I have an account with Upstox. They were formerly known as RKSV securities. In this Upstox review, I’m going to explain more about Upstox like brokerage charges, account opening charges, trading platforms, margins and customer service etc.

Upstox Review :

Upstox is the best stock broker as of now. They offer an amazing web based trading platform, charge a low comission fee, and are the most genuine stock broker . Nonstop improvement and development made them the fastest developing fintech organization in India.

Upstox has competitive pricing, helpful trading tools and an easy-to-use trading platform. With no account opening charges and hundreds of direct mutual funds on offer, it’s easy for beginners to get started, while active investors will appreciate Upstox commission-free delivery trades on Indian securities

Pros

- One of the first brokerage house to start discount broking in India

- Backed by likes of Mr.Ratan Tata

- Zero Brokerage on Delivery trades

- Zero Demat Account Opening Charges (Limited Period Offer)

- 100% Online account opening – No paper work

Cons

- Call and Trade is chargeble at Rs20 per trade

- Good Till Cancelled (GTC) orders are not supported in Delivery segment

Like Zerodha they are one of the first few discount brokers who started their operations in India.

Related Read : Zerodha Review : Biggest stock Broker of India

Upstox Customer Ratings & Review 2024:

| Customer Ratings | |

|---|---|

| Brokerage Charges & Fees | 9.5/10 |

| Trading Platforms | 9.7/10 |

| Products & Services | 9.5/10 |

| Experience | 8.9/10 |

| Overall Ratings | 9.55/10 |

| Star Ratings | ★★★★★ |

In my view Upstox is best for.

- Who is looking to open free demat account

- Zero brokerage on delivery

- Online account opening

How much Brokerage can be saved with Upstox?

Now let us see how much savings a investor and a trader can do if he opens an account with Upstox.

For investor:

if you plan to invest Rs 10 Lakh, with 0.55% brokerage (ICICIDirect charges this much!), you have to shell out Rs5,500 in brokerage itself where as you pay nil in case of Upstox (Investments are free at Upstox).

Hence there will be 100% savings in brokerage charges compared to brokers like ICICI Direct.

For Trader:

Now let us see for intraday and Futures traders, how much can be saved.

Let us assume you buy Rs 10lakh and sell 10lakh worth of shares daily. That means in around 20 trading days of month it will be 400 lakhs.

ICICI Direct charges 0.0275% hence the brokerage charges per month is Rs400Lakh * 0.275% which is Rs 11,000.

So yearly it would be,

Rs11,000 * 12 months = Rs 1,32,000

Now Upstox charges Rs 20/trade for intraday. In Upstox, brokerage is not based on trade value. For each order they charge Rs20 irrespective of trade value.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600

Hence, traders can save more than 90% of brokerage and indirectly add to their profit.

About Upstox:

Upstox was founded by Raghu Kumar, Ravi Kumar and Shriniwas Vishwanath. Hence they named the company with first letter of their name as RKSV.

Since January 2012, they have grown considerably and they are the most popular discount broker in India after Zerodha. Presently they are doing a daily turnover of Rs7000.

What is to be noted is, Upstox is backed by most prominent investors like Mr Ratan Tata, Kalari Group and GVK Davix.

They have invested substantial amount in developing inhouse trading platform which I am explaining below.

Upstox Brokerage Charges

Upstox brokerage structure is pretty straight forward. They charge Rs20 per executed order for all the non-delivery based transaction.

For all investments (Delivery trades), the brokerage charges are ZERO.

So, maximum commission one pays for trade of any value is capped at Rs20.

It is on par with Zerodha who also provide the same brokerage structure.

Upstox Trading Brokerage Charges:

- Equity delivery based trades : Rs Zero (FREE)

- Intraday (Equity) trades : Rs 20 per executed order

- Equity Future : Rs 20 per executed order

- Equity Options : Rs 20 per executed order

- Currency Futures and Options: Rs 20 per executed order

- Commodity Futures : Rs 20 per executed order

Upstox Account Opening charges :

- Trading account opening charges : Free

- Demat Account opening charges : Rs 400

- Trading Annual Maintenance Charges : NIL

- Demat Annual Maintenance Charges (AMC) : Nil for first year and Rs 150 from second year onwards

Use Below link to avail the FREE demat account (Account opening fee is waived off)

Upstox Review – Other charges:

- Standard NSE Charges, Transaction charges and taxes are levied

- Rs 20 is charged for call and trade (per call)

- Rs 7 is charged per fund transfer

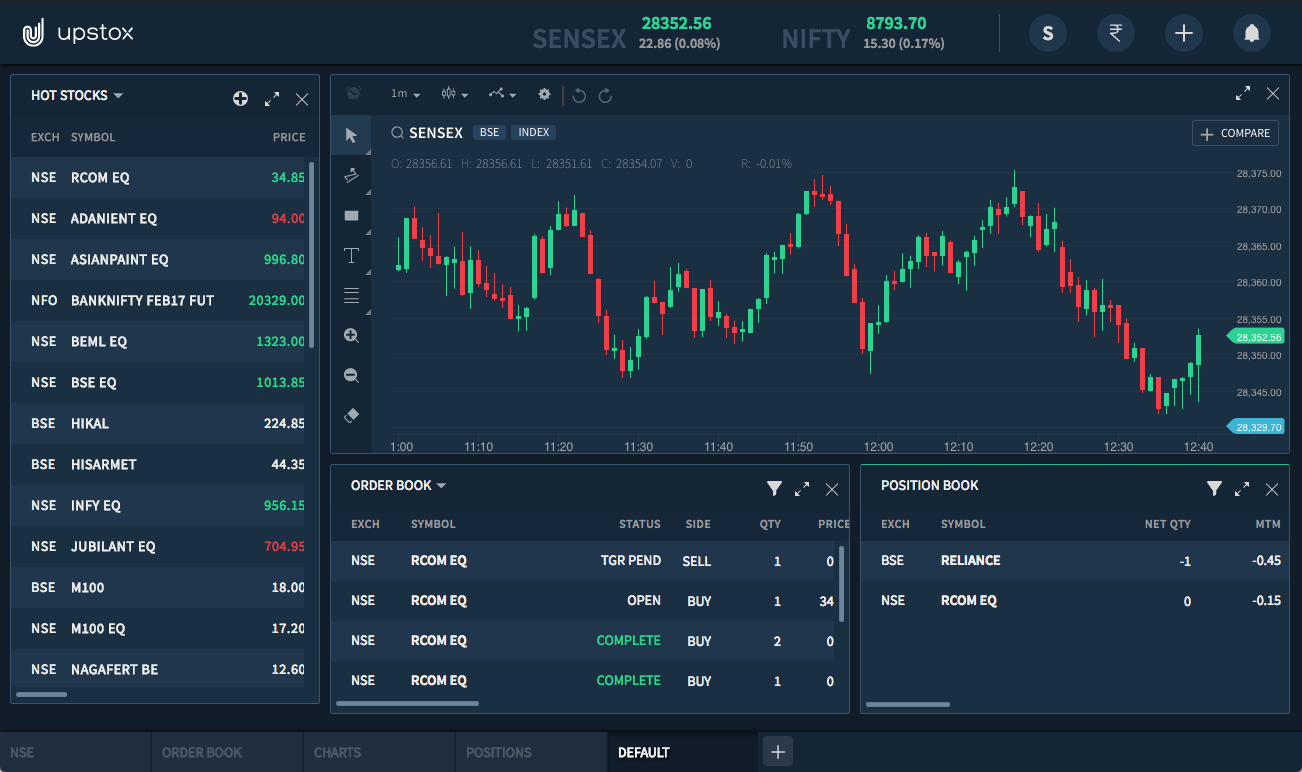

Upstox Review : Mobile, Desktop and Web Trading Platforms

Upstox Pro Mobile App review:

Mobile trading app of Upstox is called Upstox PRO and is one of the state of the art and advanced mobile trading apps available in India

Some of the salient features are

- Universal search tool to find simple and complex stocks

- Access to NSE cash, Futures and Options, and Currencies scrips

- Cutting-edge charting tools that are above industry standards

- Charts of multiple intervals, types and drawing styles

- Apply 100+ technical indicators on real-time charts

- Trade directly from charts with the Trade From Charts (TFC) feature

- Set unlimited number of price alerts for instant updates

- Create unlimited number of customized watchlists

- Receive real-time market feeds to stay on top of your scrips

- Access predefined watch-list of Nifty 50 and other indices

I have written detailed review of Upstox Pro Mobile app. Please check it out to know more about its features and which features I like the most.

Upstox Review : Upstox Pro Web

Useful for traders who dont want to install any software and apps.

It can be accessed anywhere through web browser. Some of the salient features of Upstox PRO Web platform are

- Advanced charting with more than 100+ indicators

- Minimalist interface with access from different browsers

Upstox Desktop Platform:

This for the users who wants quick access to the markets like intraday traders.

This application is from third party called Omnesys NEST.

Upstox Margin/Exposure and Intraday Leverage Details

Upstox also offers a unique schemes for the customers who are interested in getting more leverages called Priority Pack.

In Priority Pack , you need to pay monthly charges of Rs 999 for Equity, F&O and Currency and Rs 499/month for Commodities. Also, instead of Rs20/trade, the brokerage charges will be Rs30/trade for priority pack users.

With Priority pack, you will get margin upto 25X in cash Segment and upto 4 times in MCX futures.

Upstox (RKSV) Membership Information :

- RKSV NSE Membership:

- Capital Market (CM) – INB231394231

- Future & Options (F&O) – INF231394231

- Currency Derivatives (CDS) – INE231394231

- RKSV BSE Membership:

- Capital Market (CM) – INB011394237

- Future & Options (F&O) – INF011394237

- RKSV MCX Membership:

- Member Code – 46510

- FMC Regn. No. – MCX: MCX/TM/CORP/2034

- CDSL: IN-DP-CDSL-00283831

- NSDL: IN-DP-NSDL-11497282

Upstox Contact Details:

- Website: Upstox Website

- Email: support@upstox.com

- Phone: +91-2206130999

- Address: Upstox, 30th floor, Sunshine tower, Senapati Bapat Marg, Dadar (W) , Mumbai – 400013

- Upstox Customer Care modes

Advantages and Disadvantages of Upstox:

I am providing the Pros and Cons of Upstox below,

Disadvantages of Upstox:

- Call and Trade is chargeble at Rs20 per trade

- Good Till Cancelled (GTC) orders are not supported in Delivery segment

- Investment in FPO and IPO are not possible

Advantages of Upstox:

- One of the first brokerage house to start discount broking in India

- Zero Account Opening Charges

- Good commitment in developing advanced trading platforms

- Backed by likes of Mr. Ratan Tata

- Zero Brokerage on Delivery trades

- Fund Transfer with 40+ major banks

Curently Upstox is running following offers:

[adinserter block=”3″]

How safe is Upstox?

Yes, It is completely safe to open account with Upstox. It is backed by some of the reputed investors like Mr.Ratan Tata and Kalari Capitals. They are the second largest discount stock broker after Zerodha. Upstox is a reliable company as they have registration with all major stock exchanges like NSE and BSE.

Also, Upstox is registered with SEBI ( SEBI Regn. No. INZ000015837 ) which authenticates their genuineness and adds to trust.

How to open Upstox Demat Account?

Visit Upstox website and fill in your details in the form and input OTP received on mobile.

In next step, don’t forget to provide PAN number.

Only if you provide PAN number, a dedicated representative from Upstox will contact you soon and guide you about account opening procedure in details and clear all the queries if you have any.

If you don’t key in PAN number, Upstox rep will not call back you. Providing PAN number ascertain them that you are really interested in opening account

However, if you are tech savy, you can continue the application yourself and complete the process without anybody’s help. It is as easy as installing a software.

Which Is Better Among Upstox Vs Zerodha?

Though started almost same time that of Zerodha, Upstox has been lagging in terms of number of customers. But in last one year, they are able to catch up.

Recently they created benchmark by becoming first broker to open 1 lakh demat account within a month.

However, Zerodha scores well when it comes to technological and product innovation. They have whole universe of products.

Upstox’s old trading platform was very unstable but with new in house platform Upstox Pro, their major issue is addressed.

I advise you to check out this side by side comparison of Upstox Vs Zerodha to get more clarity.

Also, below table has the comparison of Upstox with other popular stock brokers of India.

Upstox in comparison with other Stock Brokers |

||

Upstox Demat Account Review – Final Thoughts:

All in all, traders looking for alternative to Zerodha can look to Upstox for opening their account.

It is always good to have two accounts if you are planning to trade frequently. For an investor, one demat account is sufficient.

With SEBI capping on extra margin that brokers used to provide, it has become a level playing field. Who has the superior products and customer support will win.

I have shared my honest review of Upstox If you want provide ratings for Upstox, please let me know through comments.

You May Be Also Interested In: