Many of my friends and relatives are located abroad. Some are permanently settled there and they have no idea of coming back to India.

However, few others are there to make money and return back. They are looking for various investment options in India. This article is for those looking for best demat account for NRIs in 2024 to invest in Indian stock market.

Indian economy is booming and they don’t want to miss the train. Given the irregularities in real estate sector, they prefer regulated markets such as stock market.

But before going though the list of top NRI demat accounts, let’s get few terminologies clear.

Who is considered as Non Resident Indian (NRI) ?

It will be easier to understand who is NRI if we understand who is treated as Resident Indian.

An individual is considered as Resident Indian if he/she is in India for 182 days or more.

Hence if an individual moved out of India possessing Indian passport for 182 days or more he will be considered as Non Resident Indian (NRI).

Though I have provided simplified version of definition of NRI, because this article is not about NRI status itself. I will write seperate post on NRI classification etc.

Can NRIs open Demat account and Trade in Indian Stock Markets?

Yes, NRIs can open demat account and trade in Indian stock market. For that they need to have either NRE or NRO bank accounts. However, NRIs are not allowed to trade in currency and commodity segments. They are also not permitted to trade intraday in equity segments.

NSDL has some FAQs about the NRI trading.

NRI Demat Account through NRE (Non Resident External) Account route:

NRE is a bank account through which any funds earned abroad can be moved to India and back without any restriction. The interest earned in NRE account can also be repatriated.

If you have NRE account, then you are permitted to trade/invest in equity segment only. For that too, you need to go through PIS (Portfolio Investment Scheme) route.

You are required to provide PIS permission letter from the designated bank. This letter and other personal supporting documents like PAN etc are need to be attested from the Indian Embassy located in the country where you reside.

All these restrictions are because of the some market rigging instances observed in year 2008 where it was said that Foreign Institutional investor (FIIs) used funds from NRIs to manipulate the market.

NRI Demat Account through NRO (Non Resident Ordinary) Account route:

NRO account is nothing but a simple Savings bank account. People use them to deposit income from India such as rents, dividends etc.

In NRO Account, you can repatriate maximum one million USD per financial year.

There is no requirement of PIS to trade in Indian stock market. One can even trade in Future and Options (F&O) segments in case of NRO account.

What are the documents required to open NRI Demat Account?

Following documents are required to open NRI Demat account:

- Valid Indian Passport (In case you posses a foreign passport, the place of birth mentioned should be India)

- Copy of Visa

- PAN Card

- Passport sized photograph

- Cancelled cheque of NRE or NRO account

- Proof of respective bank and depository accounts

- Overseas address proof (Any one of utility bills, Driving License and bank statement etc)

Ranking for Best Demat Account for NRIs – Best Stock Brokers for NRIs

Now after understanding the basics of NRI demat account, lets see which reputed stock brokers in India offer best demat account for NRIs.

Here is the list of 5 best NRI Demat Accounts,

- 1. Zerodha NRI Demat Account

- 2. FYERS NRI Demat Account

- 3. Sharekhan NRI Demat Account

- 4. Prostocks NRI Demat Account

- 5. Kotak Securities NRI Demat Account

#1 Zerodha

Zerodha always comes on top of my list. I also have my account with them and trade using it.

Zerodha is well known for NRI services. They have dedicated team exclusively set up to onboard NRI customers and provide all the required assistance. Hence, demat account from Zerodha is considered as best demat account for NRIs.

For resident Indians. the brokerage is Rs20/executed order.

For all investments, the brokerage is Zero (Yes, if you buy and dont sell it on same day, the brokerage is Zero)

But in case of NRI, there is lot of other formalities to be done and hence brokerage is higher when compared to resident Indians.

For NRIs, it is Rs 200/executed order. That means whether you buy Rs1000 worth of shares or Rs 1 crore worth of shares, maximum they charge is Rs200.

Even with this higher charge, I consider it is vary nominal when compared to other traditional brokers like Sharekhan and Angel Broking..

For example, If you buy Rs 10lakh worth of shares, the brokerage with Zerodha is Rs200. However, with Sharekhan who charge 0.1% of total value, it would be 0.1%XRs10 lakh which is Rs1000. If you trade higher volume, it would still go up.

You can read the complete information here at Zerodha Review.

Some of the salient features of Zerodha NRI Demat account are:

- Zerodha has tie up with Axis bank, HDFC and Yes bank for NRE account. So if you are planning to have PIS, then you should have account with any of these banks

- There is no restriction for NRO accounts

- Offers KITE – Best trading platform in India for FREE

Zerodha NRI Desk:

Zerodha has Dedicated Desk for NRI Customers. Please fill in below form and the NRI Sales team will contact you and take care of rest of the process.

#2 FYERS Securities

FYERS Securities is another Bengaluru based stock broker providing brokerage services to NRIs. Established in 2015, FYERS has good track record for customer support and boast more than 5 Lakh customers.

You can read more about FYERS in this review.

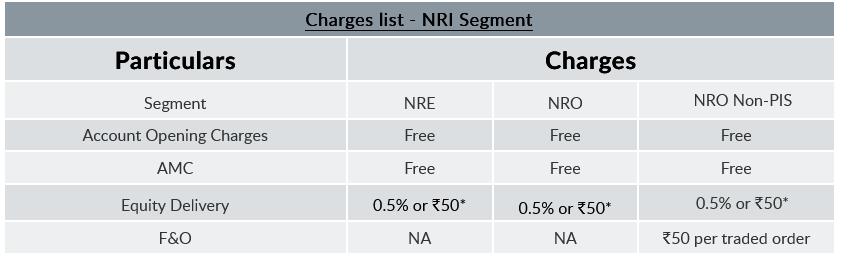

NRI Brokerage Charges at FYERS:

Other salient features of FYERS NRI Demat Account are:

- Zero Account Opening Charges

- Zero Account Maintenance Charges (AMC)

- Wide Range of Investment products

How to open NRI Demat account at FYERS:

If you wish to use NRI demat account in FYERS through PIS route, you need to have/open account in one among HDFC Bank, Axis Bank or YES Bank.

For Non-PIS accounts, you are required to link any NRO bank account with FYERS.

I suggest you to submit your deails though the link below, FYERS team will guide you in detail.

Click Here to Contact FYERS NRI DESK

Just change the country code to your country code and then provide the mobile number. Some one from their team will surely reach you.

#3 Sharekhan

Sharekhan is third biggest stock broker in India after Zerodha and ICICI Direct.

Salient features of Sharekhan NRI demat account are:

- Integrated RBI approved bank account with HDFC bank

- Research reports and recommendations

- Portfilio tracking and secure transactions

Check out the detailed review of Sharekhan here.

#4 Prostocks

Prostocks is a Mumbai based discount stock brokers offering NRI Demat account.

They have placed their fees at very competitive at Rs 100/executed order. However they are not as well known as Zerodha

Read complete information about them here at Prostocks review.

Other salient features of Prostocks NRI demat account are:

- Zero Demat account and Trading account opening charges

- No Annual Maintenance Charges (AMC), however you need to deposit one time Rs1000 refundable deposit

- Online KYC

#5 Kotak Securities

Kotak Securities is brokerage arm of Kotak Mahindra Bank.

Since it is a bank linked demat account, the fund transfer between bank account and trading account becomes seamless. However their brokerage charges is very high when compared to discount brokers like Zerodha and Prostocks.

You can read the review of Kotak Securities here.

Other Salient features of Kotak Securities NRI Demat Account are:

- Transfer of funds can be done vis Kotak Bank Netbanking Gateway

- Investment/trading in IPO, derivatives and Bonds become easier

- They provide research report and recommendations

Best NRI Demat Account – Final Thoughts

You can have both NRE and NRO route simultaneously to invest in Indian stock market. However make sure you deal with only reputed share brokers. Some brokers don’t even have any idea of issues related to NRIs.

If you are moving out of India for an onsite assignment for 6 months or more, then convert your savings bank account into NRO account and then link with demat account.

In my experience non-bank brokers normally provide good service as broking is their main business.

Lastly, if you find any other Best NRI demat accounts to be included in this list, please let me know through comments.

You May Also Like To Read :

- 7 Brokers Offerring Zero Brokerage Trading Account In India

- List of demat account which are best for Intraday Trading

- Life Time Free Demat And Trading Account In India

- How to Transfer Shares From One Demat to Another Demat Account

- Best Banks to open 3 in 1 demat Accounts

- 7 Advantages of Demat accounts

- Difference Between a Demat and a Trading Account

- Key Factors to Consider Before Opening a Demat Account

- Is it legal to open multiple demat accounts in India?