In my previous article, I had written about best demat accounts of India. Ranking of stock brokers in that article was arrived on various factors. But in this post, I will provide list of Biggest stock brokers in India based on the number of customers.

The number of active clients is indirect way of evaluating the service and products of any stock broker. Though this method is not 100% accurate, atleast we can shortlist some of the best stock brokers in India leaving out junk.

Stock broking is a tough business and many small brokers go bankrupt every year. This will result in hardship to their clients. So I advice you to stick with the leaders since they have proven track record.

Ranking for Biggest Stock Broker in India 2021

As I mentioned earlier, it is advisable to open account with leader in the business. For this reason, I have listed 9 biggest stock brokers in India out of 300+ share brokers registered at exchanges.

Here is the list of 9 Biggest stock broker in India 2021

- 1. Zerodha Stock Broker

- 2. Upstox Stock Broker

- 3. ICICI Securities Stock Broker

- 4. Angel Broking Stock Broker

- 5. HDFC Securities Stock Broker

- 6. 5Paisa Capital Stock Broker

- 7. Kotak Securities Stock Broker

- 8. Sharekhan Securities Stock Broker

- 9. Motilal Oswal Stock Broker

Check out the details of number of unique active customers of each stock broker in below table.

Now let us discuss each of these brokers in detail, their offerings and their pros and cons etc.

#1. Zerodha Stock Broker

From the above table you might have understood by now and without doubt, Zerodha is the biggest stock broker in India.

And if you calculate their market share by dividing the number of customers of Zerodha by total number of customers across all brokers of India, it comes more than 17%.

Such is the dominance of Zerodha in Indian brokerage industry. More interestingly they started their operations only in 2010 and became No.1 stock broker of India in 2018, where as many stock brokers in this list are present since 1990.

I have written detailed review of Zerodha discussing their account opening fees, brokerage plans, trading platforms and exposure margins.

I also have account with them since 2012 and pretty satisfied with their service. What I like most is the simple and clutter free user interface of Zerodha’s trading platform (KITE). It just has what is required to analyse and place my trade orders quickly without much distraction.

Read : Best Desktop Trading Platforms of India

Also Read : Best Mobile Trading Apps of India.

One more reason for success of Zerodha is lower brokerage charges. They charge Zero brokerage for all investments including mutual funds where as full service brokers like ICICI Direct charges 0.55% of total investment value.

Zerodha Brokerage charges

Below table has the details of segment wise brokerage charges of Zerodha

Zerodha Trading Platforms:

KITE is the flagship in house built trading software from Zerodha.

#1 KITE 3.0

Kite is the web based platform and no need to install any software. While most of the other brokers offer third party softwares like NEST (Developed by another company, Omnesys), Zerodha has built their own platform.

This helps them to resolve any issues quickly as they have complete control.

As I said earlier, the user interface is simple and does not distract with lots of unnecessary red and blue blinking colors. (It is my personal opinion).

#2 KITE Mobile

This is the mobile version of KITE web. What significant with this app is, it just uses less than 0.5Kbps bandwidth.

So it will suit for investors and traders of even small towns and village where internet speed is a concern.

Zerodha Advantages & Disadvantages:

Following are the some of the features which I liked and disliked about Zerodha:

Pros of Zerodha:

- Free delivery based trades and maximum of Rs20/trade in other segments

- First Discount broker of India and biggest broker with highest number of customers

- Taken initiative to educate common investors through open platform Zerodha Varsity.

- Varsity makes Zerodha the best stock broker in India for beginners as newbies can learn investing and trading lessons

- State of the art trading platforms such as Zerodha Kite

- Trading platforms are free for all customers and no subscription charges.

- New direct mutual fund investment platform called Coin

Cons of Zerodha:

- Call and trade is chargeble at Rs 20

- 3-in-1 demat account possible only if you have IDFC First bank Savings account

Zerodha Account opening is completely online and 100% paperless if your mobile number is linked to aadhar number. It can be opened in 15 min. Please go through the step by step procedure of opening Account with Zerodha.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

SaveRs200: you can save Rs200 by opening the account online. Use below button to go directly to their account opening page and save Rs 200.

#2. Upstox Stock Broker

Upstox is the second largest stock broker in India. They were earlier known as RKSV securities.

Based out of Mumbai, Upstox also started almost at the same time as that of Zerodha. But the growth in number of customer is not that quick as that of Zerodha.

Upstox is backed by some of the well known investors like Ratan Tata and Kalaari Capital.

Read this detailed review of Upstox to know more about Upstox, their offerings and trading platforms they are offering.

Otherwise, the brokerage charges of Upstox is almost same as that of Zerodha.

Check out how Upstox compares with Zerodha in this side by side comparison.

Upstox Brokerage Charges:

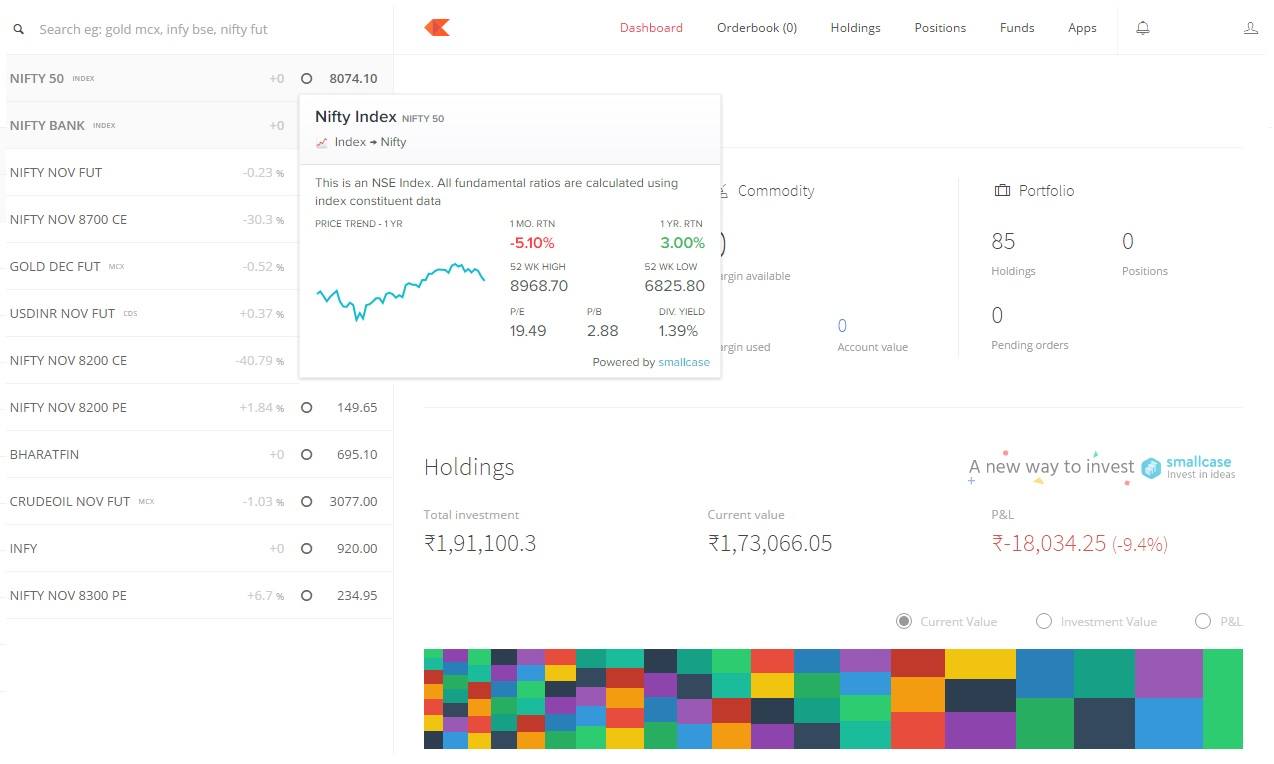

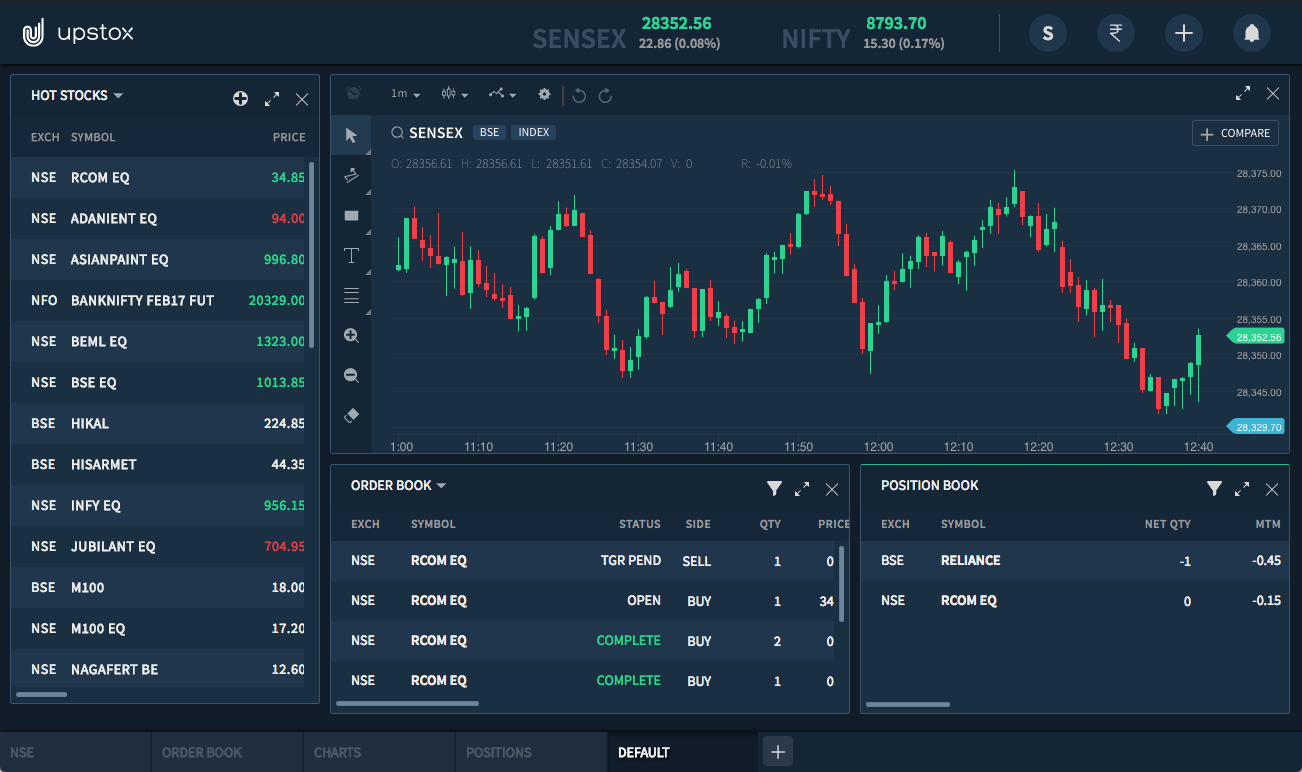

Upstox Trading Platform:

They provide both inhouse developed trading platforms and third party software.

#1 Upstox Pro Web

The Upstox pro web is developed by the brokerage firm as competition to Zerodha Kite.

It has some powerful features like API integration and 100+ indicators.

#2 Upstox NEST Trader

The software is developed by third party (Omnesys). This is available only for desktop user.

You need to download and install the application before using it.

#3 Upstox Pro Mobile

This is the mobile version of the Upstox web pro. It is available for both Android and iOS smartphone users.

Upstox Advantages & Disadvantages:

Below are some of the advantages and disadvantages of Upstox:

Pros of Upstox:

- Zero commission on delivery trades

- Free Demat account opening and lower annual maintenance charges

- Maximum Rs20 Per trade for non delivery trades

- Backed by likes of Mr.Ratan Tata

- Superior Trading platform Upstox Pro

Cons of Upstox:

- Pricing is almost similar to Zerodha

- Call and trade is chargeable

- 3-in-1 demat account possible only if you have IndusInd bank Savings account

Upstox normally have some account opening offers every month. Currently they are offering free account opening.

Click on below button to avail free account opening offer.

#3. ICICI Direct Stock Broker

ICICI Direct is the brokerage arm of ICICI bank which is one of the prominent private sector bank of India.

They were the biggest stock broker in India until 2018 before they were overtaken by Zerodha.

ICIC Direct was responsible for popularizing online trading in India in 2000s. They have depository participant accounts at NSDL and CDSL.

To know more about ICICI Direct, read this detailed review.

However, brokerage charges of ICICI Direct is on higher side. For example, 0.55% on a investment of Rs10 lakh results in brokerage charge of Rs5500 where as it is Zero in Zerodha.

Read how the brokerage charges differ in ICICI Direct Vs Zerodha.

ICICI Direct Brokerage Charges:

ICICI Direct Trading Platforms:

ICICI Direct Trade Racer:

TradeRacer is available in all three formats namely Web, Desktop and Mobile.

It has interesting features like Heatmap, Trend Scanner and Live Scanner.

ICICI Direct Advantages & Disadvantages:

Advantages of ICICI Direct :

- 3-in-1 demat account , easier flow of funds

- One of the most reputed name in brokerage industry.

- One stop solution for all the investments and also insurance

Disadvantages of ICICI Direct :

- highest brokerage among the peers

- No support for commodity trading

- Mobile app is not very good

- Minimum brokerage clause make it expensive for small and beginners

- No brokerage calculator is provided

ICICI Direct Account Opening and AMC Charges:

- Trading Account Opening Charges : Rs 975

- Demat Account Maintenance Charges : Rs 700 per year

#4. Angel Broking Stock Broker

Angel Broking is another popular stock broker of India. They have their presence in more than 900 location across India and abroad.

Their business model was full service broking until recently. But due to tough competition from discount brokers such as Zerodha and Upstox, they have introduced discount broking plan also recently.

Read more about Angel Broking in this review.

Angel Broking Brokerage Charges:

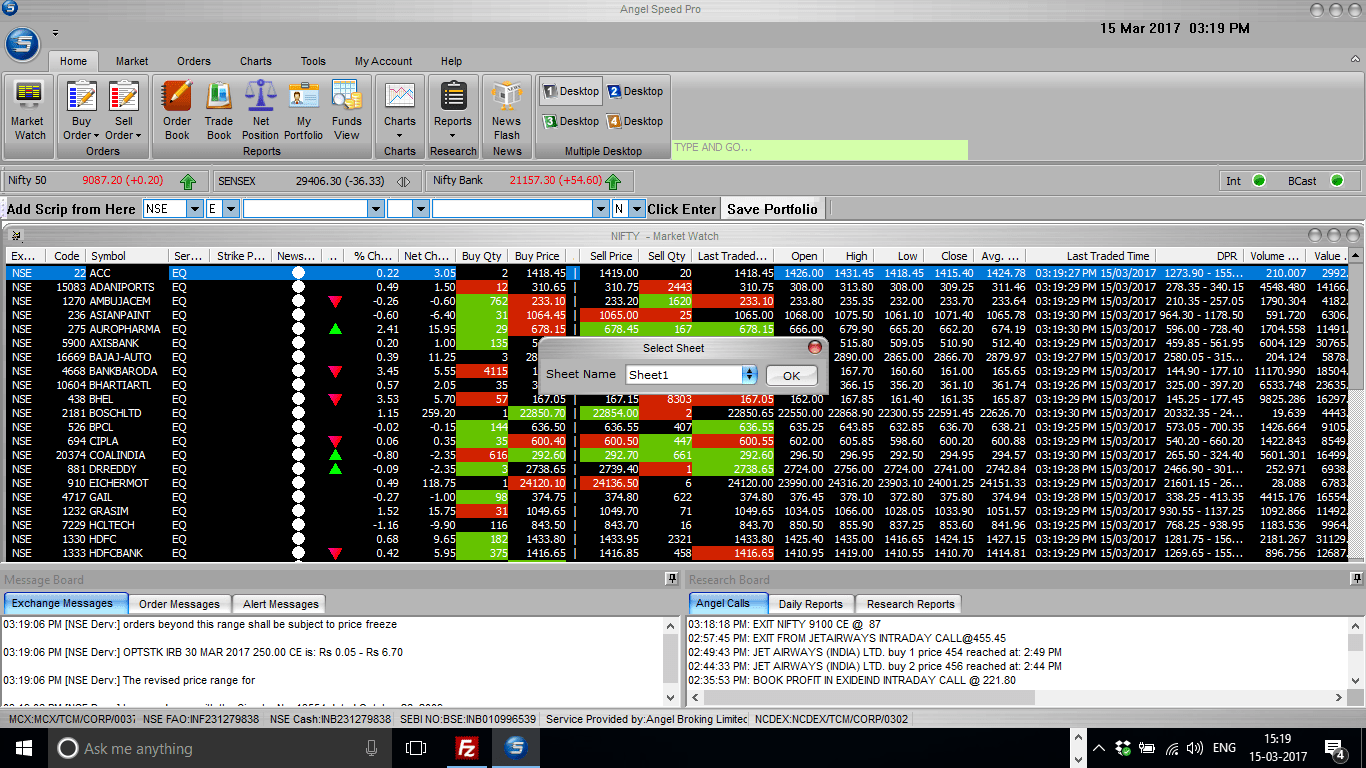

Angel Broking Trading Platforms:

#1. Angel Speed Pro

Speed Pro from Angel Broking is desktop installable software and suitable for those who want to punch quick orders.

#2. Angel Mobile

One can access on the go with Angel Mobile app. It has all the basic features like portfolio tracking, access to ledger and P&L statements.

Angel Broking Advantages & Disadvantages:

Benefits of Angel Broking :

- One of the most trusted brand of India

- Advanced trading platforms

- New investment vehicle based on Artificial Intelligence (ARQ)

- Large network of sub brokers and franchises

- Good team of research analysts providing research reports and tips

Drawbacks of Angel Broking :

- Minimum brokerage charges is Rs 30 irrespective of size of the investment

- No brokerage calculator as available with discount brokers.

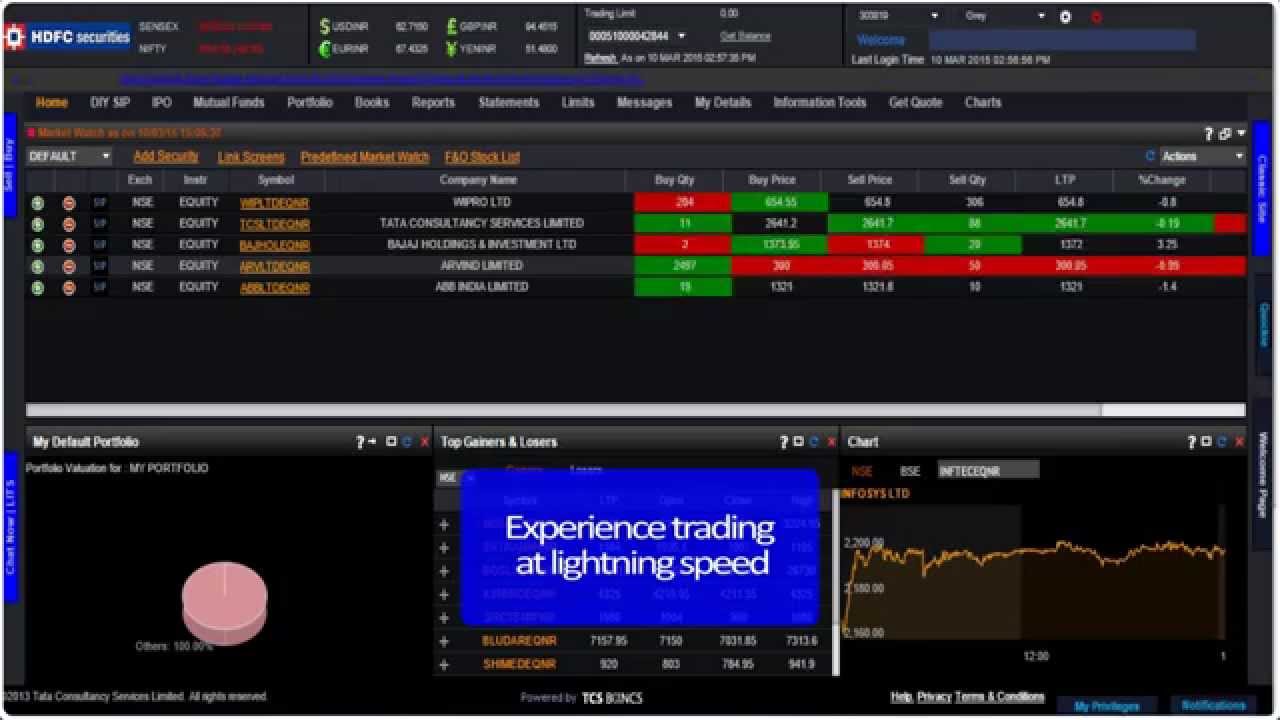

#5. HDFC Securities Stock Broker

HDFC Securities is another leading stock broker of India. They are promoted by HDFC bank which is the biggest private sector bank of India.

Read more about the offerings and brokerage charges of HDFC Securities in this detailed review.

Since the demat account is from a bank, it is known as 3 in 1 demat account. The reason is, all the three accounts namely savings bank account, trading account and demat accounts are integrated into a single account.

HDFC Securities Brokerage Charges:

HDFC Securities Trading Platforms:

#1. HDFC Securities BLINK:

A desktop trading platform suitable for high speed traders. But the brokerage company charges monthly subscription charge for using the software.

#2. HDFC Securities Mobile App:

The app is available for Android, iOS and also Blackberry users.

HDFC Securities Advantages & Disadvantages:

Benefits of HDFC Securities :

- 3-in-1 demat account useful for quick transfer of funds

- NRI account is possible

- Brand name with backing from reputed bank HDFC

- They conduct educative seminars for its customer frequently

Drawbacks of HDFC Securities :

- Trading Platform (HDFC Blink) is not free and monthly subscription charges are applied

- No support for trading in Commodity segment

- Even the SMS based research tips are charged separately

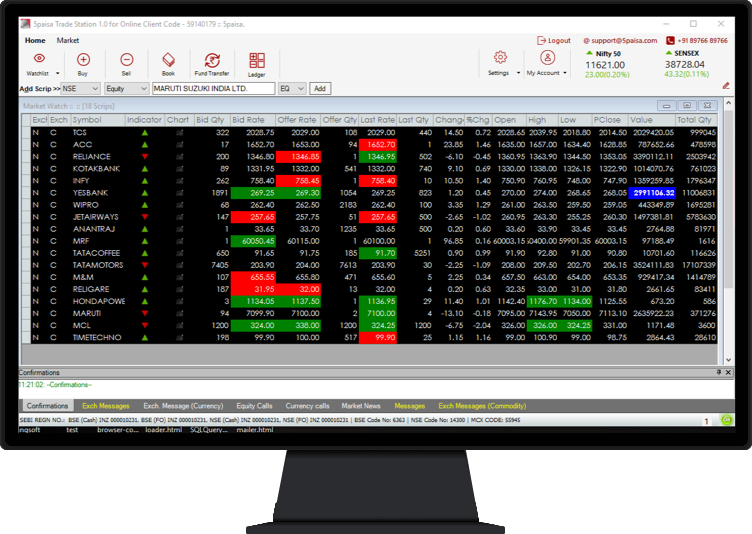

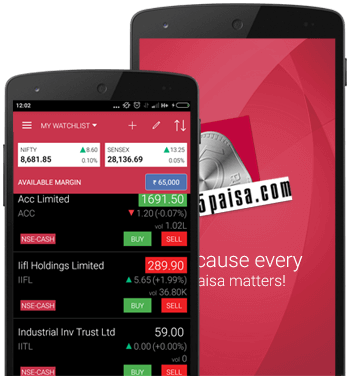

#6. 5Paisa Capital Stock Broker

5Paisa is another top stock broker of India. They are the discount brokerage arm of India Infoline (IIFL). IIFL is well known full service broker of India who are into the brokerage business from 1995.

To get more information about 5Paisa, read this detailed review.

Earlier, 5Paisa used to charge Rs 10/trade and had slight advantage in terms of brokerage charges. But now they have revised it to Rs 20/trade.

5Paisa Brokerage Charges:

Below is the brokerage charges of 5Paisa.

5Paisa Trading Platforms:

#1 5Paisa Trade Station EXE:

Trade Station is desktop based trading platform ideally suited for traders who need advanced features.

One need to install the application before using it.

#2 5Paisa Mobile App:

Mobile version of 5Paisa offers Robo research and advisory. Some of the other financial instruments like insurance and personal loans can also be availed through this app.

5Paisa Advantages & Disadvantages:

Pros of 5Paisa:

- Reputed parent company i.e India Infoline limited (IIFL)

- Research reports and tips are provided which is rare in case of discount brokers

- Investing in IPOs, Mutual funds and insurance is possible

- Zero Account opening charges

Cons of 5Paisa:

- Non availability of fixed per month brokerage plans

- The recommendations are mainly from robotic based and purely depends on their algorithms

5Paisa also offers free demat account (No account opening charges). Use below button to directly go to their account opening page.

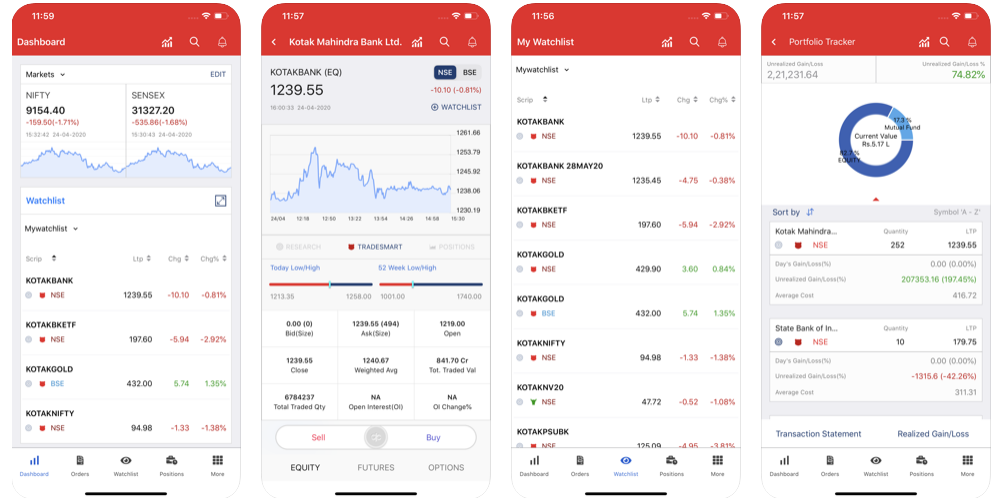

#7. Kotak Securities Stock Broker

Kotak Securities is another major stock broker of India and a subsidiary of Kotak Mahindra bank. They were established in year 1994.

Kotak Securities provides wide variety of service like equities, derivatives, currencies, commodities, mutual funds, bonds and Portfolio Management Services (PMS).

To know more about Kotak Securities read this detailed review.

Kotak Securities Brokerage Charges:

Kotak Securities Trading Platforms:

#1. KEAT Pro X:

KEAT Pro X is desktop based trading platform from Kotak Securities. One can have multiple watch list and track portfolio along with usual trading with this platform

#2. Kotak Stock Trader:

One can trade anywhere with Kotak Stock Trader mobile app. You can access your ledger, portfolio and access charts and indicators using this app.

Kotak Securities Advantages & Disadvantages:

Pros of Kotak Securities :

- They offer 3-in-1 demat account which enables seamless transfer of funds

- All investment avenues under one roof

- Above par trading platforms and also provision for traders with slow internet connection

- Online chat facility with support team

Cons of Kotak Securities :

- No support for commodity segment

- Brokerage charges are high even when compared to other full service brokers

#8. Sharekhan Stock Broker

Sharekhan was among top 3 biggest stock brokers of India but now slipped in the ranking.

It was acquired by BNP Paribas for Rs2200 crore. They have their presence in more than 570+ locations. You can find Sharekhan branches in almost all major cities and towns of India.

Read this detailed review to know more information about Sharekhan.

Sharekhan Brokerage Charges:

Sharekhan Trading Platforms:

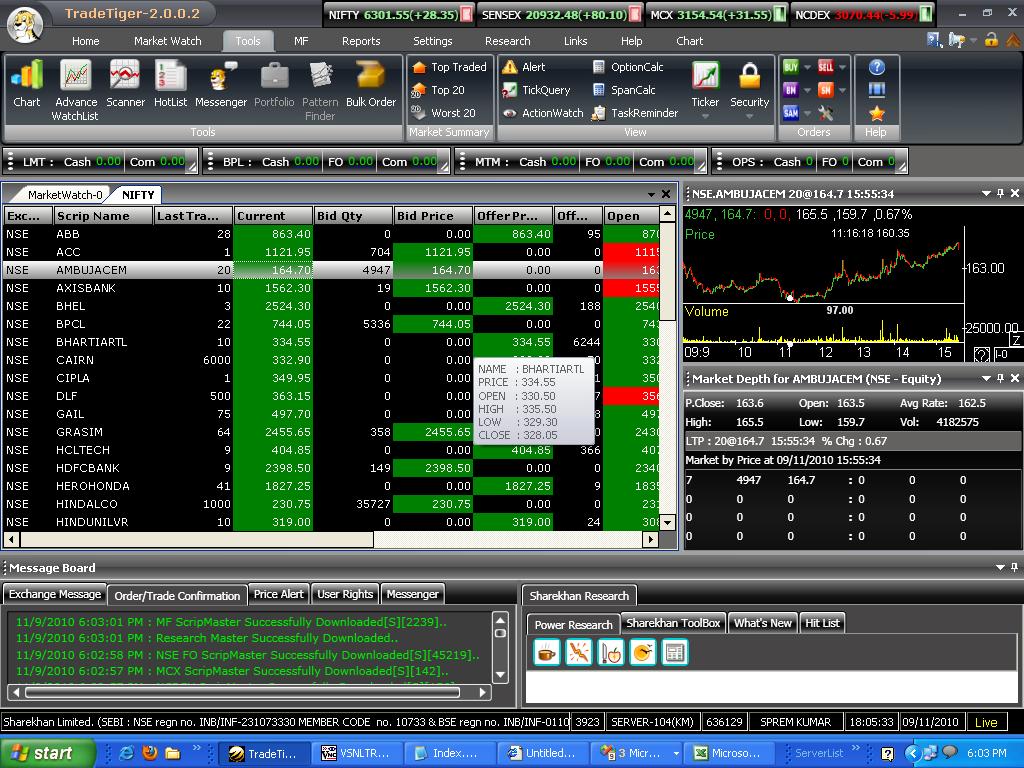

#1. Sharekhan TradeTiger:

Trader Tiger is one of the best product from Sharekhan. It has lots of features that a Trader can ask for.

Earlier Sharekhan used to charge monthly fee for the software but now they have made it free. Make sure you have atleast 2GB of RAM for seamless usage of the software

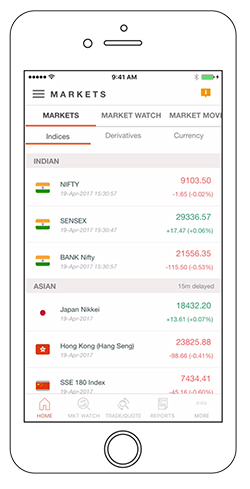

#2. Sharekhan TradeTiger:

It is the new version of their old mobile app (Sharemobile). One can invest, trade and also transact in mutual funds through this app.

Sharekhan Advantages & Disadvantages:

Disadvantages of Sharekhan :

- Minimum brokerage clause which charges 10/paise per share and because of this it is not profitable to trade in stocks which trade below Rs 20

- Sharekhan does not offer 3 in 1 demat account

- Facility to place after trading time is not available

- Commodity trading service is not offered to classic account holders

- Brokerage charges are very much higher compared to even other full service brokers such as Angel broking and Motilal Oswal

Advantages of Sharekhan :

- Call and trade is free

- No charges for fund transfers from banks to trading account and other way round

- Wide reach across India and can be accesses across all major towns

- Availability of Prepaid brokerage schemes to reduce the brokerage outgo

#9. Motilal Oswal Stock Broker

Motilal Oswal was founded in 1987 by Ramdeo Agrawal. MOSL as they are popularly known as is another good stock broker of India who have more than 30 years of track record in brokerage industry

They spend considerable amount of their revenue on stock research and reports. Motilal Oswal dont have direct branches across India like Sharekhan. But they have good franchise network.

You can check out this detailed review to know more about Motilal Oswal (MOSL).

Motilal Oswal Brokerage Charges:

Motilal Oswal Trading Platforms:

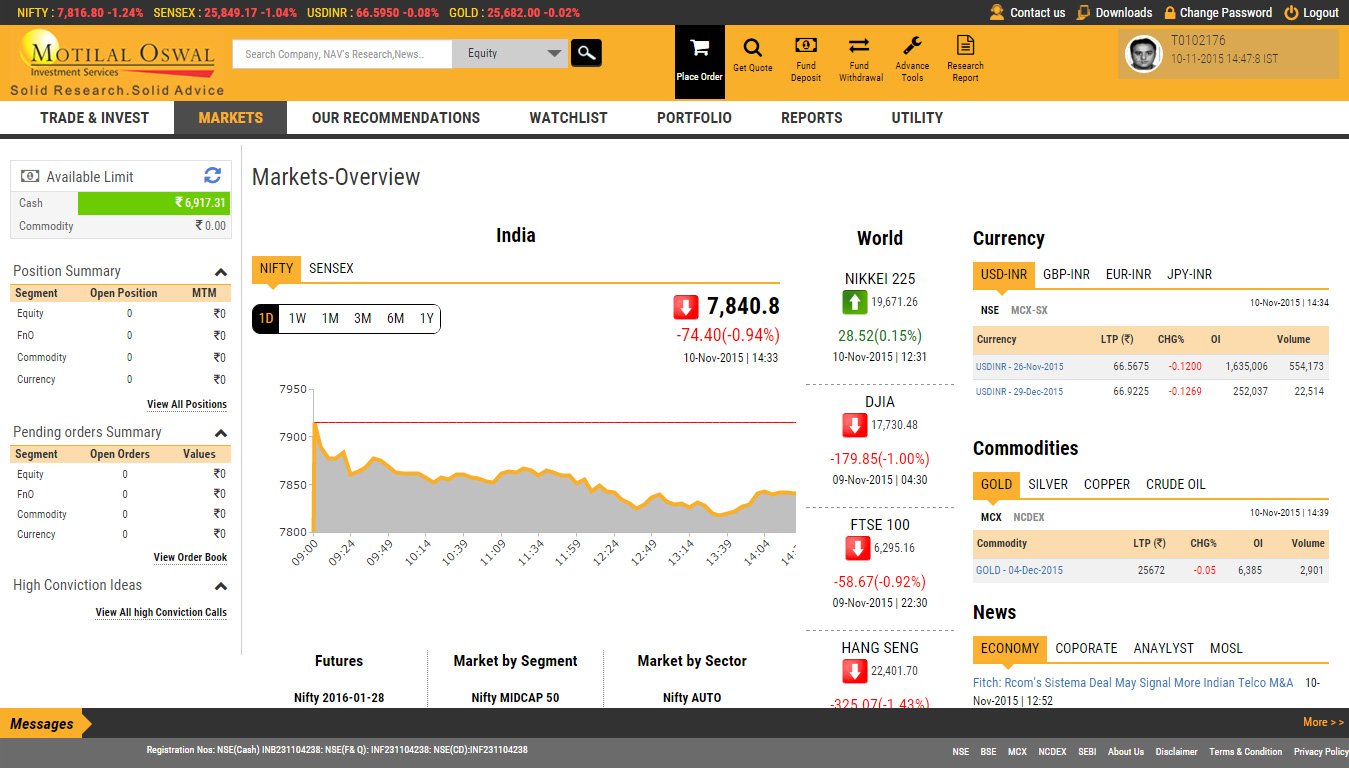

#1. Motilal Oswal Investor:

This is the web based trading platform from Motilal Oswal. The interface comes with ACE(Advice on Combined Equities) and multiple scanners.

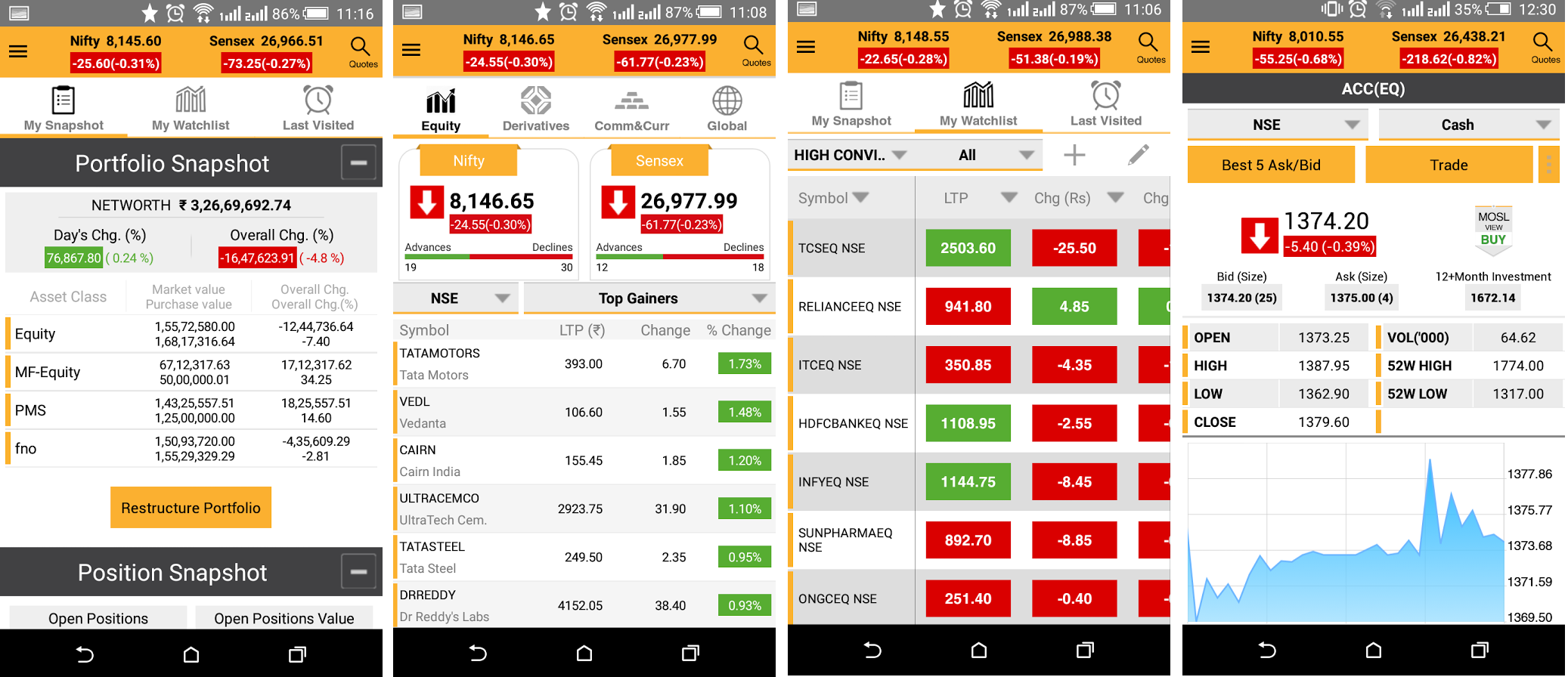

#2. Motilal Oswal App and Watch:

The demat account provider has the mobile app for the trader/investors who want to access the market on the go. In face they also have wrist tie-able watch.

Motilal Oswal Advantages & Disadvantages:

Below are the some of Pros and Cons of Motilal Oswal

Disadvantages of Motilal Oswal:

- Many complaints around hidden charges which are not explained by sales person during account opening

- Stocks recommendation are not up to the mark.

Advantages of Motilal Oswal:

- Good trading platforms and useful for all kind of traders

- One of the established brokerage house of India

- Large number of franchise network

- Fund transfer facility with more than 60 banks

Biggest Stock Brokers in India – Final Thoughts

The above list of biggest stock broker in India is purely based on the data of number of customers. It is no way ranking based upon customer feedback and ratings.

Finding best stock broker in India that will suit your profile is tedious. But you can open your account with any one of these leading stock brokers without much analysis, They have decades of track record and all are SEBI registered.

However, I trade with Zerodha. I opened account with them in 2012 much before they became No.1 stock broker of India. If you are not looking for any advisory services like me, you can open account with them. Being with leader is always provides the assurance of peace of mind.