Zerodha Review 2024

Zerodha Review & Information: Zerodha is the biggest stock broker in India with highest number of customers and offers free investment in equities and mutual funds. They are ideal for traders and investors looking to save on brokerage charges with simple to use trading platforms.

Zerodha, the granddaddy of online discount brokers of India, is good choice for active investors. Its platforms are easy to use, customer service is responsive, and trades execute quickly. Plus, it now charges no commissions on online stock investment, Rs20/trade for Futures and Options trades.

I use Zerodha Broker for my trading and investment purpose. I opened the demat account with them way back in early 2012. I am writing this Zerodha review comparing its pros and cons based on my own experience with them.

Zerodha Pros & Cons:

Pros

- Biggest Stock broker of India

- 1 Crore+ customers – highest in India

- Zero Brokerage on Delivery trades

- Maximum Brokerage is capped at Rs 20 for other segments

- 100% online account opening – No paper work

- Easy to understand brokerage structure

Cons

- Call and Trade is chargeble at Rs20 per trade

- Not a 3-in-1 demat account

How much Brokerage can be saved with Zerodha?

Before beginning the review, let us see how much savings a investor and a trader can do if he opens an account with Zerodha.

Because of the huge savings and the quality of products that Zerodha offers, they are able to overtake the likes of ICICI Direct and Sharekhan to become India’s largest stock broker within 8 years.

For Investor:

If you plan to invest Rs 10 Lakh, with 0.55% brokerage (ICICIDirect charges this much!), you have to shell out Rs5,500 in brokerage itself where as you pay nil in case of Zerodha (Investments are free at Zerodha).

Hence there will be 100% savings in brokerage charges compared to brokers like ICICI Direct.

For Trader:

Now let us see for intraday and Futures traders, how much can be saved.

Let us assume you buy Rs 10lakh and sell 10lakh worth of shares daily. That means in around 20 trading days of month it will be 400 lakhs.

ICICI Direct charges 0.0275% hence the brokerage charges per month is Rs400Lakh * 0.0275% which is Rs 11,000.

So yearly it would be,

Rs11,000 * 12 months = Rs 1,32,000

Now Zerodha charges Rs 20/trade for intraday. In Zerodha, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600

Hence, traders can save more than 90% of brokerage and indirectly add to their profit

About Zerodha:

Zerodha was started in year 2010 by Mr. Nithin Kamat and I was little apprehensive about opening the demat account with them as they were literally unknown entity at that time. But they have always met my expectation since then.

Mr Kamath himself was a trader in stock market before founding his brokerage firm. He had faced many hurdles as a trader and wanted to address them.

Zerodha Stands for “Zero” + “Rodha”. The Sanskrit meaning of Rodha is Barrier. So as name suggests, they had the vision to break all the possible barriers the common trader and investors of India faced at that time.

Zerodha Customer Ratings & Review 2024:

| Customer Ratings | |

|---|---|

| Brokerage Charges & Fees | 9.8/10 |

| Trading Platforms | 9.9/10 |

| Products & Services | 9.5/10 |

| Experience | 8.9/10 |

| Overall Ratings | 9.75/10 |

| Star Ratings | ★★★★★ |

Zerodha has a strong reputation for its technological innovations, but its brokerage segment is no slouch either: It offers Rs0 trading commissions, a swath of product offerings and an easy-to-use platform that also can be customized for more advanced traders.

Zerodha is best for:

- Active Traders (Day Traders)

- Brokerage free investments

- Direct Mutual Fund Investors

Zerodha Brokerage Charges

Zerodha is the first broker to introduce Zero brokerage for demat account. Any delivery based transaction will have no brokerage.

All the other trades like intraday and derivatives (Future and Options) are charges flat Rs20 per trade.

Below Table captures the segment wise brokerage charges of Zerodha. It is important to note the clause “0.03% or Rs 20 which ever is Lower“

This is beneficial to smaller traders. For example, if one buys shares worth Rs1000 intraday then the brokerage will not be Rs20 but 0.03% of Rs 1000, that is 30paisa.

Zerodha : Maximum Rs 20 / Trade for all trades

While I was using ICICDirect, I used to pay Rs75 per lot options trading , so to buy 10 lots, I had to shell out Rs750.

I was trading Options in 2012 and when I heard Flat Rs20 for any number of lots, the offer was irresistible.

Many of my options strategies which I was finding difficult to make profit because of the high brokerage, started to make sense now. Hence I took risk and opened the account with Zerodha and deposited small capital to try out them.

For detailed information about Zerodha Brokerage Charges , refer the link.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

SaveRs200: you can save Rs200 by opening the account online. Use below Link to get discount of Rs 200.

I have written a detailed article about Zerodha Account opening and DP Charges.

Zerodha Mobile, Desktop and Web Trading Platforms

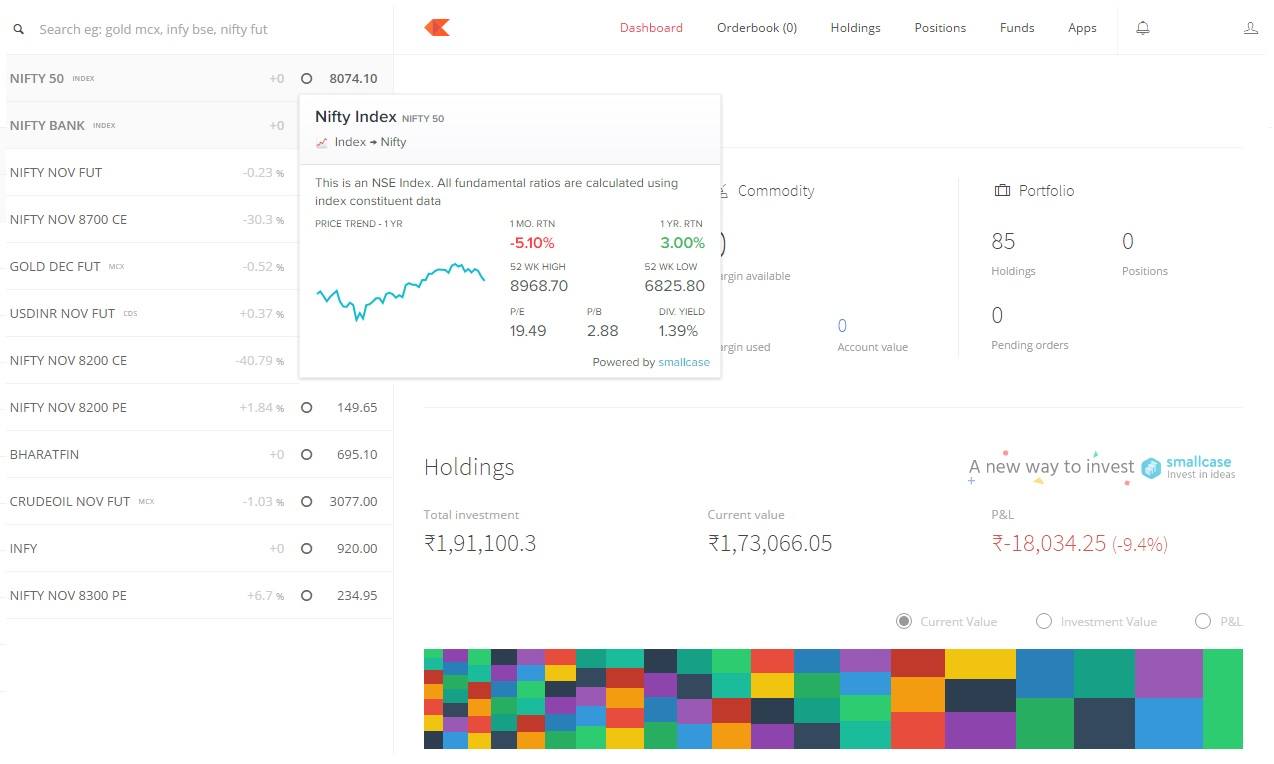

KITE is the next generation trading platform from Zerodha. I have written a detailed KITE review covering its features and pros & cons.

While some prominent brokerage houses charge monthly subscription fees for using their platforms, KITE is totally free for Zerodha clients.

Zerodha KITE Trading Platform:

What I like the most in this platform is its minimalistic nature. It is clean and clutter free which helps me in focussing on what is important to me (my trade) than some unwanted information.

Some of the salient features of Zerodha Kite are,

- Multiple market watches

- Floating Order window

- Exit multiple orders/positions in one click

- Streaming quotes

- Multiple Chart View

- Multiple order types (Regular, CO, BO and AMO)

- Browser Notifications

- Multilingual Support

- Market Depth View with streaming updates

- Place order directly from chart

Zerodha Margin/Exposure and Intraday Leverage Details

- Zerodha Margin for NSE and BSE Cash Segment:

- 20x Margin for stocks listed in F&O

- Upto 2x margin for stocks with 20% circuit breaker for all intraday (MIS) orders

- Margin for equity Futures :

- 6X leverage for CO(Cover order) and BO (Bracket Order)

- 4Xleverage for MIS orders

- Leverage for Equity Options buying:

- 1.3X leverage for CO(Cover order) and BO (Bracket Order)

- No leverage for MIS orders

- Leverage for Equity Options Selling :

- 4X leverage for all orders

- Exposure for Currency Futures : Upto 4X leverage for MIS/CO and BO Orders

- Zerodha Margin for Commodity Futures:

- Upto 3Xmargin for Non-Agri commodities with CO orders and 2.5X in MIS orders

Zerodha Membership Information

- Zerodha Broking Ltd.: Member of NSE & BSE – SEBI Registration no.: INZ000031633

- CDSL: Depository services through Zerodha Securities Pvt. Ltd. – SEBI Registration no.: IN-DP-100-2015

- Commodity Trading through Zerodha Commodities Pvt. Ltd. MCX: 46025 – SEBI Registration no.: INZ000038238

Zerodha Contact Information

- Zerodha Broking Ltd., #153/154, 4th Cross, Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078, Karnataka, India

- Phone : +91 80 4913 2020

- Website : Zerodha website

Advantages and Disadvantages of Zerodha

I like few features of Zerodha and at the same time there are also some features that I don’t like. I am providing the Pros and Cons of Zerodha below,

Disadvantages of Zerodha:

1) Not a 3-in-1 Demat account

What I miss the most in Zerodha compared to ICICI Direct is the seamless transfer of funds between my trading and savings bank account.

While Payin (transfer from bank to Zerodha account) is instant through net banking, the payout (trading to bank account) takes few hours. Payout was instant in ICICIDirect.

But I am used to it now by planning in advance and it is the small discomfort when compared to savings I am getting in brokerage charges.

Update: Recently Zerodha started offering 3-in-1 demat account but only to those who have their savings account with IDFC First Bank.

2) Call and Trade is Charged

Zerodha charges Rs 25 for every trade you place by calling to their customer care.

Though it will not affect much to those who use the app/desktop to trade.

Advantages of Zerodha:

1) Excellent Trading Platforms

I have tried trading platforms of multiple brokers and I find Zerodha Kite is the best trading platform available out there.

While other platforms are very complicated and resource heavy, for me, Kite offers whatever required with very minimalistic interface and simple to use with not so bright colors straining the eyes.

This is where Zerodha finds good rankings among its peers because of the innovation it put up in product development and offerings.

2) Customer Support Mechanism

What I like most in Zerodha is, the founder Mr Nithin Kamath himself is very active on resolving the customer queries. He answers most of the queries through Z-Connect which is the platform to connect Zerodha with its customer.

Apart from that, all the queries you raise to them are assigned with ticket and you can track all the solutions and updates provided by the customer support team through the ticket number.

Read: 9 Best Demat and Trading account in India

3) Investor Education Initiatives

Zerodha have various investor education initiative such as TradingQna – a forum for traders and investors to ask thier queries and get help answers from fellow traders.

Zerodha Varsity – Free to all collection of modules with collection of lessons from their research head Mr Karthik Rangappa.

While few established brokers charge for these kind of education, it is totally free for everyone, one need not have account with Zerodha.

Zerodha In Comparison With Other Brokers:

Check out the side by side comparison of Zerodha with some of the major stock brokers. This will help you in reviewing Zerodha in terms of various factors.

Zerodha in comparison with other Stock Brokers |

||

How to open Demat Account with Zerodha?

Opening the demat and trading account is really fast and hassle free when compared to the days I opened an account with them by submitting the physical application.

Now entire process is online and if you have all the documents, it is possible to start trading within an hour.

For opening the demat account with Zerodha, you will need following documents

- PAN Card

- Aadhaar Card

- Passport size Photo

- Cancelled Cheque or Savings Bank passbook

First step to open the account is to visit their account opening page and enter your details. Here is the link to their account opening page.

If you need step by step guide on account opening procedure, you can refer my article on how to open demat account with Zerodha, which has details with pictures for each step.

Zerodha Review : My Final Thoughts on Zerodha

As I mentioned earlier, I have been with them since 2012 and they never disappointed me.

Low brokerage can only take a brokerage house to certain extent but there is something to them which made them No 1 broker of India.

And they have grown from 10k customer since then to crore+ customers now and established them as Best Discount Broker in India and also one among the top 10 stock brokers of India.

The management is transparent enough and publicly apologized whenever there was a issue from their end gaining clients trust which is very rare from big corporate houses.

From startup like company to big establishment, their growth was astonishing and it was possible with good technology, pricing and customer support making them ideal for traders and investors like you and me.

So after analyzing various stock brokers I can say that, without doubt Zerodha is the best stock broker of India. Zerodha is good for beginners also as they provide investors education through Varsity.

Please let me know your reviews and how you rate Zerodha at the comments box below.