One onside we have Zerodha who provides lower brokerage charges and on another side we have Sharekhan who offer wide variety of products. who you should open account with?

In this page, I am providing side by side comparison of Sharekhan Vs Zerodha. Also, I will cover both similarities and differences between Sharekhan and Zerodha with in detail comparison.

When we compare Zerodha and Sharekhan keeping both side by side in tabular form, we will understand the difference between them clearly.

At the end, I will also explain you whether it is better to open account with Zerodha or Sharekhan.

Read: Top 10 stock brokers of India

Zerodha Vs Sharekhan : Comparision Parameters

I have equated Zerodha Vs Sharekhan based on Company overview, Account related charges, Brokerage Charges, Transaction charges, Exposure provided, other features, Investment services, Customer service , Research/recommendations and promotion offer on account opening if any.

So, let us check comparison of these brokers based on each parameters side by side.

Zerodha & Sharekhan: Company Information

Below table has the information about basic details of both brokerage firms. Comparison of products and services will follow later.

Zerodha & Sharekhan: Products and Services Offered

When we compare products and Zerodha against Sharekhan, we find that major difference is PMS Service.

PMS stands for Portfolio Management Service wherein they manage your investments. Sharekhan charges fees for that and minimum investment requirement is Rs 50 Lakhs.

Zerodha does not provide any service in terms of management of portfolio. They don’t even publish research reports.

Zerodha & Sharekhan Charges Comparison

Here is the main difference between Sharekhan and Zerodha is observed. Many people either choose Zerodha or Sharekhan mainly for this reason.

Let us now compare various charges associated with Zerodha and Sharekhan like,

- Brokerage Charges

- Account Opening Charges

- Transaction Charges

- Other statutory charges

1) Brokerage charges comparison : Zerodha Vs Sharekhan

Below is the comparision table of Brokerage charges of Zeroha Vs Sharekhan

Let me show you how much you can save by opening account with Zerodha in comparison of Sharekhan

For Investor:

If you plan to invest Rs 10 Lakh, with 0.5% brokerage of Sharekhan, you have to shell out Rs5,000 in brokerage itself where as you pay nil in case of Zerodha (Investments are free at Zerodha).

Hence there will be 100% savings in brokerage charges compared to Sharekhan.

For Trader:

Now let us see for intraday and Futures traders, how much can be saved.

Let us assume you buy Rs 1lakh and sell 1lakh worth of shares daily. That means in around 20 trading days of month it will be 40 lakhs.

Sharekhan charges 0.1% hence the brokerage charges per month is Rs40Lakh * 0.1% which is Rs 4,000.

So yearly it would be,

Rs4,000 * 12 months = Rs 48,000

Now Zerodha charges Rs 20/trade for intraday. In Zerodha, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600

2) Account Opening Charges : Sharekhan Vs Zerodha

Zerodha is little expensive in terms of account opening charges. Sharekhan is running free account opening offer. Please check with them before opening demat account.

But at the same time, Annual Maintenance Charges (AMC) of Sharekhan is higher than that of Zerodha

Commodity account is optional in Zerodha. You can opt for only equity account and save Rs 200 (If you don’t trade in commodities). Commodity account can be opened later also.

3) Transaction Charges : Zerodha Vs Sharekhan Comparison

Each broker has to pay the charges to stock exchanges like NSE and BSE for the transaction done.

Every brokers pass on this charges to customers. But they are free to charge little extra above the charges that they pay to exchanges.

4) Statutory Charges : Zerodha Vs Sharekhan Comparison

These are the charges levied by the government and more or less the same across every broker. These charges are nothing to worry much about.

Statutory charges are paid to Government of India and brokers don’t have any control over them. These include STT, SEBI Charges, GST and Stamp duty charges.

Zerodha Vs Sharekhan Margin/Exposure/Leverage Comparison

There is no clear winner in this section. Please check the table below and decide which segment you trade.

Both brokers offer reasonable margin (leverage). They are not offering too high leverage. Too much exposure is also bad.

Read: Stock brokers offering highest leverage in India.

Trading Platforms : Zerodha Vs Sharekhan

Trading platforms play key role in success of the trader. If you are a day trader then the software needs to be super fast. Few minutes delay can cause major change in your trade result.

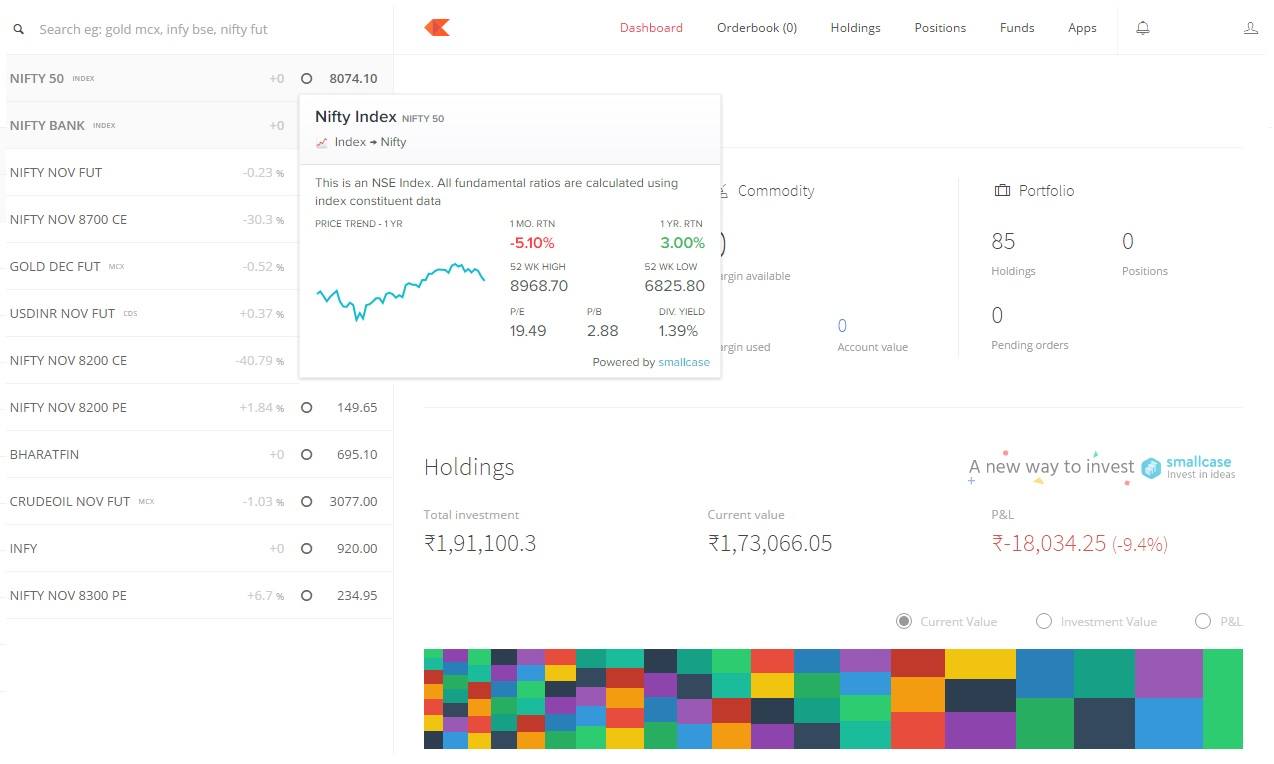

Zerodha offers one of the most advanced trading platform called KITE. Read the detailed review of KITE where I have explained all its features.

Kite interface is simple and minimalistic when compared to Sharekhan Web platforms. It is elegant and free from unnecessary clutters.

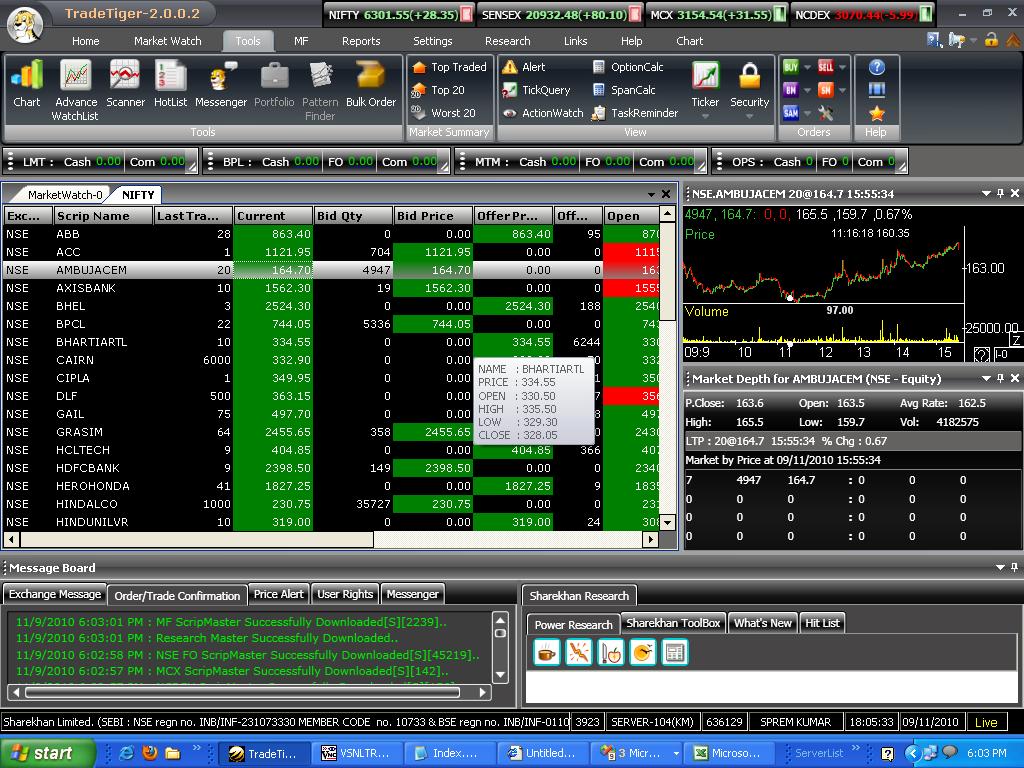

But Sharekhan’s TradeTiger is one of the Best Trading Platform of India and has lot of features.

When it comes to Mobile app. Zerodha’s KITE scores above Sharekhan Mobile App.

Read : 9 Best trading apps of India for superior trading experience

Features of Zerodha & Sharekhan platforms

Below is the illustration of Zerodha’s and Sharekhan’s trading platform features.

Sharekhan Vs Zerodha : Supported Order Types

There are numerous types of order one can place like CNC Order, MIS Order, Normal Order (NMRL), BTST and STBT orders.

Above order are supported by most of the brokers. But some of the special order types are supported by only few brokers.

These order include Cover Order (CO), Bracket Order (BO), After Market Order (AMO) and Good Till Cancelled (GTC) order

Both the brokers provide similar type of orders. Hence there is not much variation between Sharekhan & Zerodha

Branch Address of Zerodha & Sharekhan

As far as physical location is concerned, Sharekhan is way ahead of Zerodha.

They have 1800+ Branches compared to 100+ of Zerodha. Infact, Zerodha is able to reduce the brokerage to such a low extent is because, they dont have to spend on building infrastructure.

All work happens through online and there is little physical interaction with Zerodha.

Zerodha Vs Sharekhan Customer Complaints

Number of complaints gives fair idea about the quality of customer support of the brokers.

But we should not look only at the absolute numbers. We need to check how many complaints per 1000 customers.

Zerodha Pros and Cons:

Pros

- Option to invest in Direct mutual funds for free

- 100% online account opening based on Aadhaar number

- Offer best trading platform in India

- No brokerage on equity delivery

- Maximum brokerage is capped at Rs20

- NRI Demat account available

Cons

- Call and Trade is charged at Rs 20

- No recommendations and tips and research reports

- 3-in-1 demat account is available with only IDFC First bank

- Margin funding is not possible

Sharekhan Pros and Cons:

Pros

- Call and trade is completely free

- No charges for fund transfers from banks to trading account and other way round

- Online class room sessions for beginners and advance traders for free

- Wide reach across India and can be accesses across all major towns

- Availability of Prepaid brokerage schemes to reduce the brokerage outgo

- Sharekhan offers one of the finest trading platform (Trade tiger)

Cons

- Minimum brokerage clause which charges 10/paise per share and because of this it is not profitable to trade in stocks which trade below rs 20

- Sharekhan does not offer 3 in 1 demat account

- Facility to place after trading time is not available

- Commodity trading service is not offered to classic account holders

- Brokerage charges are very much higher compared to Rs20 from Zerodha

- It is more than even other full service brokers such as Angel broking and Motilal Oswal

Point By Point Comparison of Zerodha with other Brokers:

Zerodha in comparison with other Stock Brokers |

||

Point By Point Comparison of Sharekhan with other Brokers:

Sharekhan in comparison with other Stock Brokers |

||

Summary of comparison between Sharekhan Vs Zerodha:

Below is the table of detailed comparison of Zerodha Vs Sharekhan all put together

Parameters | Sharekhan | Zerodha |

| Review | ||

| Type of Broker |

Full Service Broker |

Discount Broker |

| Incorporation Year | 2000 | 2010 |

| Supported Exchanges | NSE, BSE, NCD-EX, MCX and NSEL | NSE, BSE, MCX and NCEDEX |

Account Related Charges |

||

| Trading Account Opening Fees | Rs 750 | Rs 300 |

| Trading Account AMC | Rs 0 | Rs 0 |

| Demat Account Opening Fees | Rs 0 | Rs 100 |

| Demat Account AMC | Rs 400 | Rs 300 |

Brokerage Charges |

||

| Equity Delivery Brokerage | 0.5% | Rs 0 |

| Equity Intraday Brokerage | 0.1% | Rs 20 per executed order |

| Equity Futures Brokerage | 0.1% | Rs 20 per executed order |

| Equity Options Brokerage | Rs 100/lot | Rs 20 per executed order |

| Currency Futures Trading Brokerage | 0.1% | Rs 20 per executed order |

| Currency Options Trading Brokerage | Rs 30/lot | Rs 20 per executed order |

| Commodity Trading Brokerage | 0.1% | Rs 20 per executed order |

| Minimum Brokerage Charges | Rs 16 per Scrip | NIL |

| Monthly Unlimited Plans | ||

| Brokerage Calculator | Sharekhan Brokerage Calculator | Zerodha Brokerage Calculator |

Transaction Charges |

||

| Equity Delivery | 0.00325% | 0.00325% |

| Equity Intraday | 0.00325% | 0.00325% |

| Equity Futures | 0.00190% | 0.00210% |

| Equity Options | 0.0500% (On Premium) | 0.053% (On Premium) |

| Currency Futures | 0.00135% | 0.00135% |

| Currency Options | 0.04220% (On Premium) | 0.044% (On Premium) |

| Commodity | 0.00230% ( Non Agri) & 0.00095% ( Agri) | Non Agri 0.0036%, Agri 0.00275%, |

Exposure |

||

| Equity | Upto 10 times Intraday and 5 times Delivery | Upto 20 times Intraday |

| Equity Futures | Upto 2 times Intraday | upto 2.5 times |

| Equity Options | No Leverage | upto 2.5 times |

| Currency Futures | No Leverage | upto 2.5 times |

| Currency Options | No Leverage | upto 2.5 times |

| Commodities | Upto 2 times intraday | upto 2.5 times |

Features |

||

| 3 in 1 Account | ||

| Mobile Trading | ||

| Charting | ||

| Automated Trading | ||

| After Trading Hour Orders | ||

| SMS Alerts | ||

| Margin Funding | ||

| Trading Platform | Trade Tiger, Sharekhan Mobile App and Sharekhan Mini | Zerodha Kite |

Investment Services |

||

| Stock / Equity | ||

| Commodity | ||

| Currency | ||

| Initial Public Offers (IPO) | ||

| Mutual Funds | ||

Customer Service Channels |

||

| 24/7 Customer Service | ||

| Email Support | ||

| Onine Live Chat | ||

| Phone Support | ||

| Toll Free Number | ||

| Support Through Branches | ||

| Relationship Managers | ||

Research Reports/Tips/Recommendations |

||

| Daily Market Report | ||

| Tips/Recommendations | ||

| Quarterly Result Analysis | ||

| News Alerts | ||

| Robo Advisory | ||

Promotional Offers |

||

|

|

|

Who is good? Zerodha Vs Sharekhan

On comparing Zerodha Vs Sharekhan, it is clear that both are equally good. Sharekhan scores good interms of ease of reaching, customer support etc where as Zerodha is better than Sharekhan when it comes to Brokerage charges.

But I switched from Sharekhan to Zerodha in 2012. I was not interested in any research and recommendations. My main concern was paying huge brokergage which was eating up my profits.

Since then I am trading with Zerodha and pretty satisfied with their service.

With whom you are opening account, Zerodha or Sharekhan?

You can compare any two stock brokers of your choice by visiting Comparison of Stock Brokers in India page