher leverage

- 100% online account opening based on Aadhaar number

- Offer best trading platform in India

- No brokerage on equity delivery

- Maximum brokerage is capped at Rs20

Cons

- Call and Trade is charged at Rs 20

- No recommendations and tips and research reports

- No 3-in1 demat account (Possible with IndusInd bank)

- Margin funding is not possible

- Investing in NCDs and bonds are not possible

- NRI Trading is not available

Point By Point Comparison of Zerodha with other Brokers:

Zerodha in comparison with other Stock Brokers |

||

Point By Point Comparison of Upstox with other Brokers:

Upstox in comparison with other Stock Brokers |

||

Summary of comparison of Zerodha With Upstox:

Below is the table of detailed comparison of Zerodha Vs Upstox all put together.

Parameters | Upstox | Zerodha |

| Review | ||

| Type of Broker |

Discount Broker |

Discount Broker |

| Incorporation Year | 2012 | 2010 |

| Supported Exchanges | NSE, BSE,MCX and MCX-SX | NSE, BSE, MCX and NCEDEX |

Account Related Charges |

||

| Trading Account Opening Fees | Rs 150 | Rs 300 |

| Trading Account AMC | Rs 0 | Rs 0 |

| Demat Account Opening Fees | Rs 150 | Rs 100 |

| Demat Account AMC | Rs 0 | Rs 300 |

Brokerage Charges |

||

| Equity Delivery Brokerage | Rs 0 | Rs 0 |

| Equity Intraday Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Equity Futures Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Equity Options Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Currency Futures Trading Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Currency Options Trading Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Commodity Trading Brokerage | Rs 20 per executed order | Rs 20 per executed order |

| Minimum Brokerage Charges | NIL | NIL |

| Monthly Unlimited Plans | ||

| Brokerage Calculator | Upstox Brokerage Calculator | Zerodha Brokerage Calculator |

Transaction Charges |

||

| Equity Delivery | 0.00325% | 0.00325% |

| Equity Intraday | 0.00325% | 0.00325% |

| Equity Futures | 0.00210% | 0.00210% |

| Equity Options | 0.055% (On Premium) | 0.053% (On Premium) |

| Currency Futures | 0.00150% | 0.00135% |

| Currency Options | 0.060% (On Premium) | 0.044% (On Premium) |

| Commodity | 0.0026% | Non Agri 0.0036%, Agri 0.00275%, |

Exposure |

||

| Equity | Upto 20 times Intraday | Upto 20 times Intraday |

| Equity Futures | upto 4 times | upto 2.5 times |

| Equity Options | upto 4 times | upto 2.5 times |

| Currency Futures | upto 4 times | upto 2.5 times |

| Currency Options | upto 4 times | upto 2.5 times |

| Commodities | upto 3 times | upto 2.5 times |

Features |

||

| 3 in 1 Account | ||

| Mobile Trading | ||

| Charting | ||

| Automated Trading | ||

| After Trading Hour Orders | ||

| SMS Alerts | ||

| Margin Funding | ||

| Trading Platform | Upstox , Upstox PRO and NEST | Zerodha Kite |

Investment Services |

||

| Stock / Equity | ||

| Commodity | ||

| Currency | ||

| Initial Public Offers (IPO) | ||

| Mutual Funds | ||

Customer Service Channels |

||

| 24/7 Customer Service | ||

| Email Support | ||

| Onine Live Chat | ||

| Phone Support | ||

| Toll Free Number | ||

| Support Through Branches | ||

| Relationship Managers | ||

Research Reports/Tips/Recommendations |

||

| Daily Market Report | ||

| Tips/Recommendations | ||

| Quarterly Result Analysis | ||

| News Alerts | ||

| Robo Advisory | ||

Promotional Offers |

||

|

|

|

Zerodha Vs Upstox Who Is Best?

On comparing Zerodha Vs Upstox. it is evident that both are equally best. There is no much difference between them in terms of technology. Finally, both platforms provide charting, but Upstox’s offering is much more basic and doesn’t allow drawing or customization, while Zerodha’s charting tools are much more robust. Zerodha is the clear winner for research and account amenities.

What makes Zerodha better than Upstox is in terms of more number of branches, brand name of being the No 1 broker of India, many innovative tools that help in decision making and provide well organized reports.

Upstox has edge in terms of higher margin, lower account opening and AMC charges, multiple plans etc. So they are more flexible when compared to Zerodha.

Now it all depends on the customer to choose either Zerodha Vs Upstox as both are equally good.

You can compare any two stock brokers of your choice by visiting Comparison of Stock Brokers in India page