5Paisa Review 2024:

Pros

- Very competitive brokerage plans with Rs20 per executed order

- Investing in IPOs, Mutual funds and insurance is possible

- Reputed parent company i.e India Infoline limited (IIFL)

- Research reports and tips are provided which is rare in case of discount brokers

Cons

- Non availability of fixed per month brokerage plans

- Customer service is lagging

- The recommendations are mainly from robotic based and purely depends on their algorithms

5Paisa entered discount broking industry very late but doing good business in comparison to other brokers. In this 5Paisa review, I’m providing more information about brokerage, trading platforms and other details.

About 5Paisa:

5Paisa is prominent indian share broker based out of Mumbai. It started its operations in year 2016.

5paisa.com is a leading discount stockbroker and also the first Public listed fintech company to list in NSE and BSE. It is the fastest broker to acquire more than 1 million customers in a short span of 4.5 years.

5paisa.com started operations in March 2016 and has become the 6th largest stock broker in India. Today with a daily turnover of over Rs 50,000 crore 5Paisa has over 1.2 million clients, and have registered over 6.5 million app downloads.

Further, it’s Assets Under Management are worth 3000Cr+. With a team of 1000+ employees, 5paisa has been accoladed with multiple prestigious awards and has registered 170% year-on-year growth in last financial year (FY 2019-20).

Unlike other top discount stock broker. they provide research tips and recommendation to their customer for both Fundamental and Technical analysis.

5Paisa Review:

Recently 5Paisa got listed at BSE and NSE making them the only discount stock broker to be listed on stock exchanges.

5Paisa offers service under following segments:

- Equity

- Currency

- Mutual Funds

- Insurance

- Derivative

- IPOs

- NCD and NFDs

5Paisa Brokerage Charges:

Earlier 5paisa used to charge Rs10/order whci has lower than Zerodha and Upstox. But ow they have revised it to Rs20/trade and Rs10/trade can be availed by subscribing to their monthly plan. However, delivery trade is not free.

Below table explain their brokerage structure,

Please refer to this article about 5Paisa brokerage Charges for more detailed and segment wise break up of all the charges.

So for a beginner, it is better to stick to the basic “Basic Pack” and then switch to other plans if you trade frequently.

If interested, you can also check out the side by side comparison of 5Paisa with Zerodha here at 5Paisa-Vs-Zerodha.

Account Opening Charges of 5Paisa:

5Paisa charges Rs650 for account opening. But currently they have waived off that fee.

Below is the details of the AMC charges.

5Paisa is providing following offers for limited duration:

- Free Demat and Trading account

- Research pack worth Rs 6800, free for first 2 months. The pack includes

- Swing Trader

- Smart Investor

- Portfolio Analyser

To Avail these offers click on the below button.

5Paisa Margin/Leverage/Exposure

5Paisa Trading Platforms Review:

They offer trading platforms for all types of devices namely desktop, web and mobile. Let us look into each on of them and their functionalities.

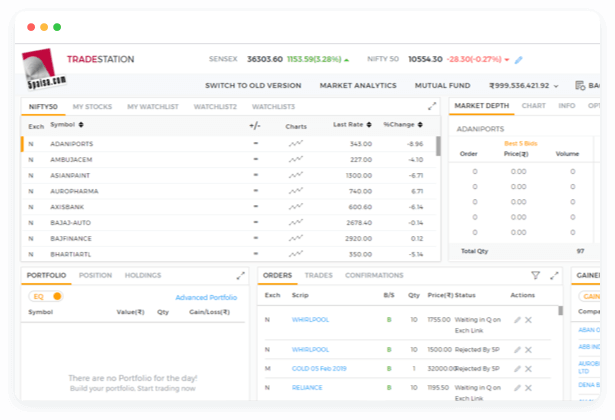

5Paisa Trade Station Review:

It is a browser based trading platform. However it is different from the ones provided by other brokers. It is a cloud based application and available only on few browsers such as Chrome, Internet explored and Mozilla Firefox.

One can access and invest in Mutual funds also through this platform. Some of he other salient features of this browser based platform are,

- Historical and intraday data for technical and fundamental analysis

- Research reports and recommendations

- Options to place multiple order types

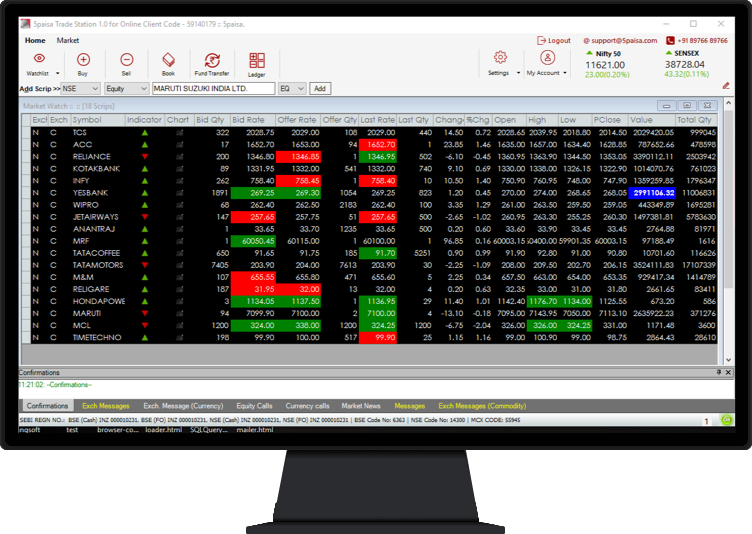

5Paisa Trader Terminal Review:

It is a desktop based software and you need to install it in your system. It is faster than “Trade Station”. It is considered as one of the top trading platforms in India.

Some of the salient features of Trader Terminal are:

- Highly customisable user interface and work environment

- Very good charting tool which has real time indication about market behavior

- Access to user portfolio and all the trade reports

- Higher security provided with two level authentication

5Paisa Mobile App:

One of its kind trading app from them not only allows to trade market, also has the Robo advisor in built.

Using the app, you can look into net position, order book , trade book and margins.

Check out my detailed review of 5Paisa Mobile App covering its Pros and Cons and top features.

One can also create his/her own watchlist. Mutual funds investment is also possible through this app. Access to back office is also provided through this app.

You can also check out the Top 10 Mobile Trading apps in India.

5Paisa Contact Details:

Registered Office:

Sun Infotech Park,

Road no 16V. Plot no B23,

Thane Industrial Area.

Wagle Estate, Thane – 4000604

5Paisa Pros and Cons:

Disadvantages of 5Paisa:

- Non availability of fixed per month brokerage plans

- It is not a 3-in-1 demat account

- Customer service is lagging

- The recommendations are mainly from robotic based and purely depends on their algorithms

Advantages :

- Very competitive brokerage plans with Rs10 per executed order.

- Investing in IPOs, Mutual funds and insurance is possible

- Reputed parent company i.e India Infoline limited (IIFL)

- Research reports and tips are provided which is rare in case of discount brokers

5Paisa in Comparison with Competitors:

Below table has the side by side comparison of 5paisa Vs other stock brokers.

5Paisa in comparison with other Stock Brokers |

||

How to Open 5Paisa Demat Account:

Opening the demat account with 5Paisa is completely online. It can be completed in 30 minutes.

They are running promotional offer of Zero account opening charges. Use below link to avail the offer.

Once you submit your details, you will receive the call from their sales team. If you are comfortable with the instruction provided at each step in account opening page, you can open the account without help from their team.

If you are stuck anywhere, you can avail their assistance.

Following documents are required to open account with 5Paisa.

- PAN Card

- Aadhaar Card

- Photograph

- Bank Proof – Either cancelled cheque or bank passbook front page

- Specimen signature – Put down your signature on a whitepaper and take a photo

You just need to have photo of above documents and upload while opening the account. No need to send xerox/physical copies of any of these documents.

How to Close 5Paisa Account?

How to close the account with 5Paisa if you are not satisfied with their service? For this, you just need to download the demat account closure form from their website.

Fill all the details properly and dispatch it to their address. 5Paisa account can not be closed online.

Before sending the account closure form make sure you have cleared all the dues if any, otherwise it may be rejected.

5Paisa DP Charges:

Apart from regular brokerage charges, 5Paisa also charges some special request charges. Please note that every brokers levy these types of charges. It only varies from broker to broker.

5Paisa Membership Review:

The broker 5Paisa is affiliated to NSE, BSE, MCX and registered with SEBI. It is the fair indication that 5Paisa is safe and reliable. Below table has the information of 5Paisa registration with these government bodies.

5Paisa Review – Conclusion:

5Paisa is one of the rare discount stock broker who provides research reports and recommendations. If you are the one who wish to have blend of both discount and full service stock brokers, 5Paisa can be considered.

When we review 5Paisa, it is evident that it also has the advantage of being the promoted by IIFL. And the brokerage structure is also very competitive in broking industry.

5Paisa is best traders who want to avail lower brokerage charges and also have tips & recommendations.

However, their customer support is not upto mark and hence improvement is required. If you want to rate 5Paisa, please let me know through comments.

You May Be Also Interested In: