I have been in the stock market for more than 1.5 decade and seen many changes in market dynamics and also in brokerage industry.

Zero Brokerage Trading account in India is something which I could not think even in my dreams. I remember I had to negotiate to death with a reputed stock broker to get the brokerage reduced by a mere 0.1%!.

But since the concept is very much in India now, I will talk about it in details and also provide you with the list of stock brokers in India offering Zero brokerage demat and trading account.

What is Zero Brokerage Trading Account?

Traditionally all stock brokers in India used to charge certain percentage of traded value from their customers.

For example, Sharekhan charge 0.5% of the trade value as commission. That means Rs 500 is deducted if you invest Rs 1lakh worth of shares.

But later, few brokers started charging fixed brokerage irrespective of trade value. They are called discount broker because they offer service at discounted price.

For example, 5Paisa charge Flat Rs20/trade for whatever the invested amount.

But there are another set of brokers who charge Zero brokerage charges irrespective trade value.

For example, Zerodha and Angel Broking have NIL fees for delivery segments. But for all other segments they charge Rs20/trade.

So in this article, I will bring out details of the stock brokers in India who offer Zero brokerage account atleast in any one segment.

There are some more brokers who offer unlimited trading for fixed monthly charges.

For example, SAS online has plan of Rs999/month. In this one can trade for any number of times and quantity but the per month brokerage is capped at Rs999.

Though this scheme is not zero brokerage plan in true sense, but we will include these category of brokers also in our list.

How does Broker make money if they offer Zero Brokerage Account?

The zero brokerage model was introduced in USA by a broker by name Robinhood.

Their research showed that, all the investors are traders in disguise. If they provided with good platform and brokerage at throwaway price, they would like to try their hand in trading.

So idea was to lure investors who were loyal to full service brokers, once they get used to better trading platform, eventually they will trade and trading is chargeable.

Robinhood became highly successful with this strategy and discount brokers in India started to replicate it here.

Zerodha is termed as Robinhood of India. Number of customers grew from 2lakh+ to more than 6million in very short span.

But whatever it may be, customer benefited immensely from this competition by having zero brokerage trading account which as I told before, could never be thought of.

Zero Brokerage Trading Account In India 2024

Zero brokerage trading account enables traders and investors to save in terms of commission outflow. There are many brokers offering zero brokerage account.

Here is the list of zero brokerage trading account in India,

- 1. Zerodha trading account

- 2. Upstox trading account

- 3. Angel Broking trading account

- 4. SAS Online trading account

- 5. India Infoline (IIFL) trading account

- 6. FYERS trading account

- 7. TradePlus Online trading account

As I explained earlier, the above list can be split into two categories.

- Zero Brokerage for Delivery Trades

- Monthly/ Yearly plan brokerage account

Zero Brokerage Trading account for Delivery Segment

Zero brokerage for delivery is most popular among investors. But swing traders who sell after few days of purchase, also benefit from it.

1. Zerodha

Zerodha is biggest stock broker in India. They are the first to introduce Zero brokerage concept in India.

This strategy worked brilliantly for them and they grew exponentially to overtake biggies like ICICI Direct and Sharekhan without spending a penny on advertisements.

To know more about Zerodha and its products, read this Zerodha brokerage review

Many other brokers followed Zerodha’s strategy but only few could succeed.

It’s mainly because of the simplicity and robustness of their trading app KITE which is considered as best stock market trading app in India.

Below table has the summary of Zerodha brokerage charges,

I also switched from Sharekhan to Zerodha in 2012, much before they announced zero brokerage for delivery. At that time they were charging Rs20/trade for delivery segment also.

For all these years, I am satisfied with the quality of their products and services.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

You can use below button to open zero brokerage trading account with Zerodha. It can be opened online in 15min without any paperwork. Check this detailed guide with screenshots about opening account procedure with Zerodha.

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200.

2. Upstox

Upstox is second largest discount broker after Zerodha based out of Mumbai. Check the comparison between Upstox Vs Zerodha.

Upstox also offers Zero brokerage trading account for delivery segment.

For detailed information about Upstox and their offerings, read this detailed review.

Infact, Upstox had monthly plans earlier but later they scrapped it.

Biggest USP of Upstox is they are backed by prominent investor like Mr. Ratan Tata.

They offer trading platform and app known as UpstoxPRO.

Below table capture the segment wise brokerage charges of Upstox,

To avail the free account opening offer, use below button.

3. Angel Broking

Angel Broking shifted from full service broking model to discount broking model owing to competition.

Checkout this review to know more about Angel Broking.

Previously they used to charge in terms of percentage value of traded volume. It was around for 0.3% for delivery and 0.03@ for intraday and futures.

But now the brokerage structure is almost same as that of Zerodha. Check the Angel Broking Vs Zerodha comparison.

Below is the brokerage list of Angel Broking. Delivery trades are of zero brokerage. Rs20/trade for all other segments.

4. SAS Online

SAS online is discount broker based out of New Delhi. They offer service in equities, derivatives, currencies and commodities.

To know more about SAS Online, Read this detailed review.

SAS Online too offers both flat fee and monthly brokerage plans.

Below is the brokerage structure of SAS Online:

Flat Brokerage Plans:

Monthly Brokerage Plans:

5. India Infoline (IIFL)

India Infoline is another reputed demat account provider of India offerring zero brokerage trading account.

India Infoline is into the broking business since 1996 and strong presence across India.

For more information about India Infoine, read this complete review.

Account opening is free with IIFL and also Annual charges (AMC) is also zero for first year. From Second year onwards, Rs450 is charged per year.

Below table has the details of India Infoline Brokerage Charges,

Use below button to avail the Zero account opening offer,

6. FYERS Securities

FYERS is Bengaluru based discount broker established in 2015. FYERS is acronym of Focus Your Energy & Reform Self.

Read this detailed review to know more about FYERS Securities.

Because they entered late compared to Zerodha, the did not have the first mover advantage. Checkout side by side comparison of Fyers Vs Zerodha.

Earlier they used to charge Rs100/executed order but now reduced it to Rs20/trade which I feel was sensible thing to do keeping in mind the market dynamics.

Below is the details of the FYERS Securities brokerage charges,

Good thing is that, FYERS is offering zero account opening charges for opening demat account.

Use below button to avail the offer.

Monthly/Yearly Plan trading account

Monthly and yearly plans are good for heavy traders. But this type of scheme is not popular though they looks attractive from traders point of view.

But doing from broker’s point of view, it looks not much viable. That is the reason Upstox and TradeSmartOnline scrapped the monthly schemes.

Since there is not much profit, broker can not invest much in developing outstanding products and service and they suffer in long run. Zerodha did the exact opposite and able to succeed.

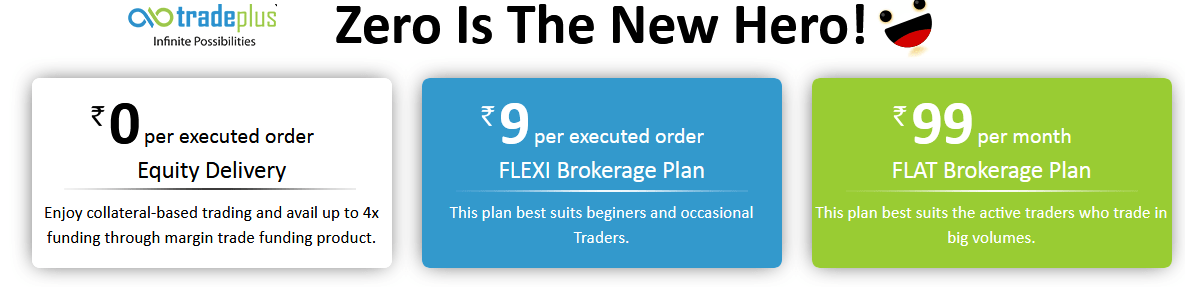

7. TradePlus Online

Navia Market is the parent company of TradePlus Online. They are based out of Chennai and into the full service brokerage business for more than two decades.

To know more about TradePlus, read this review.

TradePlus offer both monthly plans and fixed brokerage/trade plans.

Below table has the details of both the plans.

8. Prostocks

Probably Prostocks is the only broker having annual brokerage plans. They have all the 3 types of plans namely flat/order, monthly and yearly subscription plans.

To know more about Prostocks, read this review.

Below table has the details of Prostocks brokerage plans.

Flat Fee Plans:

Monthly/Yearly Plans:

Zero Brokerage Trading Account – Conclusion

Zero brokerage trading account is reality in India now. I am one of the direct beneficiary of that.

Infact, I am able to save around 80%-90% brokerage which I could invest in next trade and scale up.

But brokerage is only a single factor in our trading success. We should also look at other things which a particular broker is offering. Only lower brokerage should never be the deciding factor.

You can open account with any of the brokerage firms I listed above providing zero brokerage trading account. All are registered with SEBI and are equally good.

I prefer to trade with the leader and hence I chose Zerodha as my broker. There must be some reason why they have so many customers than any other broker.

You May Also Like To Read :

- List of demat account which are best for Intraday Trading

- Life Time Free Demat And Trading Account In India

- How to Transfer Shares From One Demat to Another Demat Account

- Best Banks to open 3 in 1 demat Accounts

- 7 Advantages of Demat accounts

- Difference Between a Demat and a Trading Account

- Key Factors to Consider Before Opening a Demat Account

- Top Demat Account In India For Non Resident Indians – NRIs

- Is it legal to open multiple demat accounts in India?