Top Mutual Funds Apps In India: I have been investing in mutual funds since 2009. Those time there was an entry load of 2.5% (How insane!). I still remember filling out the forms with multiple signatures. But now everything can be managed through mobile apps.

Through these best mutual fund apps in India, you can invest in lumpsum, SIP, redeem, check NAV and track portfolio value on tip of your fingers. In this article, we will learn more about these mutual fund apps which are good for even beginners and small investors.

I trade in futures and options to generate monthly income. From my experience I can say that, trading is only best for income generation. To create wealth, one need to invest in equities for long term and mutual fund is best way for that.

Before going through the list of best investment apps in India, let us understand more about direct mutual funds.

Types of Mutual Funds In India

In India, mutual funds are divided in to two categories based on the type of investment

- Regular plan

- Direct plan

In regular plan, the mutual funds are purchased through an advisor, broker or distributor. In regular plan, the mutual fund company (known as AMCs) pays commission to these intermediaries. Then commission is recovered from customers by levying a fee called “expense ratio”.

Expense ratio indicates how much fund charges in terms of percentage of your investment annually for the expenses incurred for managing your portfolio (like fund manager fee, broker fee, audit fee and legal etc)

In direct plan, you can directly buy the units from AMCs through their websites. Since there is no intermediator involved, there is no commission or brokerage. Hence the expense ratio of direct mutual funds are lower.

Why Direct Mutual Funds Are Better Than Regular Mutual Funds?

Direct funds are just different version of Regular funds only difference is brokers/agents are not involved.

Let us understand with an example how choosing direct over regular plan will benefit investors.

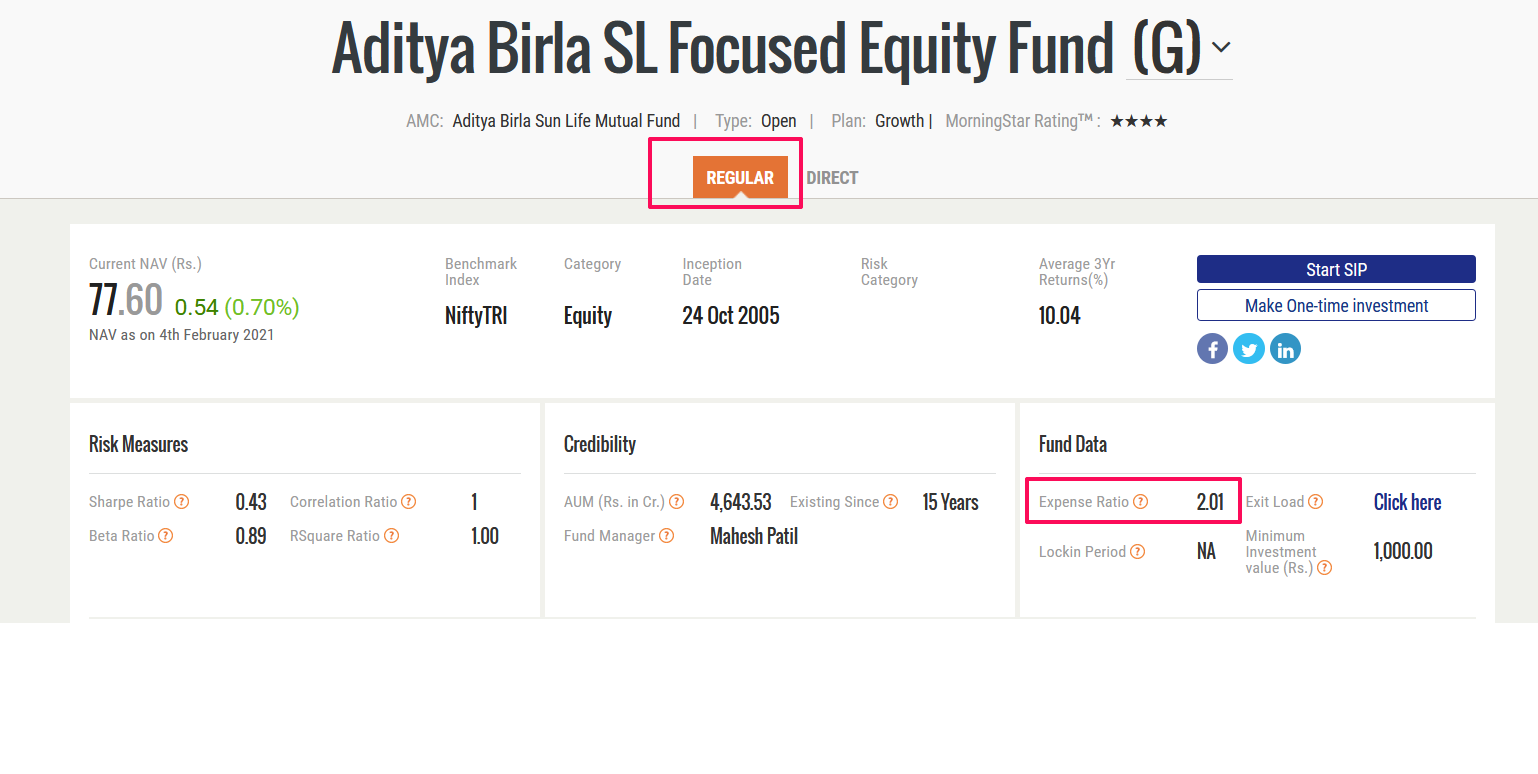

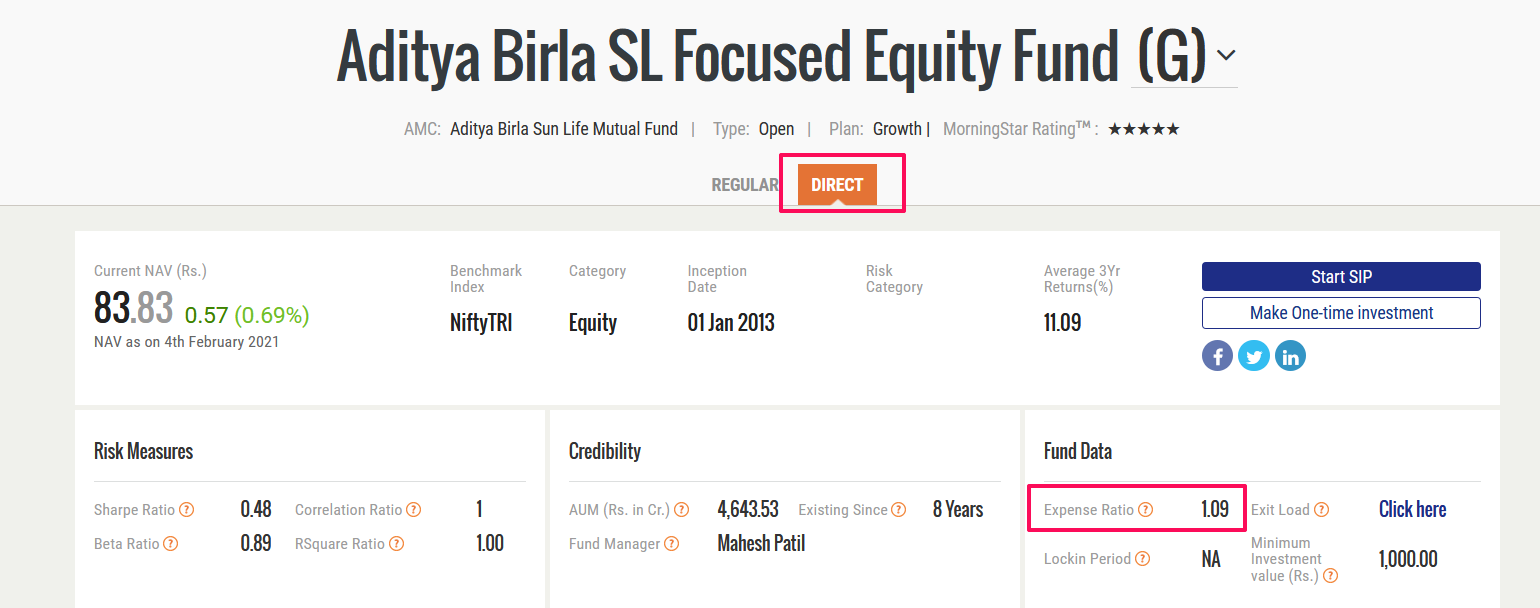

Consider Aditya Birla Sunlife Focussed Equity fund (Growth).

The expense ratio for regular plan is 2.01% and direct plan is 1.09%. So, if you had invested in direct plan. you would save 0.92% of your investment value every year.

This 0.92% might seem small, but if you held your investments long term this will be humongous.

If Aditya Birla SL Focussed fund gives 15% return for next twenty years, SIP of Rs 10000 in direct plan would be worth Rs 1.5 crores and regular would be 1.315 crores.

A whopping 18.5 Lakhs more because of the lower expense ratio and just choosing direct plan over regular plan

If you are interested in understanding more about Regular Vs Direct Mutual funds, check out this article from AMFI (Association of Mutual Funds in India)

How To Invest In Direct Mutual Funds?

You can invest in Direct mutual funds through website of mutual fund companies (AMCs) or by visiting office of Registrar & Transfer Agents (RTAs) or through private firms providing interface to AMCs.

I choose third option by investing through private firms. These companies provide apps through which I investment in mutual funds of various AMCs using a single interface.

No need to visit any office and open separate account at website of different AMCs.

Biggest advantage is , If I want to update my preference like nominee details, it will be updated for all AMCs and no need to repeat the same by visiting website of all AMCs.

So in this article, I will discuss only about the apps from the companies which are best for direct mutual fund investment.

Please note that even if you use the private firms, you are still investing with mutual funds companies only. The private firms just provide interface like app and website to make our life easier. They make money through advisory services.

Ranking For Best Mutual Fund App In India – 2021

There are several companies offering apps for direct mutual fund investment. I have short listed 7 such top mutual fund apps based on customer ratings and feedback.

Here is the list of best mutual fund apps in India,

- 1. Zerodha Coin mutual fund app

- 2. Groww mutual fund app

- 3. PayTM Money mutual fund app

- 4. ET Money Mutual fund app

- 5. Kuvera mutual fund app

- 6. myCAMS mutual fund app

- 7. KFinKart mutual fund app

#1. Zerodha Coin Mutual Fund App

Zerodha Coin is India’s largest FREE direct mutual fund platform that lets customer invest in direct mutual fund online with Asset Management Companies (AMCs) with no commission passback.

Coin was launched in April 2017 and within 16 months, more than 1 lakh customers have invested over Rs2000 crores using the platform.

The best thing is, Zerodha Coin is absolutely free. Previously they used to charge Rs50/month but now that also been waived off.

What makes Zerodha Coin as best mutual fund app in India is availability of more than 3000 mutual fund schemes across 34 AMCs.

As far as Zerodha brand is considered, they are the biggest stock brokers in India trusted by more than several million users and their client base is more than that of ICICI Direct.

The trading app KITE from Zerodha is considered one of the best trading app in India.

Related Read : Detailed Review of Zerodha and their offereings

Check out the youtube video in introduction to Zerodha Coin.

Disadvantages of Zerodha Coin:

- There is no advisory from Zerodha : You need to do your own research and zero on which mutual fund scheme to invest.

Advantages of Zerodha Coin:

- Zero commission both during the initial investment and at trail level.

- Single platform for all your investments namely equity, currency, commodity and mutual funds

- One get to invest directly in equity too as demat account is also opened along with Coin

- Mutual Funds are held in demat form, so one can pledge to get more margin for trading.

- You can place a buy/redeem order for future: The order is executed whenever the NAV level set by you reached

Unfortunately, you need to first open demat account with Zerodha to start using the Coin platform. Once the demat account is opened, the access to Coin is automatically provided to you without any extra charges. The same demat account can be used for buying/selling shares in stock market.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200.

#2. Groww Mutual Fund App

Groww has seen exponential growth in recent years thanks to heavy investment in this start up by some well known investors.

The interface of this top mutual fund app is easy to use and simple. Similar to Zerodha Coin, Groww also helps in investing in zero commission direct mutual funds.

One can start SIP or do lumpsum investment in various mutual fund schemes. Through the dashboard, one can track the actual and total return of the portfolio. Without doubt, Groww is best app for SIP investments and tracking.

Drawbacks of Groww App:

- App does not have SIP Calculator

- Difficult to analyse the funds technically using the app

Benefits of Groww App:

- Detailed data points and comparative analysis of all the funds

- Good user interface (UI) and web portal

Ratings for Groww app on playstore : 4.4 out of 5 with 1,99,828 ratings.

Here is the direct link to Groww app on google playstore

#3. PayTM Money Mutual Fund App

PayTM is well known mobile wallet service brand in India which is termed as the startup with the highest valuation.

But investment subsidiary of PayTM which is PayTM money was started late compared to other players in the domain.

But nevertheless, they are catching up and acquiring the clients quickly.

PayTM Money also charges zero commission for investment in mutual funds. They provide advisory services also with the help of Value Research Online.

Cons of PayTM Money App:

- It does not support all the AMCs available in the market

Pros of PayTM Money App:

- One can start investment with as low as Rs100

- Investors can start, stop and pause Systematic Investment Plans (SIP)

- Availability of feature like goal tracker to periodically monitor the progress of the portfolio

- Fingerprint login and Two Factor Authentication (TFA) for higher security

Ratings for PayTM Money app on playstore : 4.1 out of 5 with 75,045 ratings.

Here is the Direct link to PayTM Money App on Playstore

#4. ETMoney Mutual Fund App

ETMoney is from Times of India network which is one of the reputed news network of India.

Coupled with big brand name and zero commission on investment is attractive proposition.

ETMoney helps in investing direct mutual funds through SIP/lumpsum, save tax in various Equity Linked Savings Schemes(ELSS).

One can invest the idle money available in bank account in liquid funds to get slightly higher returns with less risk.

Cons of ETMoney App:

- It does not support all the AMCs available in the market

Pros of ETMoney App:

- Provides detailed report on portfolio performance

- It does not support all the AMCs available in the market

- Reputed brand and hence trust factor

- No commission for all the investments

Ratings for ETMoney app on playstore : 4.5 out of 5 with 1,11,175 ratings.

Direct Link to ETMoney App on Playstore

#5. Kuvera Mutual Fund App

Kuvera is another prominent mutual fund app which uses Artificial Intelligence (AI) for advisory services.

The AI based robo advisory helps in how much you need to invest to reach a particular goal within the target time.

One more unique feature is, it lets you to invest for your family members and no need to open separate account for them. One can manage all the accounts through a single account.

The services that offered by Kuvera include goal planning, tax planning and portfolio rebalancing etc.

Disadvantages of Kuvera App:

- It does not offer all the AMCs available

- Since the recommendation is from AI based robot, one need to recheck and reconfirm before start investing

Advantages of Kuvera App:

- Offers goal based investment advice

- The investments are recommended based on the customer risk profile

- Single account for entire family’s investments

- Clean and elegant user interface

Ratings for Kuvera app on playstore : 4.7 out of 5 with 8,656 ratings.

Here is the direct link to Kuvera mutual fund app on Playstore

#6. MyCAMS Mutual Fund App

myCAMS is one of the oldest mutual fund app available in India. It is co-owned by National Stock Exchange (NSE) along with other companies.

The app has been awarded as best financial app for the year 2015 and 2016. It acts as single gateway for multiple mutual fund schemes from various AMCs.

Again, the app levies no charges and requires one time KYC using the aadhaar card.

It has some cool inbuilt functions like mobile PIN and pattern login. One can set up all the functions like open new folio, start and stop SIP, purchase, redeem

Cons of myCAMS App:

- It is not from Indian government as it is believed by many

- It does not support all the mutual funds

- Not so good User Interface (UI)

Pros of myCAMS App:

- Availability of mobile PIN and Pattern for extra security

- PAN level portfolio view

Ratings for myCAMS app on playstore : 4.4 out of 5 with 66,256 ratings.

Here is the link of myCAMS Mutual Fund app on playstore

#7. KFinKart Mutual Fund App

KFinKart app offers new way of investment to its customers. It’s one touch login empowers you to invest across whole host of mutual funds schemes.

It simplifies the investment journey of investors through state of the art features. You can link folios of your family members to track its performance.

Benefits of KFinKartApp:

- Offers One Touch Login – Can login through Facebook or google account

- The dashboard is has very detailed and has all the information required.

- Download consolidated account statement.

Ratings for KFinKart app on playstore : 4.2 out of 5 with 31,246 ratings.

Here is the link to KFinKart App on Playstore

Best Mutual Fund App In India – Final Thoughts

Investing in direct mutual funds was possible even during the pandemic situation. Thanks to some of the top mutual fund apps listed in this article, you won’t miss any investment opportunities.

All the apps listed above are regulated by SEBI (Security Exchange Board of India) and hence safe. Your investments are safe even the company providing the app shuts down. So now it all boils down to company providing better user interface and good customer service.

But which is the best mutual fund app in India among this list?

Upon studying all the parameters and considering pros and cons of all the mutual fund apps, I can say that Zerodha Coin and Groww apps are best in India.

If you are also interested in direct equity investment and trading, I suggest you to consider Zerodha Coin as Zerodha’s trading platform is considered as one of the most user friendly interface available.