Sensibull Review 2024

Pros

- Best tool for building Options trading strategies

- Has very useful features like event calendar, Futures conversion, options analyser etc

- Executing a complex strategy is easier with single click

- Integrated with Broker, no need to switch to trading account to execute trade

- Simple and sleek interface

Cons

- Filtering strategies based on risk and reward is not available

- Supports only few brokers for execution

In my opinion, Options trading is a fascinating because one can put in lot of creativity. With Sensibull one can explore all these possibility in options trading.

For example, assume that you have bullish view on market this month.

Now, with futures, there is only one way to trade, that is to buy futures.

But in options, one can implement various strategies in various ways. For example, one can buy Call options, another method is to sell put options. Also, there are multiple strike prices to choose from.

That is the beauty of Options trading which futures trading lacks.

However, more the possibilities, more the confusions and more complications.

Enter Sensibull….

In this Sensibull review, I will explain all the features of it and how it simplifies options trading.

What is Sensibull?

Sensibull is an options trading platforms which suggest various strategies depending upon your view on the market.

Just to give example, suppose you think market will go up by 300 points this week and not sure how to implement a bullish strategy for your view.

Then you just need to enter your market view data in sensibull and click on GO button, that’s it.

It will provide different statergies that can be implemented based on your view which include all the data like, break even points, max profit/loss , ROI for each strategy.

Sensibull Strategy Implementation Example:

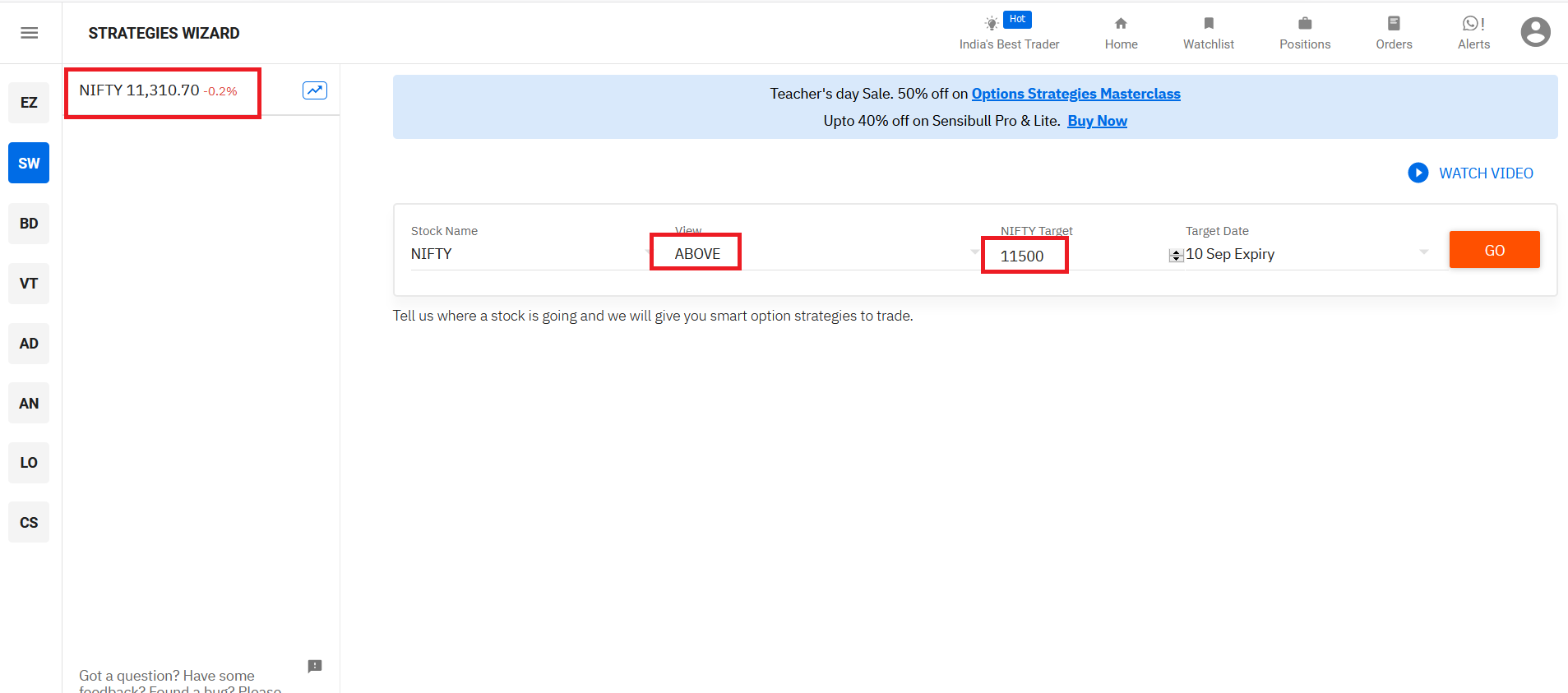

Lets implement a strategy on Sensibull and see.

Currently Nifty is trading around 11300 and suppose I have the view that it will cross 11500 this week.

All I need enter these details and hit GO as shown in below image.

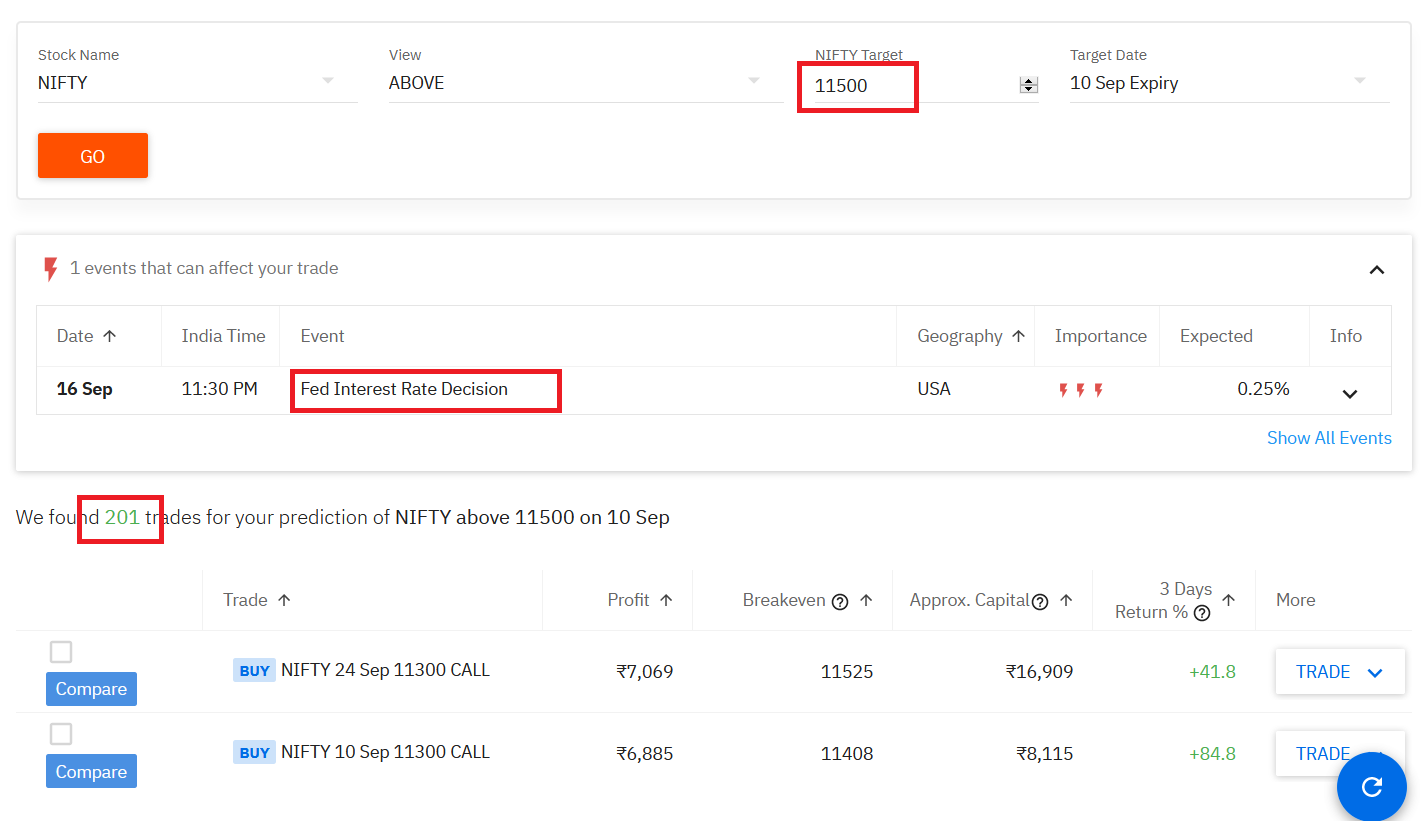

And once you hit GO, Sensibull will analyse the data and throw a set of stratergies that can be implemented for your view.

Also, it will show any event that scheduled during the period of your strategy that can impact your trade. This is just a warning so that you can reconsider your view.

Below are the results of the analysis.

As you can see, it has came out with around 201 strategies that you can implement based upon your capital and risk apetite.

Also see the events in near future that can influence the market direction this week.

So basically all you need is following details,

- Stock Name: Name of the Stock or Index on which you want to trade

- View : Your view on the stock. They provide 5 options. You can select any one of them.

- Target : Target you have set for the stock/Index selected

- Target Date : Date by which you think the stock/index will hit your target

Once you selected the strategy, the trade can be placed from the Sensibull platform itself. They have integrated their platform with stock broker’s back end.

And there is extra charges for placing the trade from Sensibull platform. You will pay the same brokerage to your broker.

For example, if you are using the Zerodha, you will pay Rs20 irrespective of number of lots.

I use Zerodha for my trades as I like their KITE interface and other products. I think they are the best option trading broker of India beause of their technically superior products and platforms.

You can open the account with Zerodha quickly using below button.

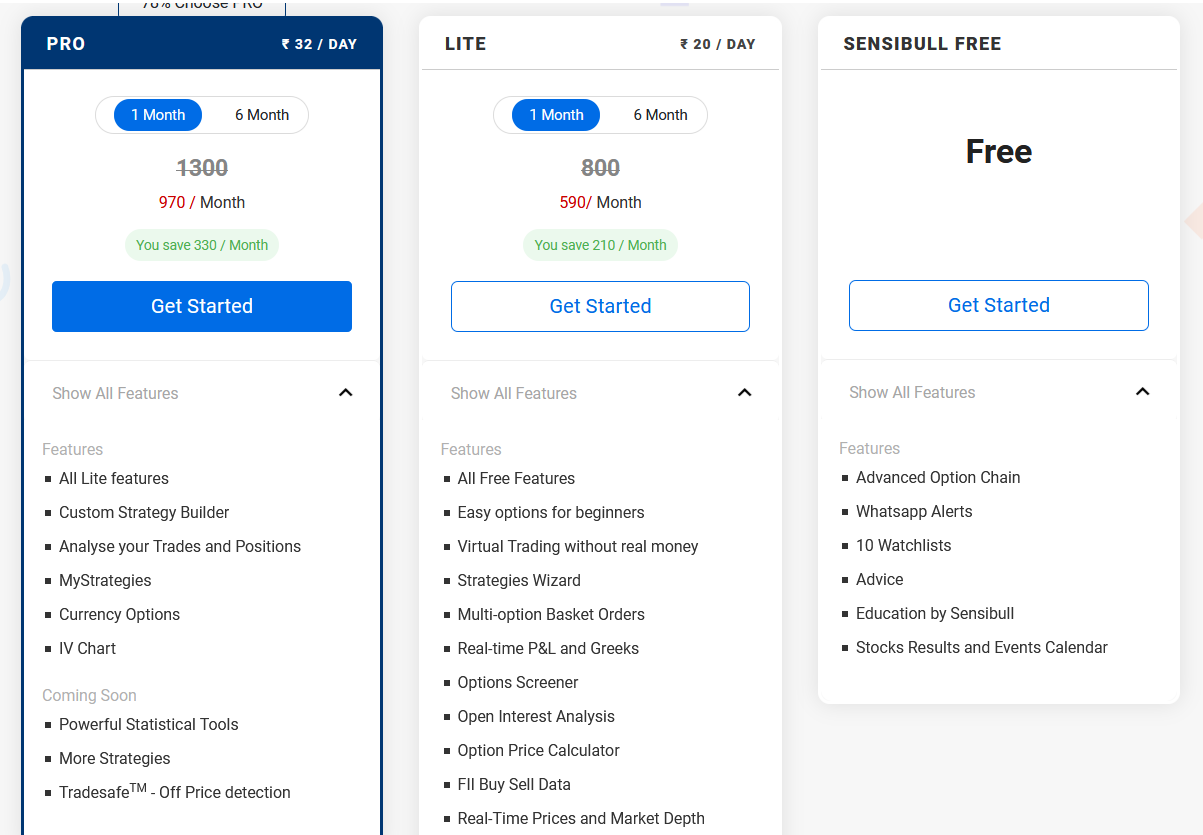

Sensibull Review – Charges and Pricing

Here is the pricing model of sensibull and features wise break up for all the plans.

As you can see, Free plan has limitations compared to other plans. There is no strategy builder feature with free plan.

Sensibull Subscription Discount Coupon:

Sensibull is providing additional 20% discount for Equityblues.com visitors.

This offer is valid for both Pro and Lite plans.

To avail this discount, you need to use the below link to subscribe to sensibull

You just need to pay 20% less than the regular charges. ( Please check the regular charges here https://sensibull.com/#pricing as it keeps varying. Calculate 20% discount price and pay using below link. Sensibull team will take care of the rest)

Sensibull Review – Final Thoughts

Usually options traders have general view on market direction. Also, they know only one or two statergies that can they implement without giving thought on other possible strategies which are better suited for their view.

Sensibull comes handy in this regards. You will have all the clarity with data.

Information is wealth and Sensibull provide all the information about your trade.

If you are a options trader, then I suggest you to try out the Sensibull and see if you find it any helpfull to you.

I have receivied lot of positive feedback about the platform. It is more like a guide with all information at finger tips.