I entered the stock market post demat era which started in year 1999. So I don’t really feel the benefits of demat account by myself.

But hearing from my father’s experience of pre demat era, I can only appreciate the fact that we are in much better times now.

They used to wait for pink colored news paper in the morning to know the closing price of the stocks they owned!. Now we can track second by second movement of the price.

On similar lines, dematerialization and demat account has solved many problems and challenges one has to go through in earlier days.

Also Read : 9 Best Demat Accounts of India

Demat Account Background

Before the demat days, the shares of companies were issued in physical certificate form. Now once the shares are issued, it was shareholders responsibility to keep then in good condition otherwise it wouldn’t be sellable.

In year 1996, NSDL (National Securities Depository Limited) introduced concept of storing the shares in electronic format (dematerialization).

It faced lot of resistance initially. My father says, nobody was ready believe in the system which don’t allow them to hold the proof of investment in their hand.

But slowly it gained acceptance as new and tech savvy young investors entered the stock market. Also people started to understand the convenience that demat account offers over physical form.

However, there are still some have old certificates lying in their home brought by their ancestors who were unwilling to convert them to demat form.

For stock brokers also, it established system and uniformity making their operation more seamless. Because of this and competition brokers have reduced the charges related to demat account and some even offer free demat account to their customer.

Read: Top 10 Stock Brokers of India for beginners and small Investors

So what are the advantages of demat account to traders and investors, lets see in details.

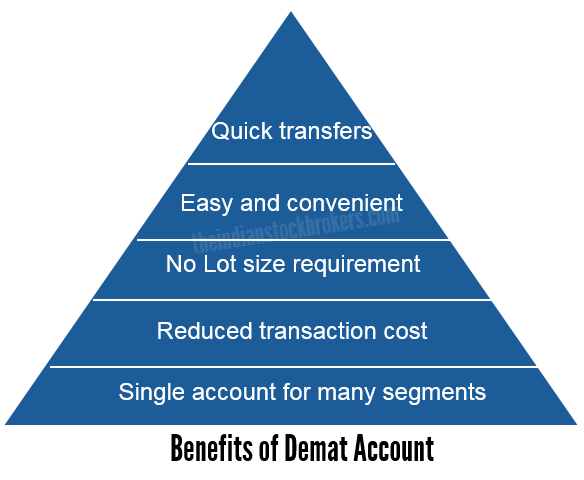

Benefits of Demat Account

Demat Account offers many benefits to traders and Investors. Following are some of the advantages of demat account.

#1. No Risk of Damage or Theft

For me, above all the benefits, it is the safety that demat account offers over physical certificates. I can sleep peacefully at night without worrying about theft or risk of damage due to fire, flood or even forgery.

#2. No Dependency on Stock Brokers to Sell Small Number of Shares

Earlier brokers would not have entertained you if you wanted to sell less number of shares (say 1 share of Reliance). They used to give preference to those possessing 100-200 shares. But it is not the case now.

#3. Transfer of Shares is Seamless

Demat transfer has become seamless. Previously if you had shares of 20 companies and wanted them to transfer to your spouse, then it was required to write to Registrar of each companies separately. Now you need to give request to your broker and shares of all companies are transferred to demat account of your spouse within 24 hours.

Check out this article on how to transfer shares from one person to another online.

#4. Single Contact Updation is Sufficient

Similarly if your contact address is changed, then all you have to do is to update it with your stock broker (DP) online instead of contact registrar of each company.

#5. Single Account For Multiple Financial Instruments

Demat account can be used to store not only shares but all other types of investments like Mutual funds, bonds and gold ETFs etc

#6. Direct Credit Of Dividends to Bank Account

Whenever a company issues bonus shares, it will be credited to demat account automatically. Earlier they used to arrive in registered post and that process had its own problems

#7. Adding Nomination is Online

Adding/updating nominee has become easier and you can be sure that your investment gets credited to your beloved one nominated by you. It has reduced many operational costs such as handling costs etc

Advantages of Demat Account – Final thoughts

Importance of demat account are many folds. along with the benefits, demat account also has some disadvantages of its own.

But when we analyze the pros and cons of demat account, I am sure everyone will agree to have thier shares in demat form.

Moreover, now it is mandatory to have demat account to get the credit of the shares.

Please let me know your thoughts on benefits of demat account.

You May Also Like To Read :

- 7 Brokers Offerring Zero Brokerage Trading Account In India

- List of demat account which are best for Intraday Trading

- Life Time Free Demat And Trading Account In India

- How to Transfer Shares From One Demat to Another Demat Account

- Best Banks to open 3 in 1 demat Accounts

- Difference Between a Demat and a Trading Account

- Key Factors to Consider Before Opening a Demat Account

- Top Demat Account In India For Non Resident Indians – NRIs

- Is it legal to open multiple demat accounts in India?